10 MustKnow Emerging Markets ETFs

Post on: 8 Май, 2015 No Comment

The growth of the exchange-traded products business has been absolutely staggering, and as of April 2010, there were 905 exchange-traded funds ( ETF ) and 95 exchange-traded notes (ETN) available to U.S. investors. One of the most exciting by-products of this ETF expansion is that investment ideas that were once too hard for retail investors to take advantage of are now commonplace.

In particular, we’re talking about emerging markets. No asset class covered within the ETF universe has experienced the growth that emerging markets have. Think back to the 1990s. Investing in emerging markets was either unsafe or difficult due to a lack of relevant products. Fast forward just a few years, and emerging markets like the BRIC countries (Brazil, Russia, India and China) have become leaders on the world economic stage.

Retail investors are clamoring for ways to access these markets. ETF issuers have responded by developing hundreds of ETFs that track countries from Brazil to Thailand and most places in-between. In fact, the variety of emerging markets ETFs is now so great that there are probably more emerging markets countries with targeted ETFs than without.

Now let’s take a tour around the world to look at 10 of the most popular emerging markets ETFs.

10. Market Vectors Russia ETF (NYSE: RSX )

Prior to RSX hitting the market in 2007, investing in Russia was viewed as risky, to say the least. The choices available to U.S. investors were limited to just a few Russian company American Depositary Receipts ( ADR ) trading on U.S. exchanges, several of which traded on the pink sheets or bulletin board exchanges.

RSX has become the premier way for U.S. investors to access Russia, an economy heavy on energy and natural resources. One of the biggest threats to emerging markets ETFs is that they tend to disappear if they suffer from low assets and liquidity. RSX has about $200 million in assets under management and trades over 3 million shares a day, highlighting the ETF’s staying power.

RSX has risks though. Russia is not necessarily politically-stable, and corruption is a major issue to consider. Plus, RSX is indicative of Russia’s economy at large as energy and materials names account for about 66% of the ETF’s weight, so RSX is not diversified at the sector level. RSX has an expense ratio of 0.8%.

Can’t decide on which of the four BRIC countries you want to invest in? There’s an ETF for that.

BKF gives investors exposure to all four of the BRIC countries, but the focus is definitely on China and Brazil, with those two countries accounting for over 71% of BKF’s country weights. At the sector level, financials, energy and materials names account for two-thirds of BKF’s weight.

BKF started trading in 2007 and has proven popular with investors, accumulating more than $800 million in assets. The expense ratio is 0.72%.

India is the BRIC nation with the second-least number of ETFs available to U.S. investors (Russia only has two), but there are still several good choices. EPI is one of the more liquid Indian ETFs, devoting about 53% of its $841 million in assets to financials and materials stocks. The expense ratio is 0.88%.

Investing in India can be considered safe as far as emerging markets go. After all, the country is the largest democracy in the world, so political issues are not quite the concern here the way they are in other emerging markets. To be sure, India’s economy is surging: Some economists think India may have a larger economy than the U.S. by 2020, making EPI a compelling idea for long-term investors.

7. Market Vectors Indonesia ETF (NYSE: IDX )

Some pundits think it’s time that analysts add another I to BRIC, with that I being Indonesia.

Once upon a time, Indonesia was the epitome of emerging markets risk. Its economy was rife with political corruption and hampered by a suffocating debt load. Since then, a change in political regime has resulted in more democratic practices and pro-growth policies that have led to a surging GDP. Its proximity to China certainly doesn’t hurt.

IDX made its debut in early 2009. As of May 2010, the ETF has over $385 million in assets, an impressive haul in just 16 months of trading. At the sector level, IDX is diverse with five sectors, financials, materials, consumer staples. consumer discretionary and energy all getting double-digit representations. IDX has an expense ratio of 0.72%.

Investing in emerging markets doesn’t always have to be about stocks. In fact, as more emerging markets truly emerge and their economies become more modern, debt issued by these countries becomes less risky.

When emerging markets first burst onto the scene, investment risk was reflected in low debt ratings that increased borrowing costs for these countries. One of the hallmarks of bond investing is that as risk goes down, the value of outstanding bonds goes up. So as emerging markets get better credit ratings and longer track records, investors can expect that good news to be reflected in higher bond prices.

PCY does a good job of offering debt from both large, highly-rated countries and lower-rated, more speculative countries like Uruguay, Venezuela and Vietnam. That certainly increases the risk profile, but it also increases the profit potential. The bottom line is that PCY is an excellent way for investors to play positive trends in emerging markets bonds. The expense ratio is 0.50%.

5. iShares S&P Latin America 40 Index (NYSE: ILF )

Investing in Latin America doesn’t have to be all about Brazil all the time. For investors that want exposure to the region without focusing solely on Brazil, ILF represents an interesting option. Yes, ILF does devote 60% of its weight to Brazil, but Mexico and Chile also figure prominently in its investment thesis.

Be aware that while the number 40 appears in the ETF’s name, ILF sometimes holds less than 40 stocks. But on the sector level, ILF is fairly diverse with materials, financials, consumer staples, telecommunications and energy issues all getting double-digit weights. ILF has about $2.4 billion in assets under management and an expense ratio of 0.5%.

4. iShares MSCI Brazil Index (NYSE: EWZ )

Brazil’s economy has soared on the back of the global commodities boom to become the tenth-largest economy in the world. That has helped EWZ become one of the most popular emerging markets ETFs. EWZ made its debut in 2000, making it one of the oldest emerging markets ETFs, but it is also a must-have for investors bullish on the emerging markets investment theme.

Well-known Brazilian companies like oil-giant Petrobras (NYSE: PBR ) and miner Vale (NYSE: VALE ) are among EWZ’s top holdings, so EWZ isn’t terribly diverse when it comes to sector exposure. Three sectors, energy, materials and financials, account for about 75% of the ETF’s weight. Still, if you want to be involved in Brazil, EWZ is one of the best ways to get exposure. EWZ has $9.4 billion in assets and an expense ratio of 0.65%.

3. iShares FTSE/Xinhua China 25 Index (NYSE: FXI )

China is the undisputed king of the emerging markets investment thesis and while U.S. investors have access to many China-specific ETFs, FXI is still the king in terms of volume (more than 26 million shares per day) and assets (almost $8 billion under management).

Continuing to refer to China as an emerging market can seem a little odd given that it is the world’s largest country by population and the world’s third-largest economy. Despite those statistics, China is still treated as an emerging market. And FXI does trade like an emerging markets security. The ETF is known for being volatile, as are most securities with ties to China.

FXI is heavily exposed to Chinese financials (they account for 47% of the ETF’s weight) so this is not the most diverse ETF on the market. FXI is designed to give investors exposure to the 25 largest, most liquid Chinese stocks, so investors should realize that if they want exposure to China’s mid- or small-cap offerings, FXI is not the way to go. On the other hand, this is the most widely followed China-specific ETF. FXI has an expense ratio of 0.73%.

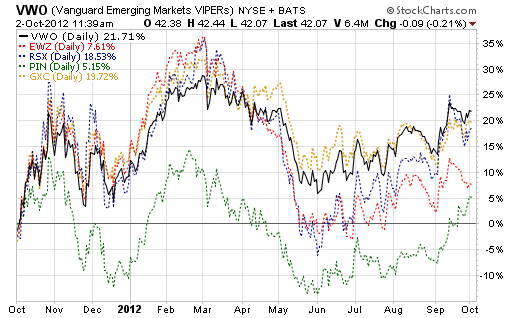

2. Vanguard Emerging Markets Stock ETF (NYSE: VWO )

&

1. iShares MSCI Emerging Markets Index (NYSE: EEM )

We’re putting these two ETFs together because they track the same index, a rare event in the world of ETFs. Both VWO and EEM chart the MSCI Emerging Markets Index, which tracks stocks in Brazil, China, Russia, South Korea and Taiwan, as well as other emerging markets. The two ETFs hold many of the same equities and both work well for a conservative investor looking for broad emerging markets exposure.

There are some subtle differences between these two ETFs. EEM’s top 10 holdings account for 19% of total holdings, while VWO’s top 10 holdings comprise 14% of its total. EEM has more assets under management than VWO, though that’s probably because EEM is older.

A not so subtle difference between the two? Expenses. EEM has an expense ratio of 0.72% while VWO charges just 0.27%.