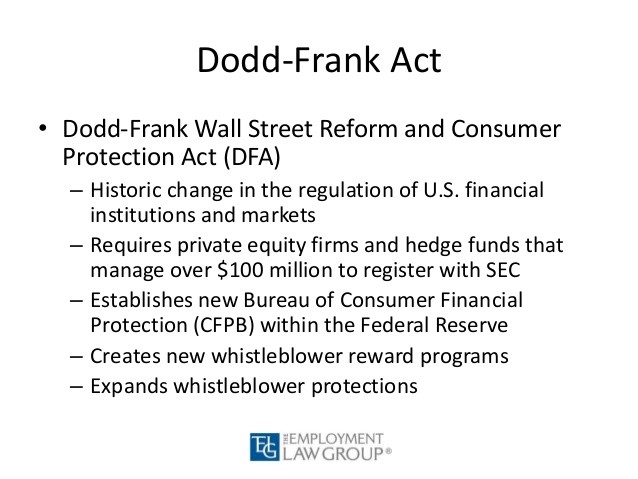

What The Dodd Frank Act Means To Hedge Funds

Post on: 27 Май, 2015 No Comment

How The Dodd-Frank Act Is Changing Hedge Fund Reporting

Hedge fund principals must anticipate the full reporting requirements of the Dodd Frank Act. Photo Credit: Clarita

The Dodd-Frank Act prompts changes to the ways hedge funds must operate to better protect the investor public. In addition, hedge fund managers—along with service providers—must consider technology, operations, and infrastructure to meet the new regulatory requirements. Hedge fund managers, and those who work for them, say that the following topics haunt hedge fund principals these days:

Compliance. Along with the need for the development of ongoing compliance policies and procedures, hedge funds must hire a compliance chief if such a person isn’t already on board. Along with the establishment of the new compliance team’s mandate, she must ascertain and write about the procedures and policies necessary by the group. Depending on the hedge fund employer, she will determine how to prepare for the frequency of audits required by the SEC. She will also assess how to address primary gaps and risks of the hedge fund when determining how to ensure the firm’s compliance.

Policies. Along with the firm’s established policies, a hedge fund must ensure that certain procedures and policies are in place concerning securities’ and asset valuation. Illiquid or infrequently traded securities must be carefully considered. The firm must have an understanding of the best practices in place for procedures, documentation, and valuation of any asset classes in which the firm invests for its clients.

SEC Audits. According to the Investment Advisers Act of 1940, the SEC is authorized to examine registered advisors’ operations and practices. The SEC remains interested in and focused upon risk and risk management practices used by the firm to safeguard investor funds. Demonstrating the firm’s compliance systems, along with the firm’s internal controls and practices to protect investor capital, is key to the SEC examinations. The compliance team must prepare for the SEC examination by determining what systems aren’t in place now (see above).

Risk and Management. Risk and how hedge fund managers manage it concerns the SEC examiners. Each registered hedge fund must strengthen risk management. The policies used by the hedge fund to report assets under management, leverage, credit exposure, counterparty risk—along with the general concerns of market, investment and trading risks—are part of the SEC focus.

Stress tests for any hedge fund considered a systematically significant nonbank financial company (SSNF) will apply. Like large financial institutions facing a critical sell-off or liquidity crisis, examiners want to understand how the firm communicates investment values and handles liquidations. The firm’s compliance to contingent capital requirements and tighter risk management models is important. If the firm trades swaps, the SEC wants to see that the firm has made risk adjustments for clearing issues.

Proprietary trading units or spun-off businesses must be considered and recapitalized as per the Volcker Rule. That is, banks may not invest more than 3 percent of Tier 1 capital (primary bank capital) in hedge funds.

Derivatives. Trading over-the-counter derivatives and other complex financial products will require additional planning for hedge funds under the new law. For example, otc derivatives may clear through a central counterparty. Hedge funds are trying to identify those winners in the central counterparty qualifications race.

Technology Upgrades. Electronic trading and other quantitative models require greater investments in technology and the development of new algorithms. Prime brokers, as partners to hedge funds, must also invest money to provide model tests, security and technology controls. Required Reporting. Additional reporting to regulators requires hedge funds and providers of services to hedge funds to spend additional time (and money) in meeting the increased reporting requirements.

Funds-of-funds (those hedge funds offering a portfolio of funds to investors) or specialty funds investing in hard assets or otherwise illiquid investments, such as real estate, have additional reporting requirements. Keeping records and maintaining the required operations—along with professionals required to maintain them—will add to the costs of running a hedge fund. Regulatory reporting requirements now could expand to even greater reporting requirements, so hedge fund management must be able to predict the future needs of the Financial Stability Oversight Council (FSOC) to some degree.

Uncertain Future Regulations. The entirety of the Dodd-Frank Act remains to be seen: 200 plus regulations are anticipated in the short-term and 60 studies outlined by the Act are in progress or planned for completion. To assist hedge funds in preparing for a wide array of new requirements, third party providers are knocking on the doors of hedge funds of all sizes. Those in the greatest need of services are the smallest hedge funds, or those with less than $125 million AUM, according to ICS Compliance consultants. Without the assistance of third-party providers, creating the projected needs of the Dodd-Frank Act is beyond the financial reach of smaller funds.

Data and Documents Accuracy. Hedge funds must insure that controls, checks and balances are in place to present accurate information about the fund’s assets under management and values. The fund’s ability to create, store, and retain these records, along with costs to install and maintain them, are part of the new compliance rules.

People. Because of the Dodd-Frank Act and its sweeping regulatory reporting requirements, firms must hire new people. A compliance chief is one of the key professionals required by the Act for each fund. Technical professionals are also key to the Act. Some funds must hire new technology professionals to oversee data development and management. Others must invest in the development of new software systems. The operations, technology, and compliance teams necessary by the largest hedge funds may already be in place. Smaller firms are scrambling to ensure the requirements of Dodd-Frank are met.