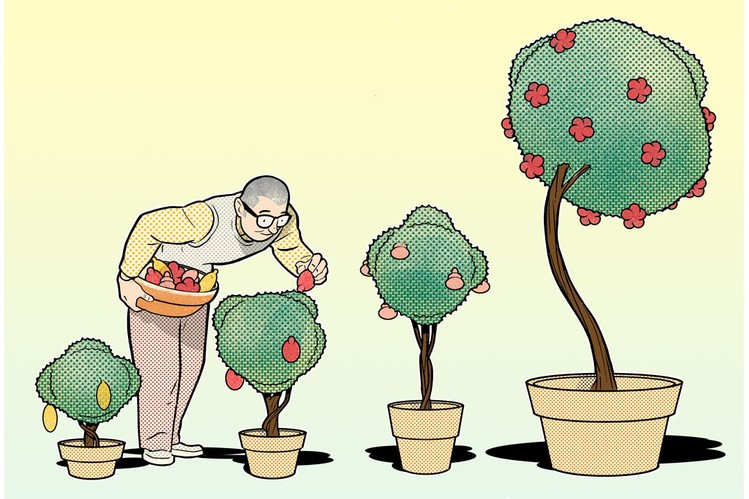

3 Juicy dividend stocks to buy and 3 to avoid

Post on: 10 Сентябрь, 2015 No Comment

3 juicy dividend stocks to buy and 3 to avoid

Knowing which stocks to buy and sell isnt easy …

In fact, Peter Lynch – the manager of the best performing investment fund in the world between 1977 and 1990 – famously said, “In this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten. ”

Being right more often than not and investing prudently is, arguably, more about avoiding losers than picking winners.

Especially when we consider theres over 2,000 companies listed on the local stock market – were certainly not going to own them all!

So to help you navigate your way through this maze, here are three stocks I think you should avoid and three stocks you should consider buying…

Avoid these three…

- Rio Tinto Limited (ASX: RIO) Australias largest iron ore miner has been criticised for pumping millions upon millions of tonnes of excess iron ore into the market, pushing the commoditys price ever lower. Whilst it is the lowest cost producer and boasts a forecast dividend yield of 5.0% fully franked, its certainly one to avoid. for now. Motley Fool Pro Portfolio Manager, Joe Magyer, said it best here .

- National Australia Bank Ltd. (ASX: NAB) – has been Australias worst performing bank for a number of years and with the local economy slowing, now is not the time for long-term investors to bet on a turnaround.

- Telstra Corporation Ltd (ASX: TLS) – is a great Australian company and one of the best dividend stocks on the ASX. However, whilst it doesnt look like a sell (more like a hold in my opinion), at todays prices, its valuation has become quite demanding. Therefore, investors should be patient and look to buy it at a lower price.

Consider buying these three…

- Coca-Cola Amatil Ltd (ASX: CCL) – is facing its fair share of uncertainty moving forward but its brand power is second to none. Indeed at its current valuation. if CEO Alison Watkins can deliver on her goal of low-single digit earnings growth, its current market price is likely to look cheap in hindsight. Whats more its tipped to yield a dividend of 3.8% in the next year, partially franked.

- Woolworths Limited (ASX: WOW) – is also facing its fair share of competitive pressures. But theres one vital characteristic that differentiates Woolworths and Coca-Cola Amatil from many other companies. A strong competitive advantage. At its current price, Woolworths shares look to be good value for long-term investors, in my opinion. Theyre offering a 4.73% fully franked dividend.

- G8 Education Ltd (ASX: GEM) – so long as this childcare centre owner and operator can: 1) keep occupancy rates above 80%, 2) continue to buy new centres on reasonable EBIT margins, and 3) keep a handle on its debt servicing; its a great buy today. In fact, the company looks cheap and boasts a forecast 6.6% fully franked dividend.

I already have a financial interest (see my disclosure, below) in Coca-Cola Amatil, Woolworths and G8 Education, yet I believe they still offer considerable value for buyers today. However, before you rush out and buy them, you should know Scott Phillips. lead investment advisor of Motley Fool Share Advisor . has just announced his #1 stock pick of 2015 . Not only is it a fast growing tech company which boasts a juicy fully franked dividend. its shares look like a great buy today! And right now, you can get its name and stock code for free in our brand-new investment report !

Simply click here . enter your email address, and we’ll send you a copy!

It’s that simple — No credit card details or payment required.

The Motley Fool’s Top Stock of 2015

Last chance: Just click here to grab your FREE copy.

Motley Fool Contributor Owen Raszkiewicz is long June 2016 $5.41 warrants in Coca-Cola Amatil Ltd, owns shares of G8 Education and has a financial interest in Woolworths (through a managed fund). Owen welcomes your feedback on Google plus (see below) or you can follow him on Twitter @ASXinvest .

Knowing which stocks to buy and sell isnt easy

In fact, Peter Lynch the manager of the best performing investment fund in the world between 1977 and 1990 famously said, In this business, if youre good, youre right six times out of ten. Youre never going to be right nine times out of ten.

Being right more often than not and investing prudently is, arguably, more about avoiding losers than picking winners.

Especially when we consider theres over 2,000 companies listed on the local stock market were certainly not going to own them all!

So to help you navigate your