White Paper Tax Loss Harvesting ™

Post on: 18 Июль, 2015 No Comment

- KEY TAKEAWAYS

Tax loss harvesting can reduce your taxes.

TLH+ is twice as effective as available automated loss harvesting strategies.

Betterment’s best-in-class system avoids pitfalls found in existing tax loss harvesting strategies in order to maximize your total tax benefit.

Introduction

Summary: Tax loss harvesting is a sophisticated technique to get more value from your investments—but doing it well requires expertise.

There are many ways to get your investments to work harder for you—better diversification, downside risk management, and the right mix of asset classes for your risk level. Betterment does all of this automatically via its low-cost index fund ETF portfolio .

But there is another way to get even more out of your portfolio—using investment losses to improve your after-tax returns with a method called tax loss harvesting. In this white paper, we introduce Betterment’s new Tax Loss Harvesting+™ (TLH+™). a sophisticated, fully automated service for Betterment customers.

Betterment’s new TLH+ service scans portfolios every day for opportunities (temporary dips that result from market volatility) to realize losses which can be valuable come tax time. While the concept of tax loss harvesting is not new for wealthy investors, TLH+ utilizes a number of innovations that typical implementations lack. It takes a holistic approach to tax-efficiency, optimizing every user-initiated transaction in addition to adding value through automated activity, such as rebalances.

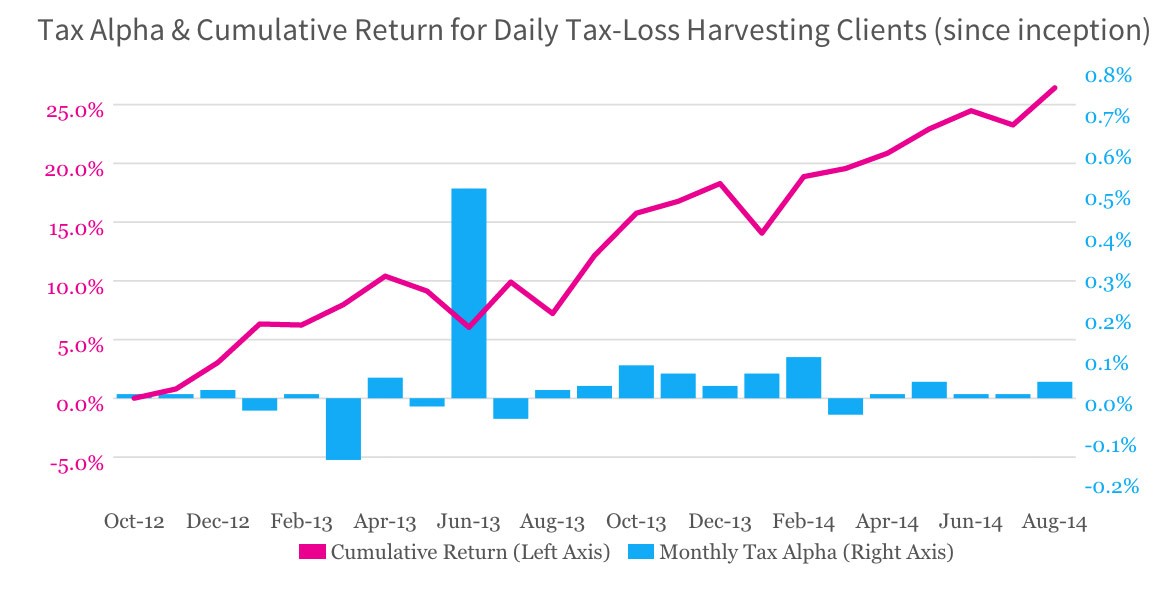

As a best-in-class service, TLH+ not only improves on this powerful tax-saving strategy—over the last 13 years, it would have provided an estimated 0.77% to a typical customers after-tax returns, annually—but also makes tax loss harvesting available to more investors than ever before.

What is tax loss harvesting?

Capital losses can lower your tax bill by offsetting gains, but the only way to realize a loss is to sell the depreciated asset. However, in a well-allocated portfolio, each asset plays an essential role in providing a piece of total market exposure. For that reason, an investor should not want to give up the expected returns associated with each asset just to realize a loss.

At its most basic level, tax loss harvesting is selling a security that has experienced a loss—and then buying a correlated asset (i.e. one that provides similar exposure) to replace it. The strategy has two benefits: it allows the investor to “harvest” a valuable loss, and it keeps the portfolio balanced at the desired allocation.

How does it lower your tax bill?

Capital losses can be used to offset capital gains you’ve realized in other transactions over the course of a year—gains on which you would otherwise owe tax. Then, if there are losses left over (or if there were no gains to offset), you can offset up to $3,000 of ordinary income for the year. If any losses still remain, they can be carried forward indefinitely (see here for more on how these rules apply).

Tax loss harvesting is primarily a tax deferral strategy, and its benefit depends entirely on individual circumstances. Over the long run, it can add value through some combination of these distinct benefits:

- Tax deferral: Losses harvested can be used to offset unavoidable gains in the portfolio, or capital gains elsewhere (e.g. from selling real estate), deferring the tax owed. Savings should be invested— assuming a conservative growth rate of 5% over a 10-year period, a dollar of tax deferred would be worth $1.63. Even after belatedly parting with the dollar, and paying tax on the $0.63 of growth, you’re ahead.

- Pushing capital gains into a lower tax rate: If you’ve realized short-term capital gains (STCG) this year, they’ll generally be taxed at your highest rate. However, if you’ve harvested losses to offset them, the corresponding gain you owe in the future could be long-term capital gain (LTCG). You’ve effectively turned a gain that would have been taxed up to 50% today into a gain that will be taxed more lightly in the future (up to 30%).

- Converting ordinary income into long-term capital gains: A variation on the above: offsetting up to $3,000 from your ordinary income shields that amount from your top marginal rate, but the offsetting future gain will likely be taxed at the LTCG rate.

- Permanent tax avoidance: Tax loss harvesting provides benefits now in exchange for increasing built-in gains, subject to tax later. However, under certain circumstances (charitable donation, bequest to heirs), these gains can avoid taxation entirely.

Navigating the Wash Sale Rule

Summary: Wash sale rule management is at the core of any tax loss harvesting strategy. Unsophisticated approaches can detract from the value of the harvest or place constraints on customer cash flows in order to function.

If all it takes to realize a loss is to sell a security, it would seem that maintaining your asset allocation is as simple as immediately repurchasing it. However, the IRS limits a taxpayer’s ability to deduct a loss when it deems the transaction to have been without substance.

At a high level, the so-called “wash sale rule ” disallows a loss from selling a security if a “substantially identical” security is purchased 30 days after or before the sale. The rationale is that a taxpayer should not enjoy the benefit of deducting a loss if he did not truly dispose of the security.

The wash sale rule applies not just to situations when a “substantially identical” purchase is made in the same account, but also when the purchase is made in the individual’s IRA account, or even in a spouse’s account. This broad application of the wash sale rule seeks to ensure that investors cannot utilize nominally different accounts to maintain their ownership, and still benefit from the loss.

A wash sale involving an IRA account is particularly unfavorable. Generally, a “washed” loss is postponed until the replacement is sold, but if the replacement is purchased in an IRA account, the loss is permanently disallowed.

If not managed correctly, wash sales can undermine tax loss harvesting. Handling proceeds from the harvest is not the sole concern—any deposits made in the following 30 days (whether into the same account, or into the individual’s IRA) also need to be allocated with care.

Avoiding the wash

The simplest way to avoid triggering a wash sale is to avoid purchasing any security at all for the 30 days following the harvest, keeping the proceeds (and any inflows during that period) in cash. This approach, however, would systematically keep a portion of the portfolio out of the market. Over the long term, this “cash drag” would hurt the portfolio’s performance.

More advanced strategies repurchase an asset with similar exposure to the harvested security that is not “substantially identical” for purposes of the wash sale rule. In the case of an individual stock, it is clear that repurchasing stock of that same company would violate the rule. Less clear is the treatment of two index funds from different issuers (e.g. Vanguard and Schwab) that track the same index. While the IRS has not issued any guidance to suggest that such two funds are “substantially identical, a more conservative approach when dealing with an index fund portfolio would be to repurchase a fund whose performance correlates closely with that of the harvested fund, but tracks a different index.

Selecting a viable replacement security, however, is just one piece of the accounting and optimization puzzle. Manually implementing a tax loss harvesting strategy is feasible with a handful of securities, little to no cash flows, and infrequent harvests (once a year is common for DIY practitioners). However, assets will often dip in value but recover by the end of the year, so annual strategies leave many losses on the table. The wash sale management and tax lot accounting necessary to support more frequent (and thus more effective) harvesting quickly become overwhelming in a multi-asset portfolio—especially with regular deposits, dividends, and rebalancing.

Software is ideally suited for this complex task. But automation, while necessary, is not sufficient. The problem can get so complex that basic tax loss harvesting algorithms may choose to keep new deposits and dividends in cash for the 30 days following a harvest, rather than tackle the challenge of always maintaining full exposure at the desired allocation.

A best-in-class tax loss harvesting algorithm should be able maximize harvesting opportunities across a full range of volatility scenarios, without sacrificing the investor’s precisely tuned global asset allocation. It should reinvest harvest proceeds into closely correlated alternate assets, all while handling unforeseen cash inflows from the investor without ever resorting to cash positions. And most of all, it should do everything to avoid leaving a taxpayer worse off. TLH+ was created because no available implementations solved all of these problems.

Existing strategies and their limitations

Every tax loss harvesting strategy shares the same basic goal: to maximize a portfolio’s after-tax returns by realizing built-in losses while minimizing the negative impact of wash sales.

Approaches to tax loss harvesting differ primarily in how they handle the proceeds of the harvest to avoid a wash sale. Below are the three strategies commonly employed by manual and algorithmic implementations.

After selling a security that has experienced a loss, existing strategies would have you