10 Best Mutual Funds for 2012 & 2013

Post on: 16 Март, 2015 No Comment

MEPB Financial’s Best Mutual Funds

If you have followed this website, you have noticed I have reviewed several of mutual funds such stock funds, bond funds, balanced funds, commodity funds, money market funds, etc. These mutual funds can be divided into variety of classes such as domestic stock, international stock, taxable bond, non-taxable bond or municipal bond, conservative allocation balanced, moderate allocation balanced, emerging markets stock, and many more.

Selection Criteria

Finding the right criteria might be difficult for regular investor. The following is my pick criteria in selecting these best mutual funds for 2012 (and possible 2013 and beyond).

1. DoubleLine Total Return Bond Fund (DLTNX)

DoubleLine Total Return Bond

With current state of economy, investors need to find an investment with consistent capital growth and income. The DoubleLine Total Return Bond Fund is relatively new. It was offered to investor since 2010. This bond fund is managed by Jeffrey Gundlach and Philip Barach . Gundlach, who previously managed TCW Total Return Bond fund (Symbol: TGLMX ), has a good long term performance record.

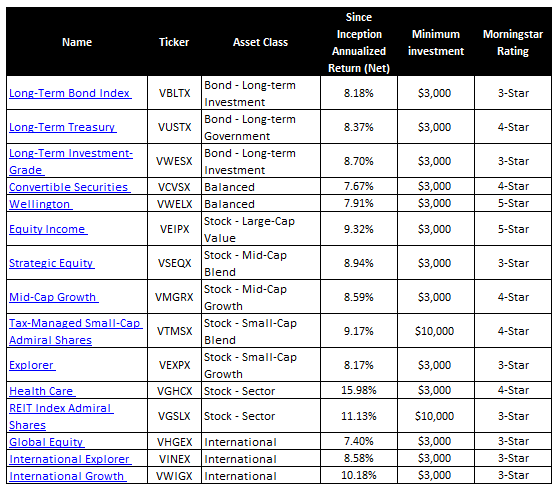

Top Stock Fund

This best mutual fund also has a dividend yield of 8%, which is much larger than most high yielding mutual funds even stocks. The fund has total assets of $15.2 billion. There is no sales load for this fixed income fund.

Investor can invest in the top mutual fund with $2,000 initial investment. Another class of this DoubleLine fund is Institutional I-share (Symbol: DBLTX ).

2. TIAA-CREF High-Yield Retail (TIYRX)

After the U.S. Federal Reserve announced longer period of low interest rate, this bond mutual fund may have the potential to be the perfect mutual fund with high yield. With dividend yield of 6.85%, this fund can consistently provide regular income for retiree and long term investors.

This best high yield bond fund is rated with 4 stars rating by Morningstar. It has an expense ratio of 0.59%. Investor can invest in this fund with $2,500 initial funding. This best bond fund has returned 6.73% over the past 1 year, 19.09% over the past 3 year, and 7.75% over the past 5 year. The average duration is 4.91 years.

3. Wells Fargo Advantage Intermediate Tax Free Inv (SIMBX)

Municipal bond fund can provide steady income stream for investors. One of the top rated Muni bond funds is Wells Fargo Advantage Intermediate Tax-Free fund. This fund provide dividend yield that is exempt from federal income tax. This best bond fund is managed by Lyle J. Fitterer and Robert J. Miller . The funds yield is 3.25%. The funds expense ratio fee is 0.73%.

Best Bond Fund

In term of performance, this best bond mutual fund has managed to outperform its index benchmark consistently (9 out of 10 years). This top mutual fund has ranked very highly for the past decade with 4% ranking. This fund has returned 9.21% for year 2011.

You can also pick your single state muni bond fund such as California municipal bond fund, NY muni bond fund, etc. This single state municipal bond fund may not be subjected to federal income tax and state income tax rate.