3 Preferredstock ETFs with dividends of at least 5%

Post on: 13 Июль, 2015 No Comment

JeffReeves

Reuters

Preferred-stock ETFs tend to hold a lot of financial shares, including Wells Fargo.

Income investors have had it tough over the past few years, as interest-bearing assets have delivered anemic yields.

Despite the likelihood of an increase in the fed funds rate within the next 6 to 12 months, 10-year Treasuries yield only about 2.35%. And with the end of quantitative easing ushering in an era of uncertainty for the stock and bond markets, income-hungry investors have trepidation about what’s next.

I myself am leery of long-term bond funds as an investment in 2015. While bond funds have done well in the past several months as rates have drifted even lower, that simply can’t last. Take, as examples, the widely held iShares 20+ Year Treasury Bond or the Vanguard Long-Term Bond ETF. Both have actually outperformed the S&P 500 of the largest U.S. stocks this year by gaining double digits in principle value alone.

However, once rates start to increase — and they will increase, even if investors remain unclear on when — these long-term bond funds will naturally take a hit to principle values. And if the yields stay stuck in the 2% to 3% range, that’s not a good place to be.

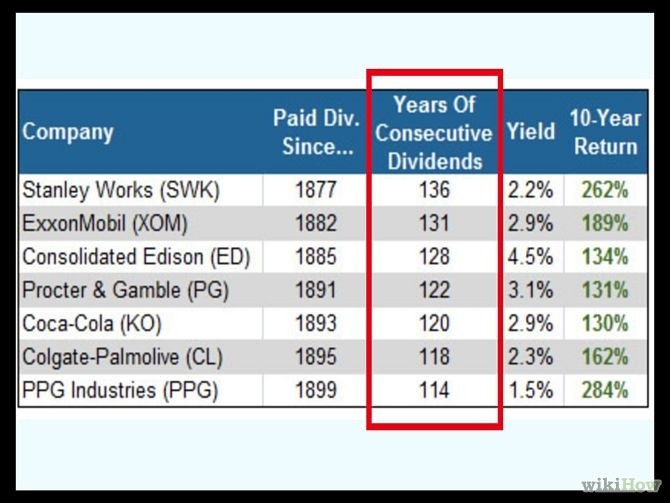

So where do you turn if you’re skeptical of bond funds but looking for yield? You could simply hold your bonds to duration if you have a lot of patience. Or you could continue to rely on dividend-paying stocks despite the risk of volatility in equity markets.

My preferred method (pardon the pun) is preferred stock. Preferred stock is, in many respects, a hybrid between common stock and corporate bonds. While not as stable as bonds, it is also not as volatile as common equity. And it’s ahead of common stock in the pecking order when it comes to getting paid.

That can give you a bit more yield but also a bit less risk than the alternatives. Among preferred-stock investments available for the average investor, here are my three favorites. Each yields more than 5%:

Global X SuperIncome Preferred ETF SPFF, +0.14%

- 30-day yield, less expenses: 6.7%

- Gross expense ratio: 0.58%, or $58 annually for every $10,000 invested

- Top 5 holdings: Wells Fargo, Arcelor Mittal, GMAC Capital, American Realty Capital, Lloyd’s Banking

- Total assets: $160 million

- 2014 return: 1%

While SuperIncome is a small fund, it is one of the top payers. It yields a juicy 6.7% after expenses, which is almost three times the yield on 10-year Treasuries. What’s even more impressive is the longer-term, 12-month yield of a whopping 7.4%.

The Global X preferred stock fund is an income investor’s best friend not just because of the yield, but also because of the monthly distributions.

Be warned that this fund is heavily weighted in financial stocks. About 75% of assets are in core financial stocks like banks, with other non-traditional financials like mortgage REITs making up another 5% or so. Also, company diversification is a bit lacking, with the top 10 positions making up over a third of the portfolio.