What the Big Mac Can Tell You about Currencies Traders Log

Post on: 16 Март, 2015 No Comment

Posted By: Bryan Rich

Currencies have experienced a massive wave of volatility in the past three years. Driving some of that volatility are the early stages of a sovereign debt and currency crisis.

As I laid out in my June 26 Money and Markets column, history suggests many of the sovereign debt problems in the world will likely be responded to with competitive currency devaluations. So its reasonable to expect large moves in currencies.

How large should we expect?

For our guide, lets take a look at the markets estimate of the current fair value of currencies.

Well use an economic theory known as purchasing price parity (PPP), which adjusts the exchange rate so that an identical good in two different countries has the same price when expressed in the same currency.

And here are two tools to help with that analysis

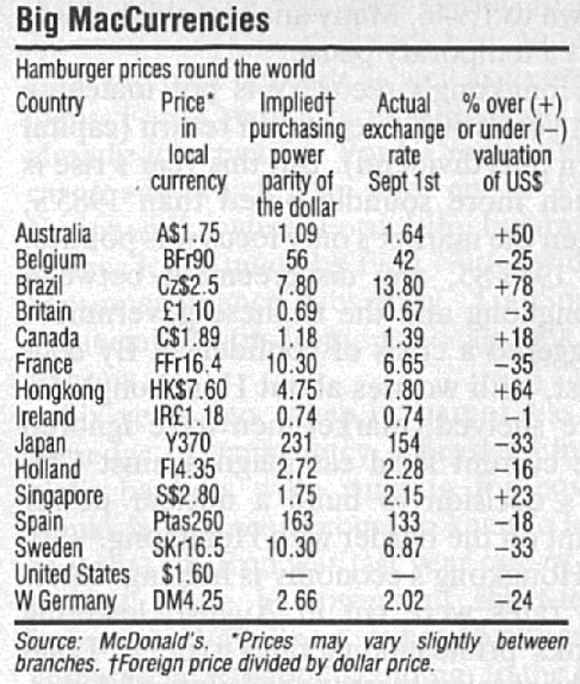

Tool #1— Big Mac Index

If you were to visit a McDonalds outside of your home country, would you expect to pay more or less for a Big Mac?

It depends.

Youd likely notice a difference though.

A major cause of this difference would be the value of the local currency relative to your home countrys currency. And thats where the Big Mac Index comes in

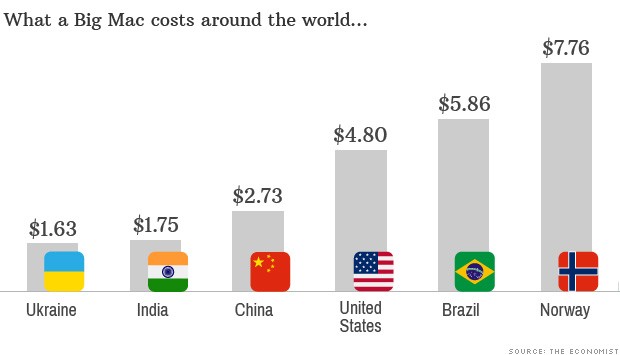

A Big Mac in the U.S. will run you about $3.50. If youre traveling around Germany, youll pay in the neighborhood of 3.15 euros for that sandwich. So at current exchange rates, the same sandwich in Germany will cost you $4.10 or 17 percent more than youd pay in America.

Expect to pay more for a Big Mac in Germany than you would in Kansas.

What does this analysis tell you about the value of the euro?

It could tell you that the euro is overvalued. But there are also other factors to consider when comparing the Big Macs prices: Labor costs, real estate costs, taxes, transportation costs, trade-related costs, the quality perception of the product and other variables that impact doing business in different countries.

The bottom line: Running a McDonalds in Omaha is quite different than running a McDonalds in Berlin. Nonetheless, the Big Mac Index is a useful quick analysis for comparing currency values.

Tool #2— OECDs PPP

The more academically accepted version of PPP is the measure against a basket of goods and services. These statistics are compiled by the Organization for Economic Co-Operation and Development (OECD).

Both the Big Mac Index and the OECDs work are broadly accepted tools for assessing the relative under or over valuation of currencies. But keep in mind that PPP analysis in general is a longer-term tool. It does not incorporate many of the short-term influences that can drive currency values.

Yet it does provide a benchmark equilibrium exchange rate as a reference point, which combined with a healthy dose of assumptions, can be used to normalize the cost of a product across countries.

So What Does PPP Tells Us Right Now about the Most Overvalued Currencies in the World?

In my chart below, you can see some of the most overvalued currencies according to the Big Mac Index and the OECDs PPP. The axis on the left shows how overvalued these currencies are relative to the equilibrium exchange rate based on purchasing price parity.

Both measures agree that the Swiss franc is one of the most overvalued currencies in the world, relative to the U.S. dollar.

The francs strength has come from its traditional appeal as a safe haven currency. Market participants have fled the troubled euro, and used the Swiss franc as a safe parking place. Thats pushed the value of the Swissie well out of line with economic fundamentals.

Also sitting well in overvalued territory is the Japanese yen

The yen has gained 28 percent against the dollar since the onset of the financial crisis in 2007 as investors exited the highly popular carry trade — where they borrowed cheap yen to buy high yielding currencies. And it continues to find favor, ignoring Japans inferior economic fundamentals.

As for the euro, despite its sharp collapse since November of last year, the OECD PPP puts a fair value even lower, at $1.18. Given the fluid nature of the problems in Europe and the tendency of markets to overshoot, it could go much lower.

As For the Undervalued Currencies

The major Asian export-centric economies dominate those currencies deemed the most undervalued, according to purchasing price parity. Among them are the Malaysian ringgit, the Thai baht, the South Korean won, and the widely scrutinized currency for its gross undervaluation the Chinese yuan.

Weak currencies help many Asian countries maintain a massive trade surplus.

The Big Mac Index and the OECDs PPP arent great trading tools. But they do give some additional perspective, when combined with fundamental, technical and sentiment analysis. Indeed, helpful in a world of increasingly vulnerable currencies.

www.moneyandmarkets.com .