Why has Google Capital moved out of its US comfort zone

Post on: 18 Август, 2015 No Comment

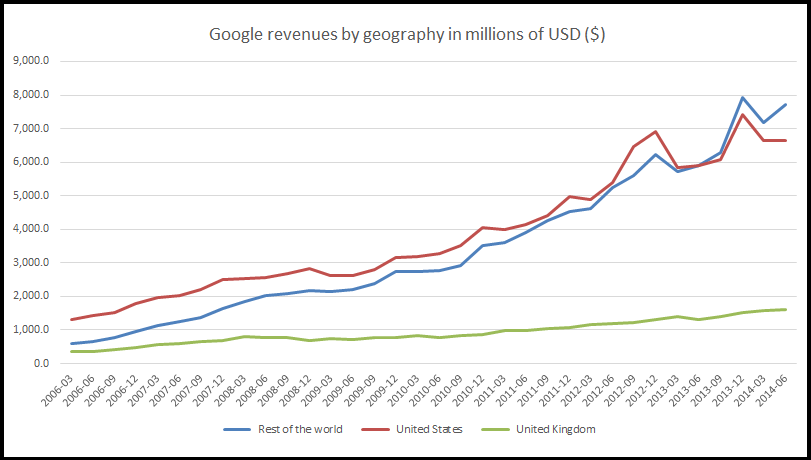

Has Google reached saturation point in the US and Europe? It moves where the action is and preferably be in from the start. The rapidly burgeoning Asian market is an attractive investment and Google is naturally keen to tap into this sector. and Indian market is one among them.

Reasons why Google is thinking of investing in India are many. For one, investment in India is preferred for the high level of technical skill and for the comparatively more salubrious business environment. Second, India is the world’s 3 rd largest economy and is the fastest developing startup system in the world with a phenomenal growth of 270% over the past six years in the startup market. And third, India is home to about 800 startups every year, many of which are highly successful.

Investments

Sources indicate Google Capital has about US $ 300 million in its kitty. But Google Capital is not going to take a whole lot of risks in its investments in India. It will invest in growing companies with already proven track records.

International startups have already entered the Indian start up market. Twitter has purchased Zipdial, Facebook has taken over Little Eye Labs and Yahoo brought Startup Bookpad. Tiger Global is another major investor that is planning to invest a large slice of it US $ 2.5 billion in the Indian start up market.

Japanese SoftBank has earmarked US $ 10 billion for investing in India. It invested US $ 627 million in Snapdeal — an Indian ecommerce company as well as investing in Ola, a competitor to Google Ventures funded Uber taxi app. Flipkart, another major Indian online player was able to raise US$ 1.9 billion investment. Amazon too is going to fund its Indian expansion program to the tune of US $ 2 billion. It seems global investing giants are all heading to India.

Google too wants a slice of the Indian pie. Last year it kickstarted with an investment of US $ 31 million in Chennai-based FreshDesk (a cloud-based customer care platform). The second investment to the tune of US $ 12 million was made last month in CommonFloor a growing real estate online portal operating from Bengaluru.

It is significant that out of the total 11 investments of Google Capital two are in India, indicative of the healthy potential of the Indian startup market.

Other investments in India

Google has invested outside of its ‘Google Capital’ and ‘Google Ventures’ in India. It purchased Indian startup Impermium. Besides fiscal investments, more significantly and innovatively Google will guide and mentor the most promising Indian startups and provide them with launch pad sessions.

Known for its commitment to science and technology, Google has through its Google X prize granted US $ 1 million to Indian space startup.

David Lawee, Google Capital Partner, had said to the Wall Street Journal that it makes a lot of sense to focus on India right now taking into account the increasing use of smartphones and its very active startup community.

Location of Google Capital office in India

This is a rather hypothetical question one may ask, but indications are it will be either in India’s Silicon Valley, Bengaluru or New Delhi, the capital city. But nothing has been confirmed. However, it has confirmed that Google plans to hire an India-based Google Capital representative.

It is heartening that Google is investing both fiscally and technically in India and it is indicative of the high degree of viability and success of the Indian startup environment.

(Images: www.lifehack.org)