Why You Should Adjust Your Withholdings On Your W4 To Save Your Tax Money

Post on: 16 Март, 2015 No Comment

by Hank Coleman

My wife and I get back over $3,000 every February when I file my familys annual income tax return. My wife loves getting that money back from the federal government every year. It is kind of like a yearly bonus. I just wish that it would come before Christmas. Conventional personal finance advice would tell you though that you need to adjust your withholdings so that you dont have too much tax withheld from your paycheck. A large income tax refund means that the government is taking too much of your money every month out of your paycheck. You are essentially giving the government an interest free loan.

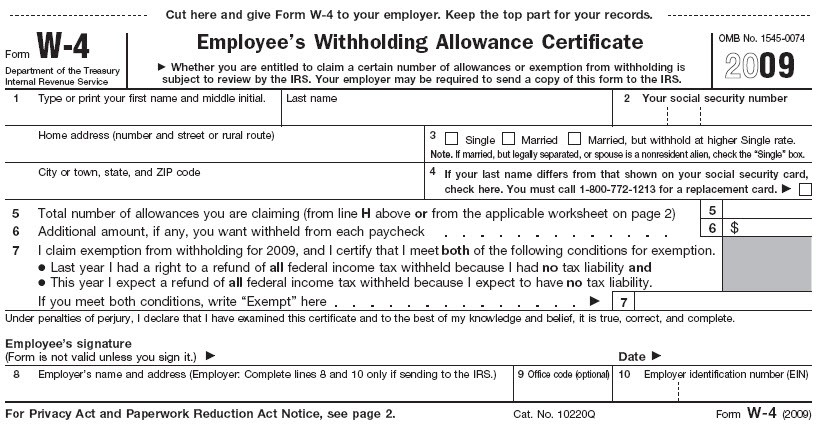

You can adjust your withholding by submitting a new W-4 to your companys HR or payroll department with an updated number of exemptions. While most employers do not advertise the fact, you have the right to change or updated your W-4 anytime you want to. To determine how many exemptions you should put down, I would use the IRS Withholding Calculator because some recent laws have made numerous rules of thumb obsolete.

To decrease the amount of money being withheld on your paycheck, you can increase the number of withholding allowances. A withholding allowance is used in the formula when figuring the amount of income tax to be withheld from your paycheck. The more allowances you claim, the less money that will be withheld for taxes. The maximum number of withholding allowances is ten. Be careful though, if you underpay your tax liability, you will end up owing more taxes at the end of the year when you file your income tax return. Your withholding allowance can be increased or decreased by completing a new W-4.

I personally over pay the government about $3,000 a year (the size of my average income tax refund). There are so many other things that you can do with that extra money that you give the federal government.

Pay Off Debt. The immediate benefit of adjusting your withholding is that youll have more money in your paycheck every month. If youre in debt, especially high interest credit card debt, you can use this new found money to increase the amount of money you contribute to paying off that debt faster than you had originally planned.

For example, if you have $5,000 in credit card debt with an average interest rate of 15% APR, it would take you over 22 years if you paid the monthly minimum of $111 towards the debt (with no other spending). If you were to increase that monthly payment by the extra $200 you overpay the federal government in taxes every month ($3,000 refund divided by 12 months = $250), you would be done in only 19 months (1½ years). You will also pay less total interest over the life of the debt (approximately $5,000 versus $600) by paying more than the minimum payments.

Invest The Difference. You can also invest the extra money you will be saving by changing your W-4 withholdings. $200 extra dollars invested every month in a good growth stock mutual fund earning an average of 6% per year will grow to $32,775 in ten years and $92,400 in twenty years.

Save The Difference. Do you have six to twelve months of your living expenses saved in an emergency fund? You can save the extra money every month that will show up in your paycheck after you change your W-4 withholdings in a high yield savings account. As of August 2009, HSBC Direct Online Savings accounts earn 1.55% APY. 1.70% at Ally Bank. or up to 1.65% with an ING Direct Orange Checking Account . You can lock in some of the best certificates of deposit (CD) rates with investments as little as $1 at Ally Bank which is offering customers 2.0% interest on a 1 year CD.