Why Junk Bonds Are Too Risky

Post on: 13 Апрель, 2015 No Comment

Now that stocks are expensive, and real estate price tags are too big (according to Alan Greenspan), is it time to invest in bonds?

In short, no. Bonds of companies that seem to have any risk at all are a bad deal right now. In particular, I suggest you avoid the temptation to invest in junk bonds (also known as high-yield bonds), and emerging market bonds.

Why? A lot of investors are attracted to high-yield bond funds right now, with yields in the neighborhood of 6.5%. But the risks these funds must take with your money to earn those attractive-looking yields are just not worth it. With an increasing amount of borrower defaults and looming bankruptcies, you can lose good money here.

Heres what I mean:

High-yield bonds actually lost nearly 10% in 1990 – and then roared back for a few years. They lost money again in 1994, and 2000 and 2002. Youd have lost money in four out of the last 15 years.

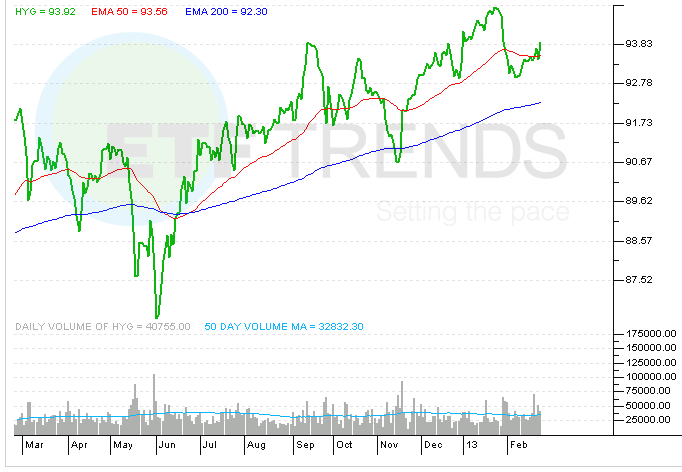

The last two years have been good, and investors are looking for new places to put their money. But after a big run, high-yield bonds are not the place to invest.

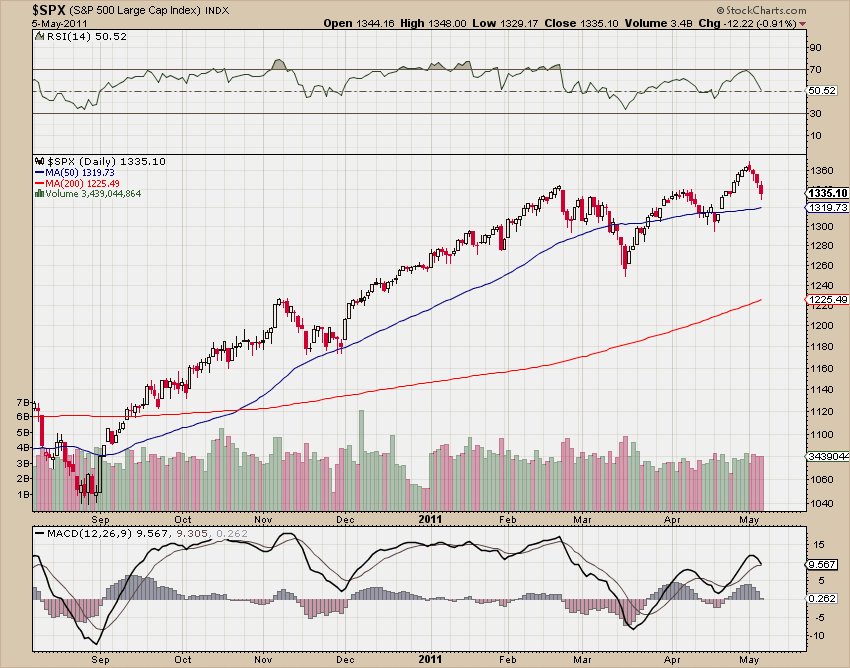

Take a look:

Total returns on the Lehman High-Yield Bond Index, 1990-2004

1990 -9.591991 46.191992 15.751993 17.121994 -1.031995 19.171996 11.351997 12.761998 1.871999 2.392000 -5.862001 5.282002 -1.412003 28.972004 11.13%

Martin Fridson is widely considered the dean of high yield. Hes done more homework and made more good calls than anyone in this field in the last 15 years. In a recent edition of Barrons, Marty issues this major warning about his speciality, risky bonds:

An already-risky segment of the investing landscape [high-yield bonds] is sure to get even riskier. That should be apparent over the next few years, when the bankruptcy dockets almost certainly will be teeming with activity.

“The credit quality of newly issued high-yield bonds nosedived in the undiscriminating investment environment of 2003-2004. Typically, defaults and bankruptcies surge a few years after such episodes.

Marty says a lot of money has flowed into these risky assets in recent years. And his homework shows that after money flows in indiscriminately, people lose money.

Were at that time now.

Dont get excited about attractive, high-yield bond funds and emerging-market bond funds. The downside risk is much greater than the upside potential at this point.

And if youre overloaded with these, lighten your load at the current high prices.

By Dr. Steve Sjuggeru, Chairman, Investment

Recommended further reading:

If you would like to know more about buying junk bonds, see beware the junk bond boom. For a full guide to investing in bonds, read: What you should expect if you invest in bonds .