Why many people and companies avoid tax

Post on: 16 Март, 2015 No Comment

By johnredwood | Published: February 11, 2015

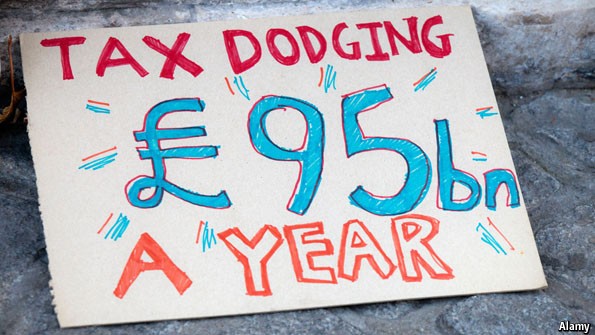

Tax evasion is bad and a criminal offence. Tax avoidance is something different.

When most people in politics seem to agree about something, it is often a good idea to ask a few questions.

Currently many politicians seem to agree that the government should crack down on tax avoidance. It is a popular policy, as people assume it is their neighbour that is the tax avoider and they are the taxpayer. It comes free, offering lots of extra revenue to spend with no apparent increase in taxes.It gets them through the interview which asks how are they going to spend more and get the deficit down.

If it were that simple, wouldnt it have happened by now? Can you remember a government that did not want to cut tax avoidance? So why is it so difficult?

It is difficult if not impossible because the self same parties and governments which want to end tax avoidance, also want to continue and expand the number of policies which allow tax relief for good things they wish to reward and identify. Most of those who condemn tax avoidance save for their retirement through pension funds. This allows them to save tax free, and to accumulate capital gains free of capital gains tax and income free of income tax in the pension fund.

Many of them with money to save also buy ISAs, to shield savings from both taxes. So why do people who so strongly condemn tax avoidance do this? Why dont they see they are doing exactly the same as the avoiders they condemn. They are taking advantage of tax policy decisions which allow people to pay less tax. If they really believed their own rhetoric they would refuse to tax shelter their savings, and put money by for a rainy day and for retirement in tax paying funds with no tax relief.

They need to understand that just as they decide to use these loopholes or legitimate tax breaks to increase their own savings and wealth, so companies use tax loopholes or legitimate breaks to increase the amount of money they earn which they can spend on the company rather than sending to the taxman. If the Treasury offers companies tax offsets for investing in certain ways, companies will invest to get the break. If the government allows tax privileges if you operate in certain parts of the country, a business would be remiss not to see if it could do so.

Some multinationals get too clever at minimising their tax bills, and find they incur reputational damage when this becomes a matter of general dislike. Whilst few have any sympathy for multinationals, they do have to seek to satisfy the often competing tax jurisdictions of their various countries of operation. The UK after all sets a lower rate of corporation tax than the other advanced countries deliberately to attract more activity and cost here amongst those multinationals. UK policy is to encourage businesses to do more here to have a lower tax rate.

We can all unite to condemn tax evasion, the refusal to pay taxes due and deceit in telling the tax authorities what your profits or earnings were. That is a different mater. The present debate is in danger of confusing legitimate tax avoidance, something most people and companies do with the encouragement of government, with the criminal offence of evasion. You can avoid all tobacco duties by the simple approach of not smoking. That I thought makes you a loyal follower of government health advice, not a tobacco tax avoider who should get on with buying some cigarettes for the greater good of the budget.

This entry was posted in Uncategorized. Bookmark the permalink. Both comments and trackbacks are currently closed.