3 Key Metrics for Uncovering Value in Canada’s Oil Patch

Post on: 1 Апрель, 2015 No Comment

3 Key Metrics for Uncovering Value in Canada’s Oil Patch

When it comes to identifying value among oil exploration and production companies many investors start off on the wrong foot. Typically they rely upon generic valuation ratios, which don’t accurately assess the value of companies operating in the industry. This sees investors placing too much credence on traditional measures such as price-to-earnings and price-to-book ratios.

Instead, investors should be focused on industry-specific multiples that allow for an apple-to-apples comparison of oil explorers and producers. The three key multiples investors should use when considering investing in oil companies are enterprise value to EBITDA, enterprise value to oil reserves, and enterprise value to daily production. When considering these ratios, typically the lower they are, the more attractively priced the company

Enterprise value to EBITDA

This ratio allows investors to make apples-to-apples comparisons of the value of oil companies, because unlike the price-to-earnings ratio, it is unaffected by a company’s capital structure. It provides a more accurate feel as to whether a company is undervalued in comparison to its peers.

It is also an important metric because of the capital-intensive nature of the oil industry, which typically means oil companies carry considerable debt, and the ratio includes the cost of paying this debt off, whereas price-to-earnings does not.

Enterprise value to oil reserves

This ratio essentially measures how well an oil company’s value is supported by its key assets its oil reserves. While this metric should not be used in isolation it does provide investors with idea as to the value of a company when little is known about its financial performance.

This can be particularly valuable information when considering how attractive junior oil explorers and producers are.

Enterprise value to barrels of oil produced daily

Finally, this ratio measures how attractively priced an oil company is compared to the volume of crude it produces, giving investors an indication as to the financial health of a company. It is also known as price-per-flowing-barrel and a high ratio indicates an oil company is trading at a premium, while a low ratio indicates the opposite.

3 companies in the patch that are attractively priced

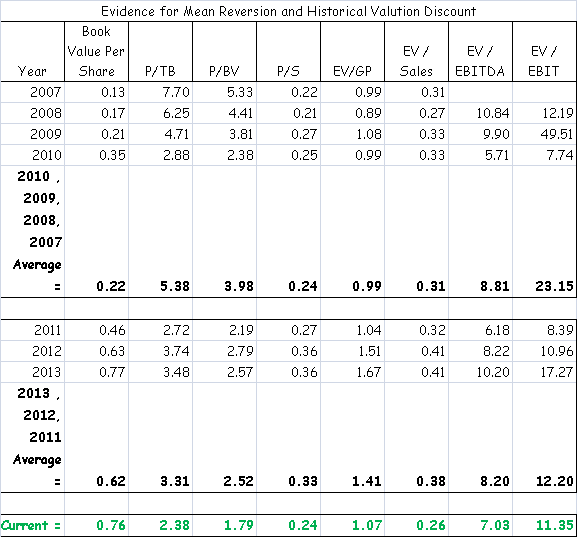

In the table below I have used these ratios to compare the valuation of a number of companies operating in the patch with a focus on light oil explorers and producers.

From these ratios out of the companies reviewed, Pengrowth Energy (TSX: PGF) (NYSE: PGH) appears the most attractively priced with the lowest EV-to-oil reserves and price per flowing barrel.

The company is currently in the final stages of completing a turnaround plan, which has seen it lift higher margin crude and natural liquids production, reduce its debt and divest itself of non-core assets. It currently pays a monthly dividend with a tasty yield of almost 7% and a sustainable payout ratio of 44% when determined using funds flow from operations rather than net income.

Another candidate for value-hunting investors to consider is Penn West Petroleum (TSX: PWT) (NYSE: PWE) which is in the midst of similar turnaround program to that of Pengrowth. It has the second lowest EV-to-oil reserves and price per flowing barrel among the companies analyzed.

Its recent first quarter 2014 results indicate the company has been able to repair its balance sheet as well as boost higher margin crude and natural gas liquids production. This has seen a significant improvement in the company’s profitability, with its netback per barrel jumping a healthy 38% compared to the previous quarter and 32% compared to the equivalent quarter in 2013.

All of this indicates it is making solid ground in transforming its operations and unlocking value for investors, making it a compelling speculative investment for investors willing to bet on the success of the turnaround program.

Perennial investor favorites Crescent Point Energy (TSX: CPG) (NYSE: CPG) and Whitecap Resources (TSX: WCP) appear expensive on the basis of these ratios. This is because of their proven and sustainable operations coupled with solid dividend yields in excess of 4%, making them particularly popular with investors.

While these three ratios do not provide a comprehensive analysis of the value of oil companies operating in the patch, they are a more accurate and useful measure for comparing the value of those companies than traditional ratios such as price-to-earnings or price-to-book ratios.

In the next parts of this series, I will take a closer look at a number of other key ratios that provide investors the ability to build a more complete picture of the value offered by oil companies operating in the patch.

2 more promising energy plays for your watch list

Check out our special FREE report 2 Canadian Energy Stocks on the Cusp of a Powerful Long-Term Trend . In this report, you’ll find that Canada is rich in other energy sources that are poised to take off! Click here now to get the full story!