3 Big Market Moves Drive Volatility Higher

Post on: 16 Март, 2015 No Comment

Three big moves in major financial markets during recent quarters should give investors reason to anticipate heightened volatility going forward, namely significant increases in the value of the U.S. dollar and Swiss franc, as well as a major selloff in crude oil.

The dollar, franc, and oil are some of the most widely traded assets in the world. Their markets are typically deep and very liquid. These are positive characteristics that fuel investor interest. At the same time, because of their popularity, major currencies and commodities are also frequently involved in exotic or opaque investment vehicles and strategies — many of which include an additional layer of complexity through the use of leverage.

It’s no surprise that big moves in major global markets may have similarly large impacts on different industries, companies, and investors. For example, the drop in oil is bad news for exploration and production companies because revenues and earnings are directly linked to the commodity price. In contrast, industries that require oil as an input, such as transportation, are happy to pay less and should experience a net benefit. Regarding the strong dollar and franc, businesses with expenses based in those currencies and revenues derived predominantly from abroad in weaker foreign currencies will feel pressure on profits. The bottom line is that these types of impacts are knowable and investors may react to them in a largely predictable fashion.

The potential for higher volatility arises when considering the unknowable impacts of big market moves. Deciding where to invest is much more difficult when uncertainty is widespread, which can breed instability in the marketplace.

To further explain, first remember that a fundamental quality of financial markets is that even the most complicated transactions can be traced back to simple agreements between buyers and sellers. Basic transactions tend to only require that each party is comfortable with the value of what’s trading hands. However, as transactions become more complex, such as when leverage is introduced, buyers and sellers want to know more about the financial well being of the counterparty.

Despite robust global financial regulatory and reporting standards, it is impossible to know with certainty who is actually levered to what, and by how much. Given this, when markets such as oil, the dollar, and the franc experience moves as dramatic as the recent past, investors will not immediately know who was on the losing end of the trades, and if the soundness of the overall financial system will be at risk. It takes days, weeks, months, or even longer for this type of information to surface. In the interim, many market participants may be wary of their trading partners and operate more cautiously, potentially resulting in less liquid markets and greater volatility.

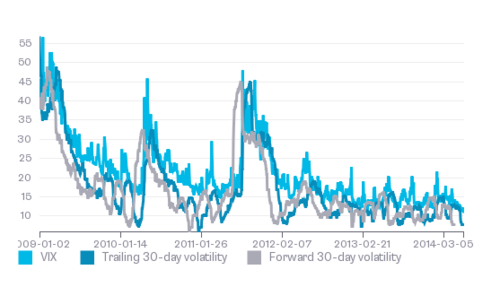

Indeed, various volatility measures suggest that we may have entered a new regime characterized by higher average volatility as compared to the past couple of years. In the U.S. equity market volatility as represented by average daily readings of the Chicago Board Options Exchange’s Volatility Index (VIX) was about 21% higher during fourth quarter 2014 through January 2015, versus January 2013 through September 2014. In European stocks, the Euro STOXX 50 Volatility Index was 27% higher on average from October 2014 through January, versus the prior seven quarters. The good news is that volatility creates opportunity. Investors should be on watch for businesses with solid fundamentals and strong competitive positioning that have experienced share price weakness as a result of broad market volatility.