When Do You Need a Quitclaim Deed Sell

Post on: 7 Май, 2015 No Comment

Share this:

Buying and selling real estate involves a variety of financial and legal transactions, which is why it is so important to involve a team of professionals, including real estate agents and attorneys, who understand the implications of transferring ownership.

If you are selling your home now, you may not remember that you signed and received a deed when you purchased your property. The deed provides proof of ownership and transfers the title to you regardless of who owned the property before you.

Two Types of Deeds

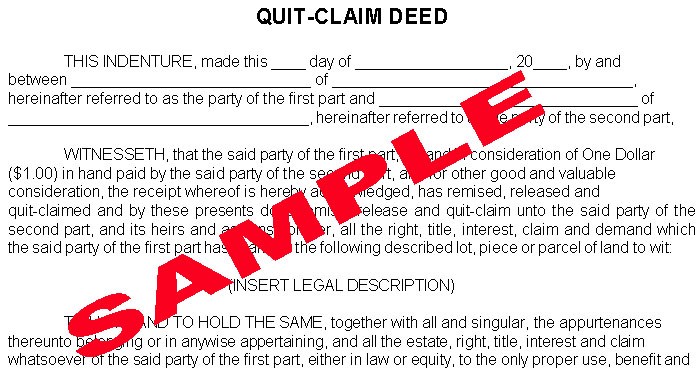

The legal document that transfers ownership can be a warranty deed or a quitclaim deed.

Warranty deed: Used in most real estate sales transactions, a warranty deed says that the grantor (previous owner) is the owner of the property and has the right to transfer the property to you. In addition, this deed serves as a statement that there are no liens against the property from a mortgage lender, the Internal Revenue Service or any creditor, and that the property can’t be claimed by anyone else. Title insurance provides the financial back-up to the warranty deed and requires a title search to verify that no other claims on the property are outstanding.

Quitclaim deed: Used when a property transfers ownership without being sold. No money is involved in the transaction, no title search is done to verify ownership, and no title insurance is issued.

When to Use a Quitclaim Deed

Quitclaim deeds are most often used to transfer property within a family. For example, when an owner gets married and wants to add a spouse’s name to the title, or when the owners divorce and one spouse’s name is removed from the title. In other cases, a quitclaim can be used when parents transfer property to their children or when siblings transfer property to each other. Some families opt to put their property into a family trust and a quitclaim can be used then as well.

One other time a quitclaim might be used is when a title insurance company finds a potential additional owner of a property and wants to make certain that this person doesn’t make a future claim of ownership. In that case, the insurance company would ask that person to sign a quitclaim deed.

It is important to recognize that a quitclaim deed impacts only the ownership of the house and the name on the deed, not the mortgage. For instance, in the case of a divorce, if both spouses’ names are on the home loan, they are still both responsible for the loan even if a quitclaim deed has been filed.

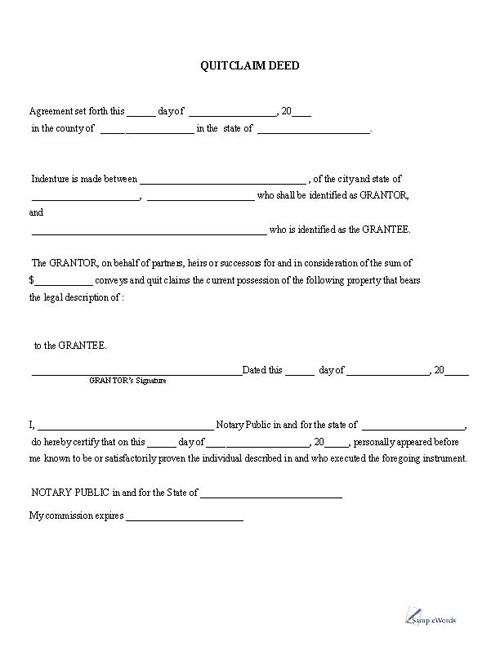

Quitclaim Deed Basics

The rules about how a quitclaim is handled vary by jurisdiction, but generally you need to include the legal description of the real estate being transferred, the date of the transfer and the names of the “grantor” and “grantee.” Not all states require you to record a quitclaim deed, but it’s wise to have the deed signed by all parties in front of a notary public, copied and recorded at the county clerk’s office.