3 Undervalued Stocks To Boost Your Portfolio

Post on: 21 Июнь, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

There’s been a lot of talk recently concerning overvalued markets. Many financial pundits have proclaimed the end is near, and that this time it will be quite a big fall from euphoria. Of course, I can understand the reasons for the predictions. This year’s market has shown strong resiliency. The stock market has been able to shake off the Ukraine conflict, Portugal’s credit scare revisited, and most recently the Middle East escalation. Any time the market has sold off, it has been for very short periods, and in retrospect, has always been a buying opportunity.

Are stocks overvalued? As always, the answer depends on many factors, and cannot be answered in generalities. I have always been able to find undervalued, or at the very least, fairly valued stocks in almost any environment.

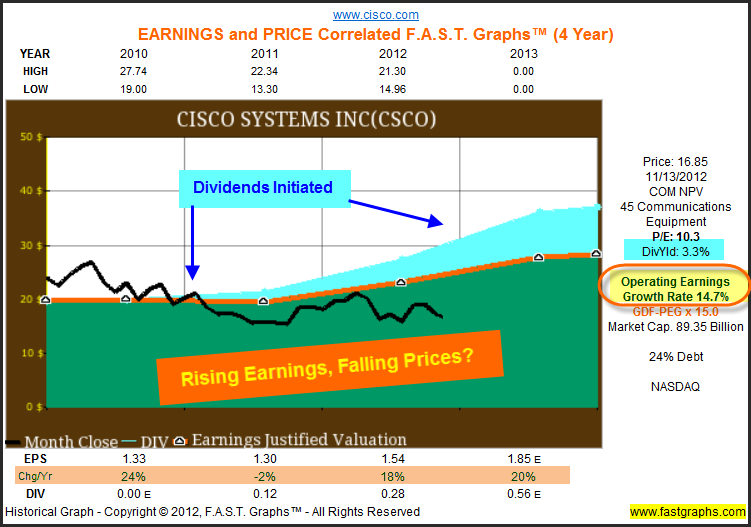

One way I check on valuations is to compute the PEG ratio for each of the stocks I own in my portfolio. The PEG is computed by dividing the stock’s P/E multiple by its earnings growth projection. Common sense convention is that any stock that trades at a P/E close to its earnings growth rate could hardly be considered overvalued.

For instance, a stock trading at a P/E of 25 and an expected earnings growth rate of 35% equates to a PEG of about .7, which is a very attractive level–even though the P/E appears to be high. In short, stocks with PEG ratios around one or less could be good values.

When I run my portfolio through the PEG analysis, I get good results, meaning there are many stocks with relatively low ratios. My concentrated mutual fund, the Congress All Cap Opportunity (CACOX) owns about 20 stocks, and more than half of them are trading at PEGs of one or lower. To me, if my portfolio holds many stocks with low PEGS, this market rally still has legs.

Here are three stocks I currently own with low PEGs that may indeed be undervalued, and are worth a look:

Diamond Resorts International (DRII)

The vacation ownership industry (aka timeshares) has had a bad rap over the past ten years. Membership payment defaults, lack of flexibility of bookings, and other management failures had deeply depressed the industry for many years. Back in the 1990’s, owners selling their shares on a secondary market would receive only pennies on the dollar.

But Diamond Resorts has figured out how to do it right, and its first year results as a public company back this up. Furthermore, unlike most other industries that have fully recovered from their 2008 lows, timeshare sales trends have not yet recovered and are still at 2002 levels. The upside for DRII is very promising, given the recovering consumer. Estimated consensus earnings growth is over one hundred percent next year.

The rental of construction equipment continues to show strong fundamental improvement as our economy exhibits slow but steady growth. URI is a great direct play on the recovering consumer and industrial builder. United Rental’s portfolio of more than 3,000 types of capital machinery is involved in almost all ranges of construction categories. Future earnings expectations look bright—in the 35 percent range, while the stock is reasonably priced.

VeriFone ’s (PAY) card swipe machines are everywhere—taxi cabs, grocery stores, gas stations. Near field communication has taken off, and PAY’s role grows stronger with every additional adoption rate for this convenient technology. VeriFone also provides state-of-the-art security through its end-to-end encryption/tokenization service. And as security continues to be a major factor in transactional reliability (think things like the Target Target security breach last winter), I suspect PAY will continue to do exceptionally well.

While a PEG analysis is by far not the only factor to employ while fishing for undervalued stocks, it goes a long way in getting you started. This is especially true in the market’s current environment, where the mere whisper of the word “overvalued” sends many mistakenly running for the exits. Instead, with the recent passing of Bel Kaufman, investors should be thinking of her famous book Up the Down Staircase. Bucking the trend can sometimes be rewarding.