3 Things Investors Can Learn From Starbucks Earnings Call (SBUX)

Post on: 30 Март, 2015 No Comment

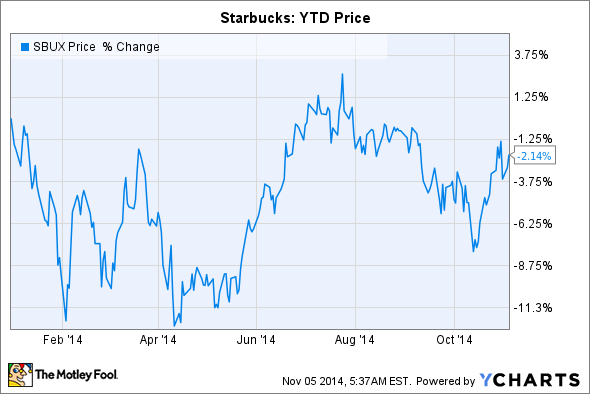

Shares of Starbucks ( NASDAQ: SBUX ) traded lower on Thursday, despite the company reporting record earnings for its fiscal fourth quarter and 2013 year-end after the bell on Wednesday. Here are some highlights from Starbucks’ earnings call last night and three key takeaways for investors.

Don’t mess with the best

Schultz went on to explain that the same-store sales guidance they’re giving is the most responsible guidance Starbucks can give today, particularly because of the maturation of the company’s store base and the number of stores. For investors, it is refreshing to see a CEO jump in and take control, especially during something as routine as a quarterly earnings call.

For the quarter ended Sept. 29, 2013, global same-store sales grew 7% including an 8% jump in North American comps. That is even more impressive when compared to industry peers, such as McDonald’s ( NYSE: MCD ). The golden arches reported global comparable-sales growth of 0.9% in its latest quarter. McDonald’s same-store sales in the United States were even worse, up just 0.7% in the period. Comps are important for these companies because they measure sales growth at stores that have been open for more than a year. Today, Starbucks has more than 19,200 stores worldwide, compared to more than 34,000 McDonald’s locations.

Teatime and beyond

Tea currently represents less than 1% of sales at Starbucks, which creates a lucrative opportunity for the company in the $90 billion global tea market. The java giant opened its first redesigned Teavana store this month in New York City and plans to add thousands of Teavana tea bars in the year ahead. In addition to complementing Starbucks’ leadership position in coffee, the Teavana rollout will enable Starbucks to add another premium brand to its burgeoning consumer-packaged goods business.

Source: Starbucks.

Aside from tea, Starbucks also has its eye on the fast-growing carbonated drink market. The company filed a trademark application last month for the term Fizzio, and has been testing carbonated drinks such as Spiced Root Beer and Lemon Ale at select Starbucks stores in Austin, Atlanta, Japan, and Singapore with promising results. Additionally, Schultz said there’s a significant food attachment tied to the carbonated beverages. As a result, we could be seeing carbonated beverages hit Starbucks stores as soon as next year.

Introducing Starbucks currency

Another interesting tidbit from the company’s recent earnings call was Schultz’s mention of Starbucks currency and the future possibilities of the My Starbucks Rewards program. Specifically, Schultz said the company is establishing a Starbucks currency, which can be interchanged between Starbucks and Teavana stores as well as across the company’s consumer products brands.

Customers can now earn Starbucks points (known as stars) on purchases made at Teavana stores in addition to money spent on grocery items like Starbucks’ packaged coffee. This should encourage more customers to join its loyalty program since it makes it easier for them to earn rewards whether shopping at a Starbucks location, Teavana store, from a mobile device, or at third-party distributors.

A cup of Foolish takeaway

That’s why investors may want to consider some other promising growth stocks. If you’re tired of watching your stocks creep up year after year at a glacial pace. The Motley Fool’s new free report can help. Motley Fool co-founder David Gardner, founder of the No. 1 growth stock newsletter in the world, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, WITH YOU! It’s a special 100% FREE report called 6 Picks for Ultimate Growth . So stop settling for index-hugging gains. and click HERE for instant access to a whole new game plan of stock picks to help power your portfolio.