3 Factors For Buying Stocks Price Intrinsic Value Enterprise Value

Post on: 16 Март, 2015 No Comment

New investors may be a little tepid about investing in the stock market. After all, buying a stock can seem really scary because there are so many things to keep track of.

To help you get a better understanding of the stock market, take a look at these 3 key factors to consider before making any investments in a company stock.

1. Price

Price is the number one factor to consider when youre making any investing decision. It doesnt matter if youre buying a stock, bond. mutual fund, commodity, or real estate. The price that you pay for an investment will determine whether it is a winning or losing bet. Here is a perfect example to illustrate that point.

Lets say you are looking to buy a coat for the winter. You go to Macys and they offer to sell you the coat for $350. You buy the coat, and are pleased because you really wanted the coat. It fits your budget and your body, and itll last all season. But once you get home, you speak with a friend of yours who purchased the exact same coat but got it for just $200. You subsequently realize that although you like the coat, you paid too much.

The exact same thing can happen when stock investing. Even a great product isnt worth buying unless youre getting a good price. Buying into even the best company at the wrong time can lead to you losing money on your investment. Youll want to look for and take advantage of value buys in the stock market. This will ensure that youre investing for the long run .

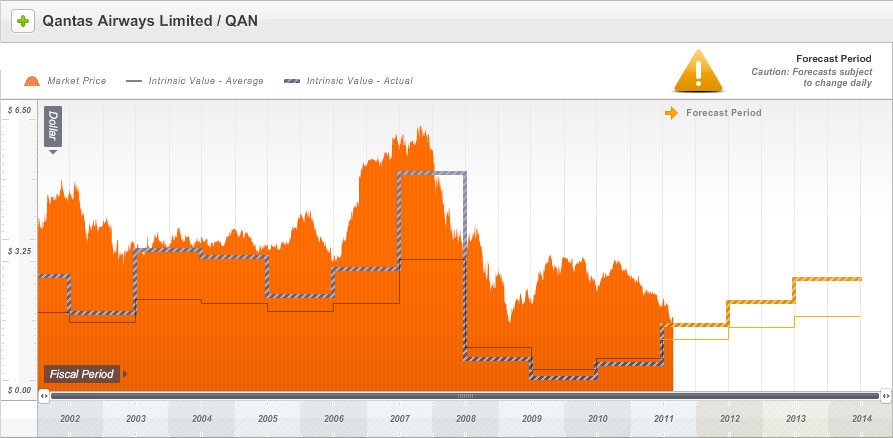

2. Intrinsic Value

Warren Buffett always likes to look at the intrinsic value of an investment before buying or selling any company. What is intrinsic value? Its the true value of an asset. When investing in a stock, the true value can be found by taking all of a companys assets and subtracting away its liabilities. This will give you the basic net worth of the company.

Thats a great starting point, but you can get a better look at a companys value without much more work. For some advanced analysis, look at the companys earnings per share (EPS) and multiply that number by the annual growth rate. As you get more comfortable with this analysis, you can also project future cash flows and subtract away the long term debt outstanding.

If youre a beginning investor, talk with your adviser or broker about this level of calculation. Many investors in stocks like General Motors and Blockbuster would not have lost all of their money if they had looked at the intrinsic value of the companies.

3. Enterprise Value

A lot of investors use market capitalization to determine the value of a company. While market cap is great for judging the size of a company, it is not the best tool to use for determining a companys value for a potential investor. The best figure to use when determining a buyout price for a company is the enterprise value. The enterprise value can be found by adding market cap plus debt, minority interest and preferred shares, and subtracting cash and cash equivalents.

The enterprise value is a great tool for evaluating a stock that may be a takeover target or a buyout candidate, particularly because it takes into account the companys debt obligations. For example, a company like SuperValu may look like a good buy to an acquirer with its $1.5 billion dollar market cap. A closer look, however, would reveal that an acquirer would really have to pay $9 billion dollars for the company because of its massive debt load.

Final Word

No amount of calculation will ever allow you to know for sure that a stock is a sure thing, especially in a secular bear market. But these three components are good tools for new investors trying to determine whether a stock is a good value buy or not. As you get comfortable working with these numbers, youll be more confident choosing stocks and trying more advanced tools for evaluating companies (Jim Cramers Action Alerts Plus is a popular one for stock picks).

Have you had stock market success looking at these data points? Share your stories and other calculations you use in the comments below.

Also, take a look at this resource for tips on when to sell stocks .