Why You Should Exclude REITs From Your Taxable Investment Account

Post on: 16 Март, 2015 No Comment

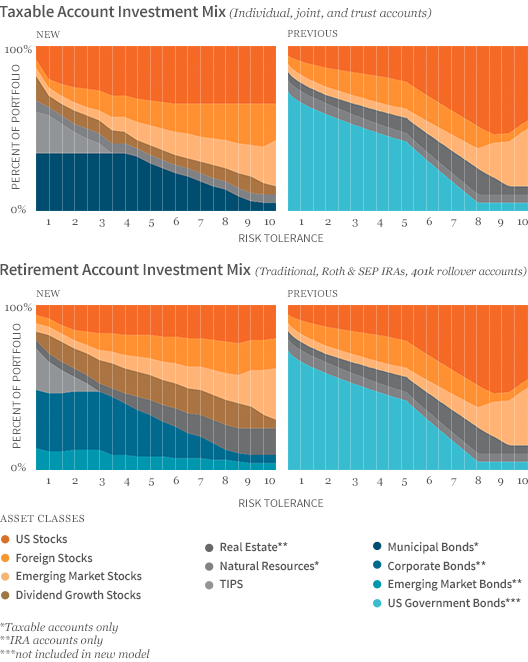

A few weeks ago, we introduced a new investment mix that excluded real estate from taxable accounts. Some readers asked why I recommended excluding real estate, when in A Random Walk Down Wall Street, I supported the inclusion of REITs in investment portfolios.[1]

I encourage people to follow four basic rules of investing: diversify your portfolio, limit fees, rebalance periodically and minimize taxes. When I tell investors to “diversify your portfolio” in my book I mean: Use many asset classes, preferably those that are relatively uncorrelated with each other. When I tell investors to “minimize taxes” in my book I mean: Use index funds to represent asset classes (index funds have very little turnover, which means they have low short-term capital gains) and invest for the long term (i.e. don’t try to time the market ).

There are two other significant ways to minimize taxes that I did not recommend in my book, because those methods were not available to my average reader, for whom the book was written – continuous tax-loss harvesting and differentiated asset location.

I had to make certain trade-offs to deliver the one-size-fits-all advice required of a book format. I was attracted to Wealthfront because the company allows me to provide a more customized and sophisticated version of my advice, to a broad audience at a cost-effective price.

A great example of that advice is the way we take taxes into account when we create a diversified investment mix for you, using differentiated asset location. By differentiated asset location, I mean that we use different mixes of asset classes for your taxable and retirement portfolios – allowing us, for example, to reduce taxes by overweighting tax-efficient asset classes in taxable portfolios. Municipal bonds are fine for taxable portfolios, but not for tax-deferred ones.

REITs (Real Estate Investment Trusts) are less effective than other high dividend-paying stocks in a taxable portfolio because dividends represent a large portion of returns of the real estate asset class, and REIT dividends are taxed at significantly higher rates than other stock dividends. In this case, tax inefficiency trumps diversification.[2]

REITs are a pretty good asset class to diversify your investments, but the math of mean variance optimization shows that other asset classes, including dividend stocks and municipal bonds, serve the same purpose, but better in taxable portfolios. Mean variance optimization considers the expected return, volatility (risk) and correlation of each asset class to determine the mix of asset classes that generate the highest after-tax return for any level of risk.

Pre-tax vs. after-tax returns tell the tale

Here’s how the math behind my recommendation works:

No single model or data source is perfect to estimate the expected risk and return of any asset class, so we blend several models and use third-party data sources. To estimate the expected returns for each asset class, we blend return estimates derived from the capital asset pricing model (CAPM) with Wealthfront’s research, using the Black-Litterman model (for details on each estimate, please see our investment methodology white paper ). To estimate each asset class’s standard deviation (volatility), we consider its long-term historical standard deviation, its short-term standard deviation, and the expected volatility implied by its pricing in the option markets. To estimate correlation, we consider long-term historical correlation and short-term correlation. We also overlay these statistical estimates with our judgments concerning how the future might differ from the recent past.[3]

To determine the optimal investment mix for taxable accounts, we evaluate each asset class based on its after-tax expected return. To determine the optimal investment mix for retirement accounts, we evaluate each asset class based on its pre-tax expected return, because taxes on retirement accounts are deferred. In Table 1 below, we compare REITs with US Stocks to show why REITs are currently less appropriate for taxable accounts than they are for retirement accounts.