Will the Lose its Reserve Status

Post on: 25 Июнь, 2015 No Comment

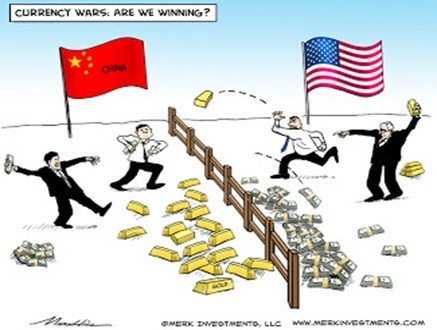

THIS is Why Gold Still Matters

Comments ( )

Monday, November 4th, 2013

The U.S. dollar has been considered the worlds reserve currency since the end of World War II.

This could be attributed to the economic and military strength of the United States and the relative stability of the dollar in comparison to other major currencies.

As usual, oil plays a major role in this issue.

Countries that export a lot of oil, particularly those in the Middle East, will usually sell their oil for U.S. dollars.

So if a group in Japan wants to buy oil from Saudi Arabia, it will convert Japanese yen into U.S. dollars to pay Saudi Arabia for the oil. The seller of the oil (more often than not, the government of Saudi Arabia) accepts U.S. dollars; they will then use these dollars to buy goods and services from the U.S. or they’ll convert dollars back their own currency.

Another option is to invest the dollars, particularly in U.S. Treasuries.

Having the dollar serve as the worlds reserve currency has been a major subsidy to both the U.S. government and to Americans. Foreign governments and central banks are more likely to buy U.S. government debt, which allows the U.S. government to spend more money and run up deficits with a lower interest rate. The two biggest foreign buyers of U.S. government debt come from the governments of Japan and China.

This has also been a major subsidy to Americans.

In addition to foreign governments using dollars and buying up U.S. government debt. many immigrants in the U.S. will take dollars in the form of cash and send the currency to relatives in other countries. This actually serves as a deflationary effect, as it makes consumer prices cheaper for Americans in the U.S.

In the last few years, there has been more talk about the U.S. dollar losing it status as the reserve currency.

This talk is certainly justified, given what we have seen. The Federal Reserve has more than quadrupled the adjusted monetary base in the last five years, and the government is running trillion dollar deficits with a national debt now over $17 trillion. and we dont see any sign of this slowing down.

The first question we have to ask is: What, if anything, would replace the dollar as the world’s reserve currency?

Is there another currency that might take its place?

Ten years ago, it would have seemed likely that the euro could compete with the dollar and possibly even replace it as the worlds reserve currency.

But times can change quickly.

Today we see countries in the European Union struggling with major debt, sky-high unemployment, and economies in shambles. In some places, like Greece, things are really bad. People are literally struggling just to put food on the table.

The only plan that anyone seems to have is to inflate the euro to make the debt less burdensome. And since countries like Greece, Italy, and Spain cant do their own inflating, it is a real possibility at this point that they may simply leave the European Union.

We dont even know if there will be a European Union ten years from now. And if that’s the case, the euro could vanish with it.

Regardless of whether all of this happens, the chances of seeing the euro serve as a reserve currency are remote at best right now.

The Japanese yen would have seemed like a good candidate to compete with the dollar.

Again, things change quickly.

Japan now has a debt-to-GDP ratio of about 250%. This is absolutely unheard of, and the only reason it hasnt all blown up yet is because the Japanese people themselves continue to buy their governments debt. Now, I dont know if this is some kind of patriotism or national honor thing, or if it is just plain foolishness on the part of investors but it isnt going to end well.

While the Bank of Japan was relatively tame in the past, we have seen a major policy change just in the last year. The Japanese government is determined to get its price inflation rate up and is directing the central bank to engage in major monetary inflation.

With an aging population and massive debt, I dont see how the Japanese yen can be taken seriously, let alone possibly act as the worlds reserve currency.

The Best Free Investment You’ll Ever Make

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, Gold & Silver Mining Stocks.

Enter your email:

The Chinese yuan (sometimes known as the renminbi) is frequently thrown around now as a possible replacement of the dollar.

There is certainly no question that China has come a long way in the last three decades. In fact, China might be the best example of the greatest number of people escaping poverty in the shortest period of time.

With that said, the country is still ruled by communists, even if in name only. At the very least, they are mercantilists. They believe they need to continually devalue their own currency so that it doesnt appreciate against the dollar. They do this for their exporting sector. This provides cheaper prices for Americans by keeping the value of the yuan down. It is a subsidy to Americans at the expense of the Chinese people.

While it does help the exporters in China, it also hurts the hundreds of millions of Chinese who would otherwise have cheaper consumer goods in their own country.

In addition to all of this, it is important to realize that the Chinese currency is still not a free-floating currency; it cannot be traded on the open market like other major currencies.

For this reason alone, the yuan cannot serve as a reserve currency.

Other Currencies

There are a handful of other countries that may have more attractive currencies than the United States.

The Swiss franc, for example, has typically been strong but even that has been tainted in the last few years.

Regardless of whether we are talking about Switzerland, Singapore, or some other small country, they are simply too small to have their currency serve as a major currency of the world. Their overall economies just aren’t large enough.

You can also forget about currencies from countries such as Canada, New Zealand, Australia, and even Britain: All of these countries and their currencies have similar problems, and the economies are much smaller in size when compared to the U.S.

And of course, you can forget about any other major countries like India or Brazil, where the economies are still living in the third world and the historical record of their currencies is completely unstable.

Other Possibilities

You might be wondering in the first place: Why do we need a reserve currency of the world?

We live in a digital age, and most of the major currencies are freely floating. If Japan wants to buy oil from Saudi Arabia, why do they need U.S. dollars for their transaction? They can simply convert from one currency to another without using the dollar as a middleman. If Saudi Arabia doesnt want Japanese yen, they can quickly convert it back into their own currency, or whatever other currency they prefer to use.

There is a possibility of having a basket of currencies, but you still have all of the problems mentioned above.

So again, why does everyone need a middleman?

Another possibility is that countries start using some kind of commodity or basket of commodities. The most likely candidate would be gold. which has a historical record of being used as money for thousands of years.

I believe that if a major country started backing its currency with gold, the rest of the world would quickly start using that currency more and more for trade and investment. Unfortunately, that seems unlikely at least in the near future.

What to Expect

It’s important to understand that you won’t just wake up one day to find the U.S. dollar has lost its status as reserve currency.

This isnt an official designation. In todays world, it’s not as if a committee meets and decides on what is going to be used by everyone else.

If anything, the dollar will lose its status subtly over time. It is already starting to happen in many cases, where countries realize they dont need to use the dollar as a middleman.

Over time, Americans will lose their subsidy for inexpensive consumer goods. This will be good for people in foreign countries trying to escape poverty.

Right now, though, there is still a widespread mercantilist mindset. Virtually every country or region is trying to devalue its currency. It’s a race to the bottom.

I would not recommend investing on the basis of the dollar losing it reserve currency status, at least to another fiat currency.

What other currency are you going to invest in? Every major currency seems like a terrible choice right now.

For that reason, if you are trying to hedge against a depreciating dollar (or any other fiat currency, for that matter), you shouldnt invest in another depreciating currency.

While there’s certainly nothing wrong with speculating in foreign currencies for short-term profits, for a long-term hedge against the dollar, you should stick with hard assets such as investments in gold, silver. real estate, and oil.

At least these things cannot be created out of thin air with the push of a button.

Until next time,

Geoffrey Pike for Wealth Daily