Will Rising Interest Rates Chill the Hot Real Estate Market Interview with Diana Hill

Post on: 2 Апрель, 2015 No Comment

Diana Hill, our in-house real estate maven, started her association with Online Trading Academy around the time of the 2008 housing price implosion. On the occasion of her 200 th article for Lessons from the Pros. we asked her what’s changed since then and what hasnt.

What’s changed as a result of 2008?

There are cycles in any market but the run-up to 2008 was very dramatic because people really didn’t think the bubble was going to burst. Then, the collapse was caused by a combination of the larger economic decline and the end of easy money and creative financing. Of course, that was a great time to buy at the bottom of the market; while the media and individual home buyers were reacting with hysteria, the institutional buyers and investors got some really great deals. Now, individual home buyers look at the market more realistically. Instead of thinking of their home as an ATM that’s going to spit out money, they ask if it really makes sense to buy a home.

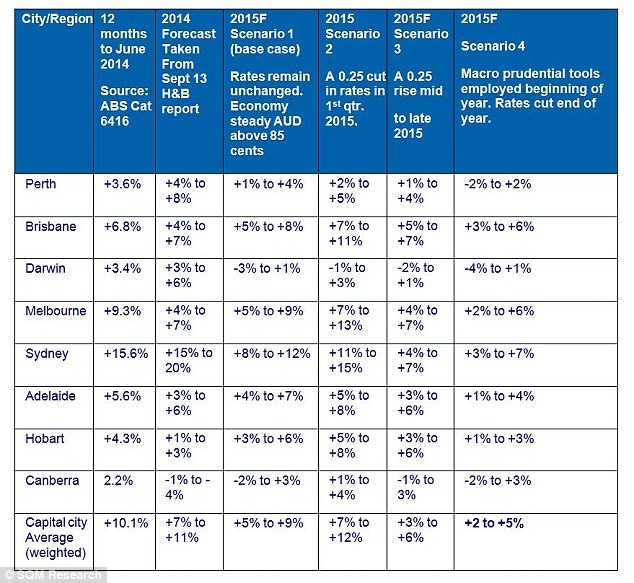

Are rising mortgage interest rates going to put a damper on today’s hot-again real estate market?

It may slow the market a bit, but rates will have to rise quite a bit to have a real impact on the market. Even at 4-5% today’s rates are historically low. We used to think 6-8% was an attractive rate, and we’re a long way from there. The biggest problem is lack of inventory—not for the higher end but for middle income or starter homes. There, you’ll see buyers putting 20-30% down, waiving the appraisal, and there are multiple offers on every home. This makes it hard for the investor, unless that investor comes in with all-cash which is increasingly rare.

Where there still great real estate opportunities to be found?

Not in the MLS—these days even the proverbial “fixer upper” will have multiple offers. You need to find properties where you’re not competing with a lot of other people—which lets out short sales, because they legally have to be advertised. Look for probates, tax liens, divorces, bankruptcies—scenarios where a property is going to have to be sold, yet it’s not on the market.

One of the strategies I like to talk about is rental property; we’re seeing rent increases to match the rising housing prices in many areas making a rental property a good source of steady income. Another strategy, if you’re looking to flip a home, is to carry back a note from the home buyer. This can make the deal very attractive because lending is so tight—I’ve heard of cases where the borrower had to “verify” that they were a stay-at-home mom or prove they had $6 in a savings account. So you make money on the sale, and make money on the interest for the note—and you’re secured by the value of the real estate itself.

To learn more from Diana, check out the course she teaches at Online Trading Academy: Professional Real Estate Investor .