Why most Canadians should be begging for a housing market correction not fearing one

Post on: 16 Март, 2015 No Comment

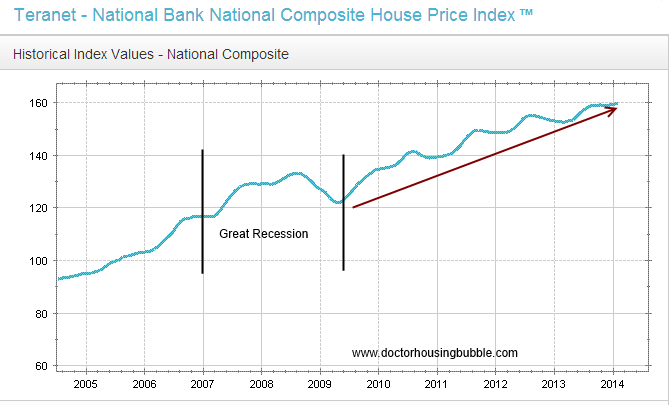

Most Canadians should be keenly aware of the incredible and gravity-defying increase in real-estate values in Canadian metropolitan areas over the past 20 years.

Calgary says it has the highest concentration of millionaires in the country and they are transforming Canada’s fourth largest city into a hub of luxury housing

Homeowners in Vancouver and Toronto, in particular, have celebrated as their residences have increased in price by more than 100% in many neighbourhoods. This represents an enormous gain on the equity value they have in their houses, since many have taken advantage of low interest rates, high loan-to-value mortgages and seemingly infinite amortization periods.

Much of the coverage of urban housing has focused on whether there is a Canadian housing bubble and whether and when it will burst. The experience of the U.S. housing crash in 2007/08 — also the result of dramatically increasing home values coupled with the availability of cheap high-loan-to-value debt — serves as a cautionary tale of what inevitably follows in the wake of irrational exuberance in the pricing of any asset class.

Most assume that a housing “correction” (Canadians are too polite to use the term “crash”) would be a negative event for everyone. This is simply not the case.

Only one of the three main groups of home-buyers — first-timers, young homeowners with growing families, and older homeowners thinking about downsizing — would suffer from a precipitous decline in home prices. The other two would benefit from such a decline.

Don’t believe me? Lets break it down, using the simple assumption that a correction would mean a 20% across-the-board reduction in home values.

For first-time buyers, the marked increase in real-estate values has made it more difficult to enter the housing market without artificial assistance in the form of CMHC-backed financing and near-zero interest rates.

Even with these tools, the hope of building any meaningful home equity in the first 10 years of ownership is very slim. These folks simply arent in a position to save enough money to pay down the principal on their mortgage, even if they had the foresight and discipline to do so.

Chop 20% off the purchase price, however, and a huge number of buyers currently on the outside looking in can at least contemplate the notion of ownership.

This does not, of course, solve the problem of cheap and easy debt leading to long-term stress when rates rise, but it partly addresses the issue of affordability. There is no doubt that someone entering the market would much prefer a correction to the status quo.

As for homeowners in their 30s with growing families, many have purchased condos or smaller starter homes with the plan to buy something bigger as their families (and, hopefully, their discretionary incomes) increase in size.

Say a couple owns a two-bedroom home that they paid $500,000 for in 2009 and it is somehow now worth $750,000. With two kids and a third on the way, they want to move to a larger home in a safe neighbourhood with quality public schools. That house is currently priced at $1.3-million.

Then a 20% correction comes along. Their $750,000 house is now worth $600,000. But the $1.3-million house is now worth $1.04-million. The small house has decreased in value by $150,000 and the dream home has decreased in value by $260,000. The upwardly mobile couple is $110,000 closer to realizing their goal of upsizing. Although counterintuitive, this family should be begging for a correction rather than fearing one.

So who loses in the event of a correction? The empty nesters looking to downsize.

Theyre the ones who own that $1.3-million house and have been eyeing a chic little $650,000 condo in a trendy neighbourhood with lots of restaurants, cafes and movie theatres within walking distance.

When the correction hits, they will lose $260,000 on the house they own and gain only $130,000 on the condo theyre buying. The $130,000 difference was the money that they were going to use for all their restaurant meals, lattes and movies during their retirement. For them, a correction will cause permanent pain or, at least, significantly more home cooking.

The assumptions made above are, of course, simplistic. Homes, for example, will not all decrease by a flat percentage. But these nuances are lost on buyers looking at the market as a whole and seeing all prices move in tandem.

I have also ignored that a 20% housing correction could bring with it a recession and increased unemployment. A recession coming at this point in Canadas fragile economic recovery could set us back years and this would be bad for all of us, whether homeowners or not.

So what should we really be wishing for? That’s easy. We should all wish for real estate to do what it used to do: appreciate in line with inflation, keeping incomes and home prices more or less in check, and affordability at a constant. For first-time homeowners and those looking to move up, this would be perfect — after a nice little correction.

David Kaufman is president of Westcourt Capital Corp. a portfolio manager specializing in traditional and alternative asset classes and investment strategies. He can be contacted at drk@westcourtcapital.com .