Why Fear is Gone from the Markets

Post on: 12 Июнь, 2015 No Comment

I don’t know about you, but I always have at least a little fear in my head whenever I put my money to work in the financial markets. Now, I don’t let this healthy sense of skepticism about the positive direction in stocks rule my world; however, it is just plain smart to be on the lookout for the “fear factor” operating in stock.

Well, so far, the fear seems all but gone from this market.

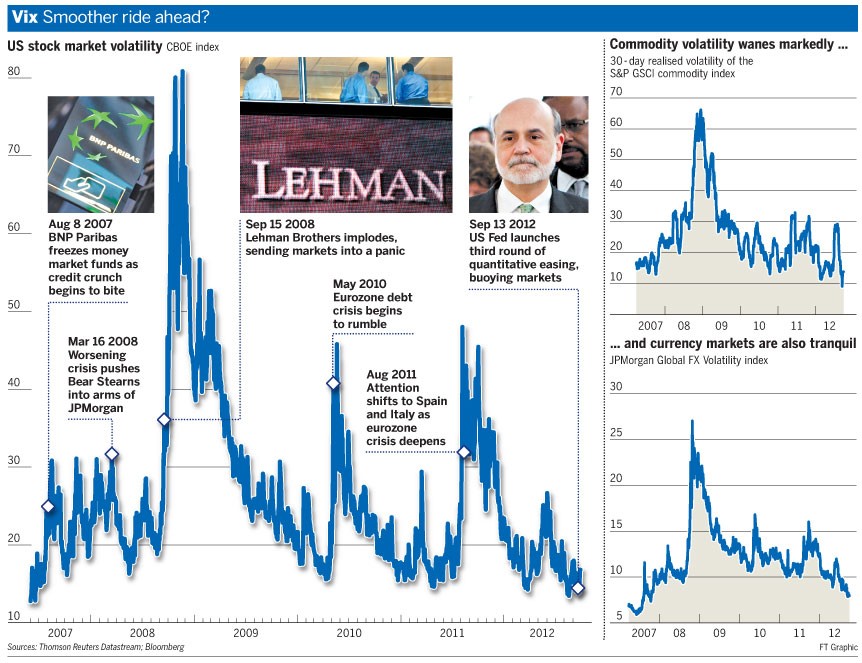

One way to measure this fear factor numerically is via the CBOE Volatility Index, or VIX. The VIX tells us what investors are willing to pay for options protection from a down market. Recently, the VIX plummeted to a five-year low, and that tells us that there is virtually no real fear out there about a market pullback.

I recently read an interesting take on the markets and the lack of a pullback in stocks from one of my favorite market strategists, Jeff Saut, of Raymond James. Saut’s view is that we are in a secular bull market, but he also predicts that in the short run we are overdue for a pullback. I agree with him, but right now, the fear factor that could lead to some selling is just not present.

Still, when you think of a market as resilient as this one has been during the past several years, you should start to get at least a little sense of fear. Just the fact that it has been some 20 months since the last 10% correction in equities should give us all pause.

Now, as you likely know, when most pros out there refer to “the market,” they are referring primarily to U.S. equities. And while indices such as the Dow and S&P 500 have been hitting new highs this year, they still lag other markets around the globe. For example, the year-to-date (YTD) return in the S&P 500 is 5.6%. Not bad, unless you compare that gain to stocks in India, which are up some 25% this year, and Turkey, which is up 24%.

I am watching these booming markets right now, but one market I am paying very close attention to is China (see today’s ETF Talk). China has been in the doldrums for several years, and there is no shortage of stories about the slowdown in the rate of the country’s economic growth, the real estate bubble or the lack of transparency in official economic data.

Still, China remains an economic powerhouse, and it is the second-largest economy in the world. If the economic data in China continues to improve, and if the smart money continues to pour into the region, we will continue to see more upside in China.

To find out how you can take advantage of moves in China, emerging markets, bonds and many other market sectors using exchange-traded funds, check out my Successful ETF Investing newsletter right now.

Hayek on Being Foolish

“We shall not grow wiser before we learn that much that we have done was very foolish.”

Friedrich August von Hayek

Perhaps the greatest economic mind ever, Friedrich Hayek also knew that in order to gain more wisdom about yourself, you have to analyze your past and unearth its foolishness. You see, it is chiefly through our mistakes that we become better people. This is true in nearly every aspect of life, including our past foolish investing decisions.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow Making Money Alert readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug .

In case you missed it, I encourage you to read my e-letter column from last week about the top-performing ETFs in May. I also invite you to comment in the space provided below.

Was this article interesting?

Sign Up for Eagle Daily Investor News Alerts