10 Top HighYield Funds With Low Risk

Post on: 16 Март, 2015 No Comment

Exclusive FREE Report: Jim Cramer’s Best Stocks for 2015.

BOSTON ( TheStreet ) — Investors have poured money into high-yield bond funds at a record pace this year as they seek less-risky alternatives to the volatile stock market while getting better returns than those of other fixed-income securities.

Cameron Brandt, director of research for EPFR Global, told TheStreet that new investments in high-yield bond funds have been driven by the desperation for yield.

And that isn’t going to go away, given the miniscule returns now being offered by Treasuries, money-market accounts and certificates of deposits.

Benchmark Treasury securities dropped to less than 3% last week on signs the U.S. economy is weakening. The jobless rate rose in May, and consumer spending is still lackluster as housing prices extend their declines.

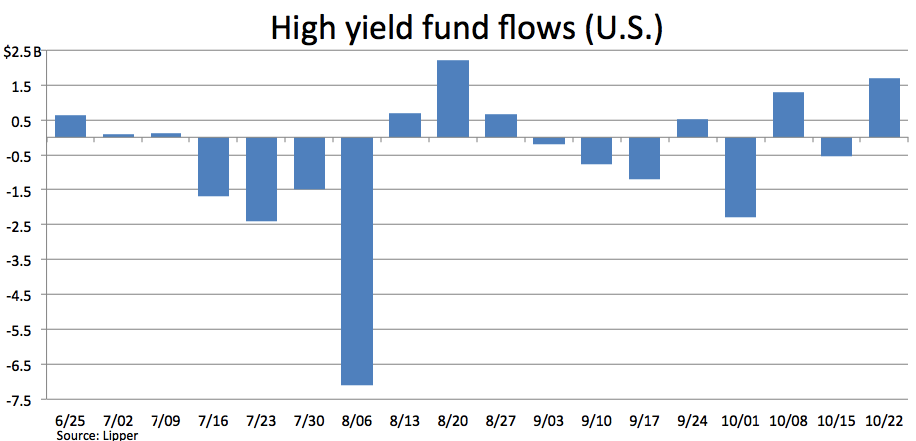

Still, recent economic uncertainties have given investors pause. There has been a decline in inflows over the past few weeks and a week of outflows.

There are concerns due to the scheduled expiration of the Federal Reserve’s QE2 program at the end of the month and sovereign debt problems boiling in Europe, as well as concerns over the health of the economy at home and its potential impact on high-yield bonds, which used to be known as junk bonds.

High-yield bonds have a history of providing much better returns than most other fixed-income investments because of their perceived higher risk of default, that is, their ability to continue to make scheduled payments.

But Brandt said junk bond default rates are still really pretty low, much lower than it was expected they would be, even when the economy struggled over the previous 2 1/2 years.

But it’s not all bullish in the sector as several years of strong appreciation for these bonds means they are fully priced and returns are likely to start flattening.

As a rough measure of performance, the SPDR Barclays Capital High Yield Bond Index ETF, an exchange traded index fund, has a current yield of 8.3%, and a total return of 2.4% this year and 16.4% over the past 12 months. It has an average annual return of 7.4% over three years.

The S&P 500 Index is up 2% this year, including a loss of 2% over the past three months. It has risen 19% over 12 months, but flat over the past three years.

What follows is a list of 10 bond funds that have records of producing strong, steady returns and that have received at least three stars out of a possible five from ratings firm Morningstar for their management’s performance.

The returns cited include changes in share price and reinvestment of dividends and capital gains, if any.