Who s More to Blame The Repeal of the GlassSteagall Act or Alan Greenspan

Post on: 24 Июнь, 2015 No Comment

Join the Fool as we assess blame for this financial meltdown — March Madness bracket style. Below is one of eight first matchups you can vote on … enjoy!

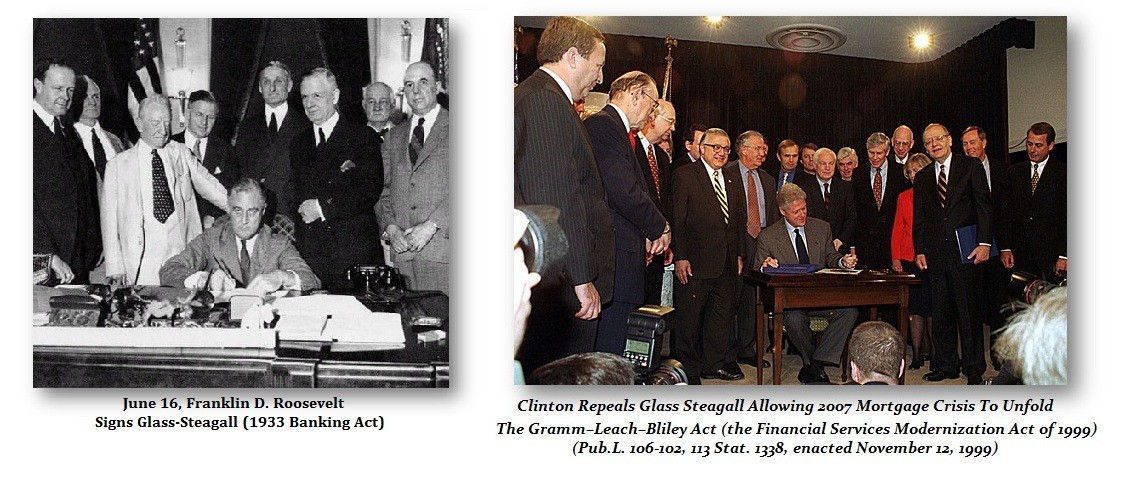

The case for the repeal of the Glass-Steagall Act, by Christopher Barker

Consensus is rare, but I’m sure we can all agree that the enormity of this financial collapse serves a healthy helping of humble pie to everyone involved. In this unsavory pie-eating contest, the biggest slice must be passed to the myriad Congress-critters, lobbyists, and financial-sector executives who managed to repeal the very legislation enacted to prevent this sort of thing from ever recurring.

Congress passed the Glass-Steagall Act in 1933 amid a familiar atmosphere of disgust toward the excessive greed and malfeasance that caused the first Great Depression. Had Glass-Steagall not been systematically assaulted on multiple fronts from the 1960s through its final demise in 1999, the hazard of financial institutions that are too big to fail could have been averted. Without super-conglomerates like Citigroup ( NYSE: C ) and AIG ( NYSE: AIG ). I believe the markets alone could purge the poison without creating systemic risk.

I hope Alan Greenspan skipped breakfast, since he too must feast upon a serving of humble pie. Unloading our collective anger upon this vocal proponent of deregulation is all too easy. Keep in mind, though, that although his policies contributed substantially to the problems we now face, he did try to warn the public of emerging risks.

While Greenspan’s 1996 caution against irrational exuberance seemed prophetic, not even he knew how right he was. Even the sobering dot-com bust — which nearly destroyed the likes of Cisco Systems ( Nasdaq: CSCO ). Palm ( Nasdaq: PALM ). and Yahoo! ( Nasdaq: YHOO ) — failed to deter the exuberance that an under-regulated financial world generated. In 2005, Greenspan warned that Fannie Mae ( NYSE: FNM ) presented significant risks to the nation’s financial system.

He is not absolved, but at least he tried to warn us; and therefore I believe those who repealed Glass-Steagall bear greater culpability.

The case for Alan Greenspan, by Joe Magyer

Who is the cat, been throwing bricks, he’s most to blame, for our sky-high VIX?

Greenspan!

Darn right. He refused to take the fall, blamed Bernanke – now that took some gall.

Greenspan!

Can ya dig it? He made borrowing cheap as sin, then pinned it all on Helicopter Ben.

Greenspan!

Right on. They say this cat is a bad mother-[Editor’s note: Shut yo mouth! ]

I’m talkin’ about Greenspan!

[Editor’s note: Then we can dig it! ]

He’s a complicated man – a public servant but a fan of Rand.

Greenspan!

Mm-hmm. He drove interest rates to lows, now we see that the chairman had no clothes.

Alan Greenspan.

Sure, the 1999 repeal of the Glass-Steagall Act probably won’t go down as one of history’s great regulatory moves. Still, saying that the repeal of Glass-Steagall is most to blame for our economic meltdown is like blaming the Beatles’ breakup on Ringo. The unruly expansion of leverage and derivatives trading was already well underway before the Act’s repeal. Long-Term Capital Management, anyone?

Let’s not give Alan Yoko Fed Greenspan a pass here. Glass-Steagall was one piece of regulatory legislation unwound 10 years ago. Greenspan, meanwhile, was the single most influential person in the global financial markets during his 19-year reign over the Federal Reserve, itself a regulator. While real estate markets were looking uncomfortably frothy to anyone who took the time to reflect, Greenspan kept interest rates at unnatural lows and gave public support for ARMs. The result? A leverage concoction that acted like a financial-market mickey, that’s even hurting businesses supposedly far away from the housing mess.

There are any number of reasons why we’re in this mess. The repeal of Glass-Steagall is probably No. 20 on the list. Alan, we’re taking this one all the way!

Now that you’ve read the above arguments, tell us who is most to blame for today’s mess. Who should pass on to round 2, on their way to being crowned the Fool’s March Madness champion … in a good sort of way?

Check out the Fool’s entire 2009 March Madness bracket here .

Fool contributor Christopher Barker captains yachts and writes about stocks. He can also be found blogging actively and acting Foolishly within the CAPS community under the username TMFSinchiruna . He owns no shares in the companies mentioned. Joe Magyer owns shares of no company mentioned, either. The Motley Fool’s disclosure policy didn’t do it.