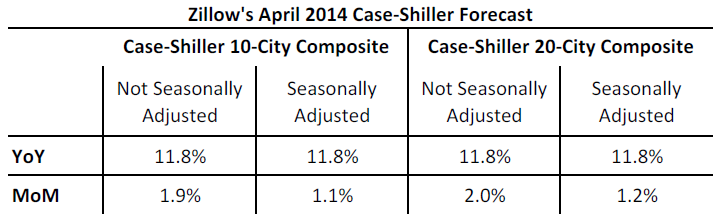

Zillow Home Value Index Compared to CaseShiller

Post on: 31 Январь, 2016 No Comment

While the Zillow Home Value Index has become an important tool in understanding housing markets, it is by no means the only such index. Standard&Poor’s Case-Shiller Home Price Index is another oft-quoted index. Some differences that exist between the Zillow Home Value Index and the Case-Shiller Index are outlined below.

First, some background on the S&P/Case-Shiller Home Price Index. This index uses a weighted repeat sales methodology originally conceived in the 1960s and subsequently elaborated upon by Professors Karl Case (currently at Wellesley) and Robert Shiller (currently at Yale). This methodology represented a significant improvement over the more conventional median sale price. The median sale price has proven to be problematic because it is heavily influenced by the types of homes that are selling at a given time. Specifically, the median sale price captures both the change in home values (which it intends to measure) as well as the change in the price distribution of sold homes (which it doesn’t want to measure). This means that the median sale price can change if there is a shift in the price distribution of sold homes (e.g. lower priced homes sell disproportionately more than higher priced homes) even if the actual price level of all homes remains the same. This property of the median sale price makes it a less than ideal measure of home price levels (median sale price is discussed in a separate article here). The repeat sales approach addresses these shortcomings by looking at the price change between repeat sales of the same home versus simply looking at the sale prices of homes sold in a given period of time.

While the repeat sales methodology is an improvement over the median sale price, one important limitation of indexes employing this approach is that they are based, by definition, on the set of homes that have sold at least twice. As such, they inherently exclude all new construction, which can account for more than 10 percent of real estate transactions. Moreover, the set of homes used in the construction of the index will tend to represent older homes since a home must have sold at least twice in order to be included in the computation of the index.

Another important aspect of the Case-Shiller Index specifically is that it includes foreclosure sales in its calculations. Since foreclosure homes will typically sell for a significantly lower price than non-foreclosure homes, this can lead one to conclude that real estate depreciation is greater than is actually the case if one is interested in looking at price trends for only non-foreclosure homes. Since the foreclosure and non-foreclosure markets are actually two distinct markets for homes, an index that blends the two types of transactions obscures the changes of both markets (for more details see the blog post here).

The Zillow Home Value Index (ZHVI) takes a different approach to creating a market index. Zillow generates valuations several times a week on more than 70 million homes, or roughly three out of four homes in the U.S. and calculates historical values dating back to 1997 (thus creating over 13 billion Zestimates).

This complicated process allows Zillow to aggregate these house-level valuations into indexes (the ZHVI) at the neighborhood, ZIP code, city, county, metro area and national levels. The ZHVI eliminates the bias present in median sale prices by looking at the value of all homes in a region, not just those homes that sold. The statistical models underlying the Zestimates control for the mix of housing for sale by finding patterns in the types of homes that are selling (no matter how unrepresentative of the overall set of homes) and then applying these patterns to all homes. For example, if only a few homes of a certain type sell in a given period, the models can extract the information from those sales and apply it to all homes of that type.

An important property of the Zillow Zestimate valuation that allows them to be aggregated into a very accurate and reliable ZHVI is that they have relatively little systematic error meaning that, while each Zestimate has some margin of error, they are just as likely to be above the actual sale price of a home as below. This means that individual estimates, each with some error, can be aggregated to form a quite accurate measure of all homes. What little systematic error does creep into the Zestimates is removed from all historical data series when the ZHVI is calculated at a local or national level. The statistical reasoning that supports this approach is that it is generally preferable to have estimates (each with some known and symmetrical margin of error) on the full population of homes (the ZHVI) than it is to have actual values for a biased subset of homes (the median sale price).

Two other important differences between the Case-Shiller Index and the ZHVI are coverage and latency. Regarding coverage, the ZHVI is reported for more than 160 metropolitan areas, whereas Case-Shiller reports on 20 higher-level metropolitan areas (although the national Case-Shiller Index uses data from about 100 metropolitan areas). Regarding latency, Case-Shiller releases reports on a monthly basis with a two-month data lag (e.g. data through January comes out in March). Zestimates and ZHVIs are published multiple times per week on Zillow.com, and our full Real Estate Market Reports are generally released just over a month after the close of the quarter. You can always check out the ZHVI for your ZIP code, neighborhood, city, state or U.S. by clicking on the Zestimate and Charts link on any home details page.

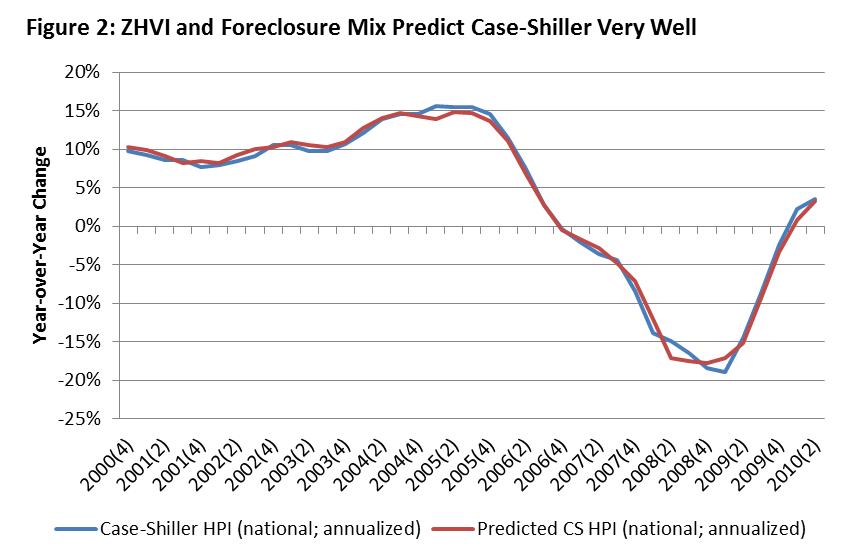

In terms of empirical comparison, the graph above compares year-over-year changes in market values for Case-Shiller and the ZHVI between February 2003 and the end of 2008 on a national basis. The two indexes track each other fairly closely until 2007, at which point they begin to diverge somewhat. This divergence is largely attributable to foreclosure transactions being included in the Case-Shiller Index but excluded from the ZHVI. As foreclosure rates increased significantly in late 2007, the Case-Shiller Index begins to be pulled down by these sales. If one is interested in knowing the change in home values irrespective of the type of transaction (foreclosure versus non-foreclosure), then the Case-Shiller Index provides some insight. If, however, one is interested in knowing the change in home values for homes sold outside of foreclosure, then the Case-Shiller Index gives an overly pessimistic picture of that market. The ZHVI is designed to provide insight into this latter market specifically.

The table below compares the December 2008 year-over-year change in the Case-Shiller Index to that of the ZHVI. The Case-Shiller numbers are uniformly lower than the ZHVI, particularly in areas with either high rates of foreclosures or where there is a large difference between the median prices of foreclosures and non-foreclosures (indicated by a lower ratio of foreclosure to non-foreclosure prices).