3 Retirement Strategies for Your 40s

Post on: 19 Июль, 2015 No Comment

Credit: Financial Planning Image via Shutterstock

Its never too early to start planning for retirement. Knowing what strategies to employ at each phase of your retirement planning will help you develop an overall strategy that will work no matter what your age. With that in mind, BusinessNewsDaily asked three financial experts what workers need to do before turning 50 to retire with enough savings.

Plan for major life events

Retirement planning can be a challenge at each stage of life, but new challenges in particular appear once workers turn 40. To successfully arrive at their retirement goals, workers must be sure to factor in those events.

People in their 40s are what I call a part of the sandwich generation, meaning they are taking care of their parents and their kids, so they have a lot of expenses, said David Ogman, financial adviser at The Shapiro Ogman Group at Morgan Stanley. That leaves them with the decision to try to save for their own retirement or do their best to help out their children and their parents with their investments.

Despite that unique set of challenges, Ogman says that workers can in fact make a great deal of progress in their retirement goals before turning 50.

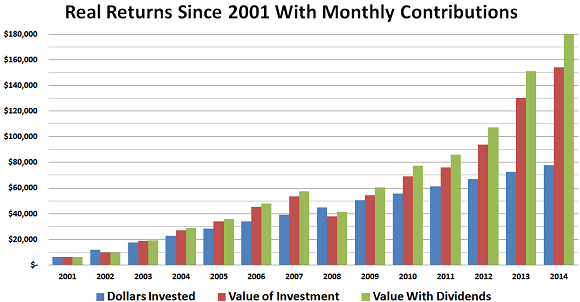

Use your 40s as the peak of your career to save money, so that in your 50s it is smooth sailing, Ogman said. Although these days, as we discussed, people are living longer, thus working longer, so you can use both your 40s and 50s to really sock away money into your investment accounts. You can remain fairly aggressive in your 40s, investing in blue-chip growth stocks, REITs and commodities (through an ETF or mutual fund), and then revisit the allocation in your 50s when you tweak the allocation to include more bonds.

Review your asset allocation

Upon turning 40, workers should also be sure to check their asset allocation fairly regularly. Liran Hirschkorn, a personal finance expert and founder of ChooseTerm. says this is a habit that will only help people as they get close to their retirement goals .

One thing we have seen with the economy and the stock market over the past 10 years is that things can be very volatile and you never know what will be the next change in the economy, Hirschkorn said. As you are getting closer to retirement you are at more of a risk to not be able to recover in time. People who were not balancing their portfolios were hurt in 1999 and 2008. It is important to make sure you are at the proper asset allocation so that you dont go into a situation where you cant retire when you want to because you havent recovered from losses in the market.

However, Hirschkorn says when saving for retirement people need to be cautious about being too reactive when checking their investments. In particular, investors should be sure to continue looking forward in order to not get too caught up in what has happened in the past.

I would say it is good to look at your quarterly statement for your 401(k) to see how it is doing, Hirschkorn said. Its not good to make changes too often. A lot of people end up chasing returns but they are chasing something that already happened. If you have a portfolio outside of your 401(k) you should look at it at least once a year to see if it requires any changes.

Pay down the right debt first

Debt is an unavoidable reality for a majority of Americans, but that doesnt mean those debts need to sink retirement goals.

Debt has a time and place in most Americans financial lives , said Simon Roy, president of Jemstep. a website that offers financial advice. For major purchases such as a new home or a college education, debt is a necessity for the average American. Both these purchases benefit from subsidies with the mortgage interest deduction and below-market interest rates providing a boost to consumption of housing and education, respectively. That is not true for most other forms of debt such as credit card debt, which typically carry higher interest charges. Given how expensive such debt is, few would argue that such debt should be avoided or reduced as soon as possible irrespective of an individuals age.

Roy says that people can dramatically improve their retirement chances by following certain simple steps. In particular, Roy says that all people should try to reduce their mortgage obligations to help in their retirement.

There are various strategies for reducing ones mortgage obligations, which include paying it off prior to retirement through reduced spending and also selling ones house after children have left and buying a smaller house with a smaller or no mortgage, Roy said. However one achieves it, going into retirement without large debt obligations will improve ones lifestyle in retirement and reduce the risk of running out of money and the stress to you and your children that goes with that.

Follow David Mielach on Twitter @ D_M89 or BusinessNewsDaily @ bndarticles . Were also on Facebook & Google+ .