Why Utilities REITs and Preferred Stocks Are Lagging

Post on: 10 Май, 2015 No Comment

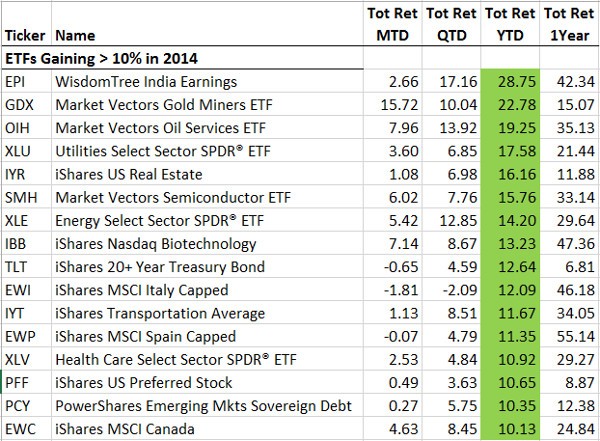

The theme over the last several months in the stock market has been buy the dip, and by dip I mean any day that you see red on your screen. The SPDR S&P 500 ETF (NYSEARCA:SPY) hasn’t closed down for more than two consecutive days since May and is now clinging to gains of over 20% this year. Despite a modest hiccup in June, the market has been screaming higher, and it would seem that nearly every sector is sitting at or near their 2013 highs. The one caveat has been interest rate-sensitive investments such as utilities, REITs, and preferred stocks that have consistently lagged their more growth-oriented peers.

The Utilities Select Sector SPDR (NYSEARCA:XLU) was one of the early momentum leaders in 2013 as investors sought stalwart dividend-paying companies with low-volatility returns. Interestingly enough, the May high in XLU also coincided with a low in the 10-Year Treasury Yield Index (INDEXCBOE:TNX).

Since briefly falling below its 200-day moving average in June, XLU has regained its upward bias but is still well off of its high-water mark. Utility stocks can often exhibit an inverse correlation to interest rates because they are capital-intensive companies that rely on debt to manage their operations. Higher interest rates can weigh on their earnings and capital requirements, which makes these stocks less attractive in a rising-rate environment.

The two sectors that have witnessed even more bloodshed to the rise in bond yields are the iShares US Real Estate ETF (NYSEARCA:IYR) and the iShares US Preferred Stock ETF (NYSEARCA:PFF). Both of these ETFs are currently sitting below their 200-day moving averages and are clinging to maintain positive returns for the year.

It’s no secret that the future outlook for REITs will be severely hampered by a rising rate environment despite the positive trend in real estate prices. Securing ultra-low financing is one of the ways that the Fed has been stimulating not only housing, but also the expansion of office, medical, and apartment complexes that many REITs control. Higher financing costs will slow the future growth of these markets and incur greater expenses for their ownership.

Preferred stocks, on the other hand, are unique in that they function as a hybrid between an equity and bond. The benefit of owning a preferred stock is that the equity component stations you higher in the capital structure of the company while the income component typically pays a higher yield than bonds. The price of preferred stocks on the secondary market typically fluctuate with interest rates, similar to bond prices, but they can also be subject to equity-like price characteristics as well.

The benefit of lower prices in each of these three sectors is higher yields for new capital investment as well as the potential for an entry point well off of the established highs. However, I believe that the volatility in interest rates will continue to be a headwind for these stocks in the near future. If the broader market continues to rise, then these sectors may be buoyed by the rising tide of dividend seekers. Stabilization in interest rates will likely spur additional demand for these asset classes that will strengthen their future prospects for capital appreciation.

Read more from David Fabian, Managing Partner at Fabian Capital Management: