3D Systems Has A Lot To Prove In 2015 3D Systems Corp (NYSE DDD)

Post on: 12 Апрель, 2015 No Comment

Summary

- This was one of 2014’s worst stocks.

- Revenues and earnings growth must come in strong.

- Short interest continues to hit new highs.

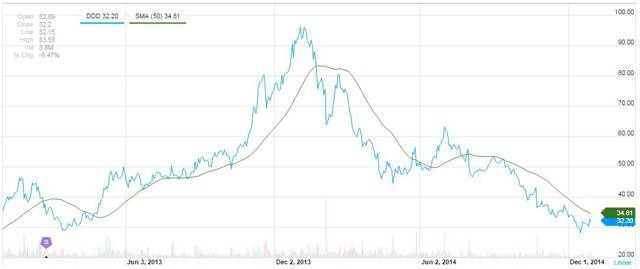

We keep hearing about how the US market did extremely well in 2014, and that fact is true. However, not all names participated in this rally. When you look quickly at the chart below, you may think I’m showing you the fall in oil or gas prices. Well, if my title didn’t give you a hint, the chart is actually of 3D Systems (NYSE:DDD ). Yes, the 3D printing company has been one of the worst performing stocks in 2014, which makes it a potential bounce back candidate for next year. Today, I’ll discuss why the name still has a lot to prove, and why if it does, it could be a big winner for shareholders.

(Source: Yahoo! Finance)

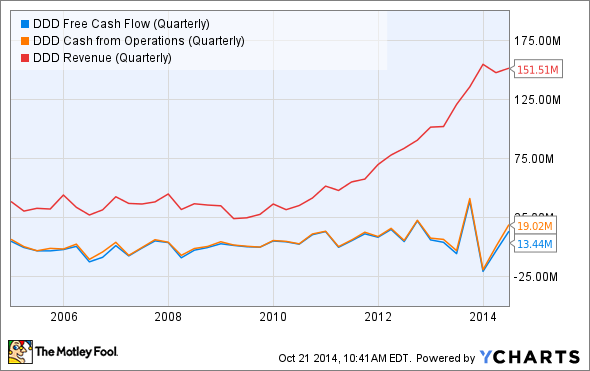

Results cannot disappoint again:

The second half of this year was not pretty for the company or the stock. The company’s Q2 earnings report was a big disaster. and that started the snowball rolling down the hill. Big revenue and earnings misses led to a guidance takedown, and thus, we’ve seen a drop in analyst estimates. In the table below, you can see how much these estimates have declined since late July.

In 2013, the company reported $513.40 million in revenues and $0.85 in non-GAAP EPS. That meant that analysts were looking for almost 40% revenue growth in late July, and now, the forecast is for about 30%. The bottom line forecast has gone from a 4 cent decline to a 12 cent non-GAAP drop. As a result, analysts have also had to reduce their hopes for 2015. With estimates falling, the stock has as well. The company must issue a decent 2015 forecast when it reports its Q4 2014 results, and it would be nice if there could be a Q4 beat as well. The worst possible scenario would be another major warning, which is what happened a couple of months ago. We are likely to get a very wide range for revenues and non-GAAP EPS from the company early in 2015, but the midpoints of those forecasts must be at least close to current estimates.

A reasonable valuation?

One criticism of the entire 3D printing sector in 2014 was that these stocks were extremely expensive. When 3D Systems was at much higher share prices, obviously, the valuation was a lot higher. The question now is are you getting enough growth for what you are paying? In the table below, I’ve compared 3D against the larger Stratasys (NASDAQ:SSYS ), and two smaller names, ExOne (NASDAQ:XONE ) and voxeljet (NYSE:VJET ). These are current analyst forecasts for each, with the valuations based on those estimates as well as Monday’s close.

*P/E and EPS are non-GAAP. ExOne and voxeljet are both forecast for losses, so there are no P/E values for these two names.

Trading at more than 30 times expected non-GAAP earnings per share for 2015 seems a bit expensive for many. With the overall market trading at 15-20 times earnings, investors might find this valuation troubling. There are two items to consider here. First, you are getting a lot more potential growth, so the valuation does seem somewhat reasonable in that respect. On the other hand, GAAP earnings are much lower. For 2014, 3D forecast non-GAAP earnings per share of $0.70 to $0.80 per share, but only $0.18 to $0.28 for GAAP earnings. Using GAAP, that makes the valuation substantially higher.

The good news is that 3D and Stratasys are profitable on a non-GAAP basis, unlike the other two names detailed above. 3D is expected to show the least revenue growth at this point, although 30% plus is nothing to shy away from. Since voxeljet and ExOne are losing money, they do not have an EPS growth rate. 3D is currently projected for more EPS growth than Stratasys. Overall, I don’t think 3D is that expensive for the given level of growth, when looking to the comparison names above.

Another way to look at these names is what the professionals think. In the table below, I’ve compared analyst opinions for each. The average rating goes on a scale of 1.0 to 5.0, where 1.0 is a strong buy and 5.0 is a sell. A 3.0 rating would be a hold. The potential upside amount represents the potential increase from Monday’s close to the median price target.

At the moment, 3D comes in as a slight buy, which isn’t surprising given the disappointing results in the second half of 2014. Overall, however, analysts seem to believe that all of these names offer considerable upside. While $43 a share might not seem like much for 3D investors that saw this name above $90 early in 2014, it would represent significant upside from where shares trade currently.

Short interest hits a new high:

3D Systems made it to my radar because it was a highly shorted stock. Stocks like this, because of their tremendous growth and high valuations, often find a number of non-believers. Short interest in this name has continued higher in recent months, and those betting against the stock have done quite well. In the chart below, you can see a history of short interest over the last 18 months.

We recently received the mid-December short interest update. and it showed another new high. More than 37.38 million shares were short the name, about 350 thousand shares more than the previous high a month earlier. Based on float data provided by Yahoo, the percentage of shares short is now 35.49%, which is also a new yearly high.

A lot of investors are clearly bearish when it comes to this name, and that means that a short squeeze is definitely possible if this company could finally report some good news. The days to cover ratio at the latest update was over 16. That means that it would take more than three full weeks of trading volume for all shorts to cover their positions, which is a tremendous number. If 3D is able to prove itself in 2015, a massive amount of short covering could push this name substantially higher.

Establishing a base of momentum:

Since 2014 was a really bad year for the stock, especially in the second half, the name is stuck in a down trend for the moment. All of the momentum is going the wrong way, with the 50-day moving average line continuing to decline each day. In my most recent article on 3D Systems, I noted how the 50-day was crossing into the high $30s, and now it is under $35. You can see this moving average over the last two years in the chart below.

(Source: Yahoo! Finance)

When the stock was rising in 2013, the moving average mostly helped to provide support on pullbacks. This year, we’ve seen the opposite, with the trend line providing resistance as shares have gone lower. Shares did break above the 50-day during the middle part of this year, but the move was short-lived because more bad news sent the stock lower, and the moving average soon joined.

With the stock stabilizing in the low $30s, the 50-day moving average line should start to level off rather soon, although it still has a little lower to go. This is another reason why the company needs to prove itself in 2015, because it needs to get positive momentum back on its side. Investors want to see this trend line turn higher, and right now, it would take a move back into the high $30s or low $40s for that to occur.

Final thoughts:

After a terrible year for shares of 3D Systems in 2014, potential exists for the name to be one of 2015’s winners. The company is projected to show a large amount of growth, and the stock does trade at a more reasonable valuation than it did earlier this year. Analysts believe there is significant upside, and a large short interest amount could lead to a short squeeze. However, as the case has been for this name all along, results cannot disappoint anymore. This name warned and took down its forecast a couple of times in the second half of 2014. If results can actually come in above expectations next year, this name could see large gains.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.