Where the Jobs are in Investment Banking

Post on: 16 Март, 2015 No Comment

The financial crisis has certainly taken its toll on the investment banking industry. The crazy deal activity that created the big institutions, as one investment banking insider notes, is gone forever. During the second half of last year, it was fairly brutal with few deals and huge layoffs at many of the leading firms. And many small firms and hedge funds simply closed their doors.

But that doesn’t mean that there aren’t job opportunities available in the industry. One observation the industry insider, who wished to remain anonymous, noted was that many investment bankers have found new opportunities on the corporate side, helping private companies manage smaller mergers and acquisitions. Others have joined private equity firms, wealth advisories or started their own businesses as financial advisors.

Another trend noted by the source was the increase in unpaid internships to students on spring and summer breaks from top colleges. Many students are more than willing to invest four to eight weeks in New York at an investment banking firm to gain valuable experience crunching numbers, creating PowerPoint presentations and assembling pitch materials for senior team members. This is a win-win for the student and the small- to mid-sized firms that offer these internships, notes the industry source.

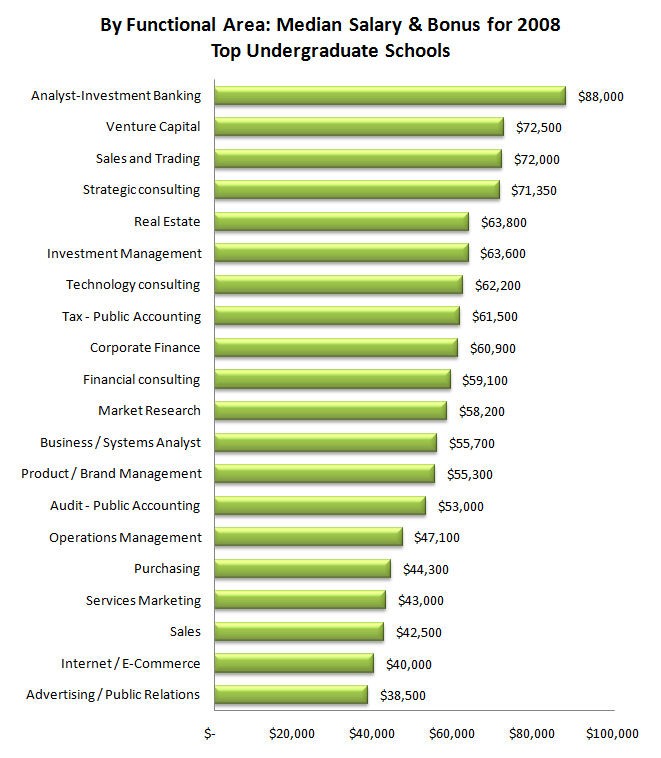

Since most investment banking firms no longer have the resources to pay for on-staff administrative support, students fill the gap and have the opportunity to analyze data and work on the few deals that are out there. Upon graduation, these students are scooped up by top investment banking firms. Once they have their degree and a few internships under their belt, they can land good-paying jobs as entry-level analysts.

The financial crisis and job cuts at the big institutions have also given small, mid-sized and minority-owned firms the opportunity to bring on top talent, noted the industry source. This had been difficult in years past when the best of the best chose to join the Wall Street giants.

The industry insider also noted that while the U.S. banking industry took some big hits during the financial crisis, Canadian Banks were much more conservative and, due to a different regulatory structure, were not allowed to take as many risks as their U.S. counterparts. As a result, a number of top Canadian banks have expanded across the border into the U.S. like BMO (Bank of Montreal) Capital Markets and RBC (Royal Bank of Canada). Other smaller local and regional U.S. firms have expanded nationwide, creating new employment opportunities for seasoned investment banking veterans and recent college graduates.

The industry is also very welcoming to veterans, providing them opportunities as investment bankers or traders, says the anonymous source. Former military personnel are very disciplined and understand the importance of teamworktwo attributes that are important in investment banking.

Last Updated: 23/04/2012 — 9:29 AM