Which Type of REIT Should You Purchase

Post on: 10 Июнь, 2015 No Comment

Knowing the Differences is Quite Important to Your Investing Success

You can opt-out at any time.

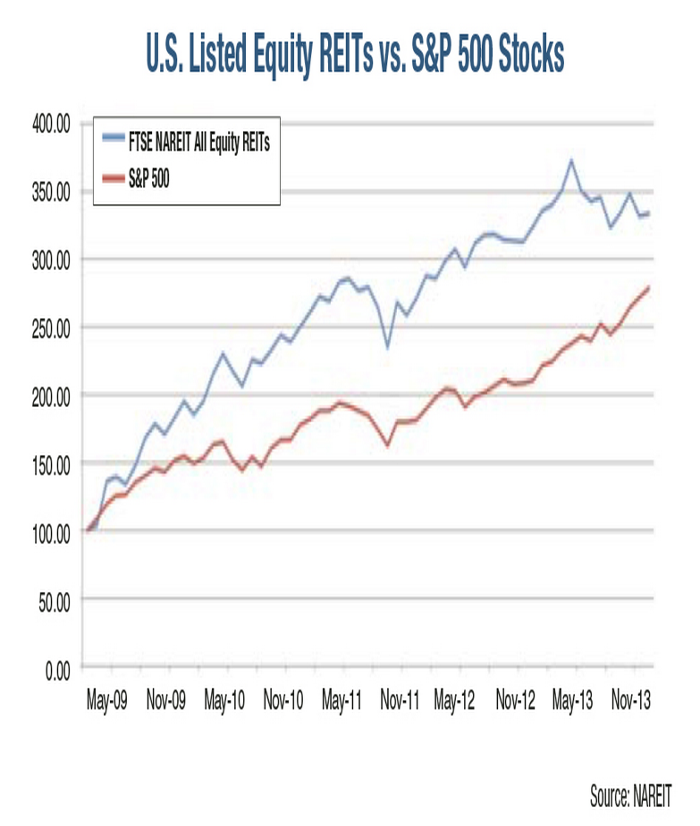

Once a real estate investor has bought into the value of REITs for their investment portfolio, there’s an interim step before looking at individual REITs and their performance. That step is to fully understand the differences in the two major REIT types, Equity and Mortgage REITs.

Why is this major difference of critical importance to the REIT investor? The nature of the two makes their risk and performance characteristics quite different. Your risk tolerance and investment goals will determine which of these REIT types will be appropriate for your portfolio. Though they act differently, they don’t seem to be chosen in tandem by many investors. It seems to be an either/or decision in most cases.

The equity REIT invests in ownership and management of commercial and rental properties. There is a potential for investment return based on several factors:

Though mortgage REITs can produce significant returns, sometimes in short time frames, they carry significant added risks. Since they only hold debt instruments and not property, they cannot participate in the appreciation of the collateral properties. Their value is also quite sensitive to interest rate fluctuations. This isn’t a large factor in equity REITs, as they generally are financed by fixed rate mortgages. With interest rate influences being so important to mortgage REITs, their prices tend to be more volatile than those of the equity type. Owned property values are more stable and predictable than the mortgages in the mortgage REIT.

Generally, mortgage REITs are considered more for trading in the shorter term than the longer term holding strategy of the equity REITs. As an investor, thoroughly familiarize yourself with the characteristics of both before selecting REITs in which to invest.