When There Is Blood On The Streets Buy Gold

Post on: 17 Апрель, 2015 No Comment

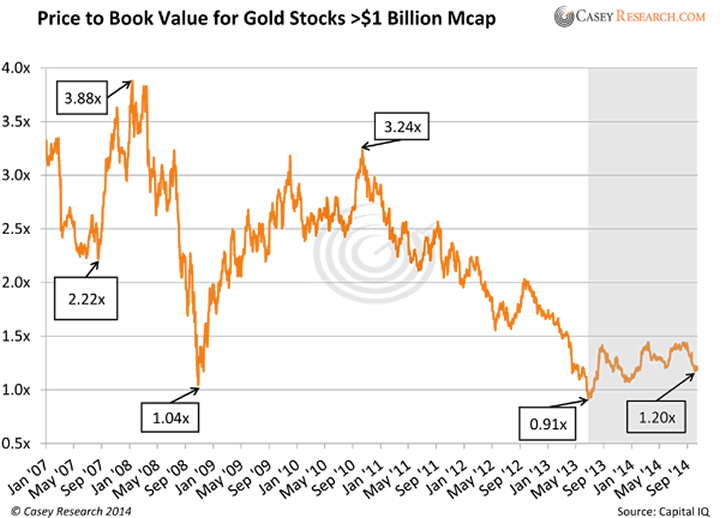

Are those that bought gold and silver panicking yet? I would hope not. My advice to dollar cost average into a position is paying off as my prediction of a stronger dollar is coming to fruition. But there are some investors who bought gold or silver the past few months that might be panicking. There is a possibility the blood on the streets is not over, but we are inching ever closer.

While many other gold gurus, the ones who say the dollar is toast or doomed have been telling everyone to load up with gold, I have been trying to tell people to be patient. I have likened it to the tortoise versus the hare approach to investing in precious metals. The key for me has been the strength of U.S. Treasuries and the fact that Europe has more problem issues to deal with than the U.S. You dont see dollar doomsday scenarios in my articles and I have only written one article on hyperinflation. This is because all along I have been in the deflation camp. But dont get me wrong, at some point all currencies will fall collectively versus gold and silver.

Deflationary Credit Contraction

I clearly laid out what is occurring in Chapter 4 of my book Buy Gold and Silver Safely. It has been clear to me that the quantitative easing the Fed has thrown at the markets hasnt worked. Real estate is still declining. Banks arent marking to market their assets. Businesses are still struggling to make ends meet as they try and unwind their debt. Unemployment (the real figures) is still high. All this and interest rates are at historic lows. The Fed cant make people or businesses take out a loan, and consumers and businesses are busy reducing debt instead of making purchases or expanding. The economy is not growing as some would have you think, except for the government subsidized ones of course.

What this means, is people are more concerned with conserving their wealth. This is what occurs in a deflationary environment. It isnt about how to make money as it is about how to not lose money. While you will see that many financial advisors and journalists will come out with their the gold bubble has popped articles, keep in mind that this will be the 11th straight year that gold has finished higher with another double digit return. No other asset can lay claim to this track record the last 10 years, but some investors may still think the gold bubble has indeed popped.

Tortoise vs. Hare

The reason I continue to use the tortoise vs. the hare analogy with gold and silver is I dont want people to think of gold and silver as much as a get rich quick investment, but rather, insurance against the United States unsustainable economic future. For me, its simple math. Perception though is another term I use often. People still perceive that U.S. Treasuries are strong and of course safe. This perception would change overnight if people knew what was on the Feds balance sheet and how they continue to secretly try and manipulate the economy as was just reported by Bloomberg. But you wont hear the media talk about what the Fed does. Go ahead and Google Bloombergs story below. There are very few references.

Federal Reserve As Saviour?

Most reading this might not realize that the Fed secretly gave banks and other countries $7.7 trillion during the 2008 financial crisis.

Continue reading Part 2 Including gold and silver market analysis