2015 The Year Of Currency Hedging

Post on: 24 Май, 2015 No Comment

One of the great things about exchange-traded funds is that they put institutional-quality tools within reach of every investor. Take the Schwab U.S. Equity ETF (SCHB | A-100 does): The fund charges 0.04 percent per year, and provides exposure to essentially every stock listed on a U.S. exchange. You can’t get much better than that.

One of my favorite developments along these line in recent years is the advent of currency-hedged ETFs. In 2015, I think they can be critical tools for investors.

Why Does Currency Hedging Matter?

Most investors don’t realize it, but when you invest in international stocks, currency movements have a huge impact on your returns.

Let’s say you invest $1,000 in the SPDR Euro STOXX 50 ETF (FEZ | A-64). It’s one of the most popular ETFs in the space, with $3.7 billion in assets.

Now let’s suppose the Euro Stoxx 50 Index goes up 10 percent. You’d think your investment would be worth $1,100, or 10 percent more than the $1,000 you invested.

But it’s not. As a U.S. investor, there’s no way to know what your return will be until you know what the currency did.

Let’s imagine that, when you invested, one euro was worth $1.40. What happens, essentially, is your money is converted to euros to buy stocks on the European exchange. At $1.40/euro, your $1,000 buys €714.29 worth of European stocks. After those stocks rise 10 percent, your investment is worth €785.71. That sounds great.

Factoring In Currency Moves

But let’s imagine the euro has fallen significantly in the interim period, and is now only worth $1.25. All of a sudden, your investment is only worth $982. So despite the fact the index rose 10 percent, you actually lost money!

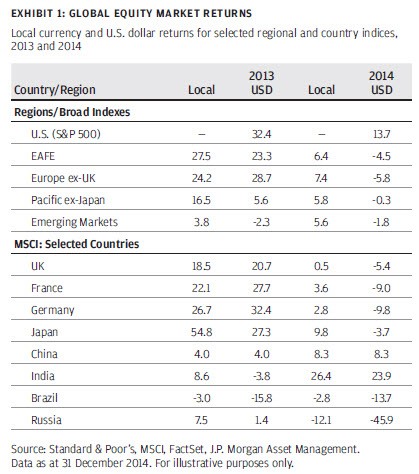

If you think that’s a ridiculous example, consider this: Last year, the German stock market was up 4.38 percent … but a U.S. investment in German stocks lost 8.06 percent. That’s a 12 percent swing in a single year.

Why Currency Hedged ETFs … And Why Now?

A few years ago, an investor had no choice but to accept this currency impact. Hedging your currency was complex and out of reach for the average investor. But today, there are more than a dozen currency-hedged ETFs available.

The largest and most successful is the WisdomTree Currency Hedged Japan ETF (DXJ | B-63). DXJ has almost $12 billion in assets and charges just 0.48 percent a year in fees. That’s the exact same fee charged by the $14 billion iShares MSCI Japan ETF (EWJ | B-98) .

But over the last year, DXJ has outperformed EWJ by nearly 15 percent on a net-asset-value basis, as Japan’s yen has crumbled. Hedging your currency has meant the difference between being up 10.47 percent and being down 4.43 percent.

With the euro on the rocks, more and more investors are turning to currency-hedged Europe as well. The WisdomTree European Hedged Equity ETF (HEDJ | B-47 ) was the 10 th -most-popular ETF in the world last year, pulling in $4.9 billion in new assets.

Deutsche Bank and iShares offer currency-hedged ETFs as well. The complete list of equity ETFs is available below.