What to Do When Traditional Diversification Strategies Fail

Post on: 8 Апрель, 2015 No Comment

What to Do When Traditional Diversification Strategies Fail

A Study on Diversification and Asset Correlation in Up and Down Markets

In 2008, market events showed that some of the protection provided by diversification is lost when correlation among asset classes changes rapidly. Now, the question is: Are traditional diversification concepts no longer applicable due to some systemic change? Or is there still a simple, repeatable approach to diversification that can lead to significant protection against loss of principle?

Many factors could be contributing to recent volatile market behavior, for example, globalization, investor fear, government policies, and alternative investments. This article explores a methodology that attempts to address these factors.

gsbm-med.pepperdine.edu/gbr/audio/fall2009/diversification.mp3]

Correlation is the statistical measure of diversification; when calculated between the S&P 500 and MSCI EAFE indices over the last 30 years, a noticeable trend occurs. Correlation increased from 0.47 (from 1980 to 1990) to 0.54 (from 1990 to 2000) to 0.83 (from 2000 to 2009). [1]

Clearly, understanding how diversification of investments changes over time is very relevant. [2] For example, when liquidity became an issue in the fourth quarter of 2008, asset correlations began to approach 1.0, the point at which diversification can fail. [3] Such failure is largely due to the variation of asset correlations over time. The market stresses of 2008 and their effect on asset correlation were reported by others who saw greater positive correlation. [4] The effect of buy-and-hold strategies, along with the need for more active management techniques, was further reinforced by market observations. [5]

Hypothesis and Simple Illustration

Is there a simple, repeatable approach that can continue to provide the practical benefits of diversification? To develop assumptions and test such an approach, the following questions were addressed:

- What publicly available asset classes should be considered in building a diversified portfolio?

- How much history should be examined before making decisions?

- How frequently should portfolio changes be made and how do switching costs influence such decisions?

- What is an appropriate correlation coefficient threshold?

- What allocation strategy should be employed?

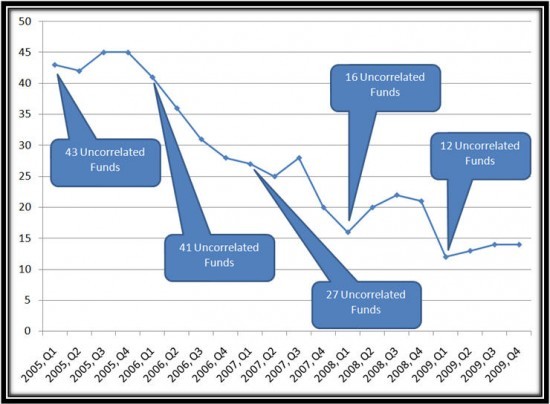

To explore these questions and to develop a rationale on an analytical framework, Figure 1 was constructed and tracked by representative exchange-traded funds (ETFs).

Figure 1 — Total Return of Bond, Domestic Small Cap, Domestic Large Cap, and International Asset Classes in 2008

Figure 1 shows a time series of gains and losses for each of the asset classes listed in Table 1 below. All of the asset classes, except bonds, suffered a significant loss in 2008. A broader look at 2008s gains and losses shows that real estate and commodities fell by 39 percent and 47 percent, respectively, in addition to the domestic and international equity assets shown in Figure 1. Domestic bonds gained 5 percent, non-U.S. bonds gained 10 percent, and short-term Treasury bills returned 1.5 percent. [6]

Table 2 illustrates the result of a naïve approach, which spreads assets equally across asset classes. In 2008, applying this approach to these four funds would have led to a 27-percent loss.

Table 2 — 2008 Performance of Naïve Allocation

The concept of diversification suggests that only uncorrelated assets should be held in a portfolio. To measure the correlation, or lack thereof, among assets, we calculated correlation coefficients based on returns of risky assets over a fixed period of time. A positive correlation coefficient indicates asset returns are directly related to one another, while a negative correlation coefficient suggests an inverse relationship. A correlation coefficient near zero implies the change in one risky asset has little to no effect on the change of the other.

Applying this active approach, Table 3 shows the correlation coefficient based on daily returns from 2007. The value of 1.0 along the diagonal is expected, as it is a measure of an assets price movement relative to itself. A correlation threshold of 80 percent implies a diversified portfolio should only hold two of these assets because the correlation coefficients associated with SPY, EFA, and IWM are all greater than 0.80. Thus, bond (AGG) and domestic large cap equities (SPY) should be selected for future allocations and SPY could be replaced with either IWM or EFA in order to satisfy the 0.80 correlation threshold.

After selecting AGG and SPY, a naïve allocation strategy was applied to construct a portfolio and to test its performance in 2008 (Table 4). Both classes demonstrate the first part of our hypothesis—that a simple approach to diversification (e.g. applying an 80-percent threshold on correlations from the previous year) could lead to significant protection against loss of principle the following year. The results also showed that in a downward-trending equity market such as 2008, one should move to less risky, lower beta assets, thus adhering to the precepts of modern portfolio theory (MPT). The challenge is that the three equity classes had small gains and losses in 2007, providing inconclusive evidence about the broad equity market downturn to come.