What Is Hedge Fund Investin Do Hedge Funds Make Money

Post on: 31 Июль, 2015 No Comment

And How Do Hedge Funds Make Money?

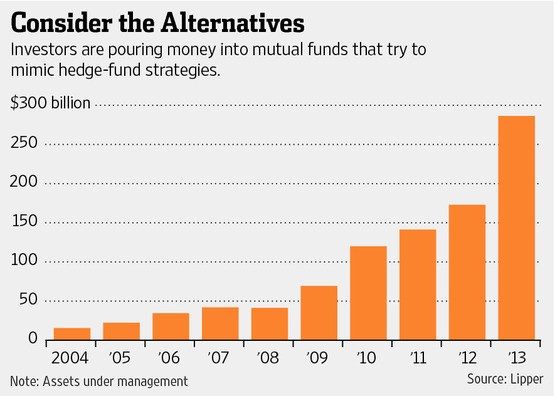

Hedge funds pools of capital for investment. They are a prime example of capitalism in the 21st century. They reward risk takers and they exist to make rich people richer. Is it possible to beat the investment markets? Finance professors say no. Hedge fund managers say yes.

Alfred Jones Started the First Hedge Fund

Alfred Winslow Jones created the first hedge fund in 1949. He came to finance from a background in publishing, including a job at Fortune magazine. He created the successful strategy of hedging his investments, and went on to earn great wealth and lots of imitators. To hedge an investment means to offset a long position with a short position. For example, if you see pricing imbalance in the automotive industry, you might buy shares of General Motors and sell short shares of Ford Motors. To sell short shares of a stock means that they borrow the shares from the investor who owns them and sell the shares in the marketplace, with the expectation of buying back the shares at a lower price later and then returning the shares to the lender. The tactic of hedging investments, being both long and short in related securities, is felt to protect the investments from the risk of market swings. Today many hedge funds use other strategies and often do not hedge their investments.

How Hedge Funds Operate

A hedge fund is a private entity organized as a limited partnership. It has a private pool of capital to invest in securities. A hedge fund is a vehicle for holding and investing the money of its investors. The fund itself has no employees and no assets other than its investment portfolio and cash. The portfolio is managed by the investment manager, who acts as the general partner, runs the business and has employees. The hedge fund compensates its managers with a share of the fund’s profits. Although hedge funds are investment companies, they do not seek funds from the general public and are thereby exempt from many regulatory restrictions. A hedge fund is not a bank, so it does not take money on deposit like a bank. It is not an investment bank, so it does not organize corporate fund raising and it does not sell new issues of stock like an investment bank. A hedge fund accepts multi-million dollar investments from wealthy investors who are aware of the risks. The hedge fund does not allow the average Joe and Jane to invest. Often the managers of the hedge fund are its largest investors, so they are risking their own money. The hedge fund cannot borrow money from the Federal Reserve, the way banks do. Hedge fund investments are not guaranteed by the FDIC, like bank deposits. Because hedge funds are simply private pools of money, they are not regulated like banks, insurance companies and investment banks.

Hedge funds charge a performance fee which is usually 20% of all the investment gains. They also may charge expense fees and also withdrawal fees to discourage short-term investors. Hedge fund investors agree not to withdraw their money for a stated time. Of course, earnings are not guaranteed. They grow by accepting new investments. Performance fees have been criticized by many people, because fees give managers a share of profit but do not penalize them for losses. Thus, performance fees give managers an incentive to take excessive risk.

The Investment Strategies Hedge Funds Use

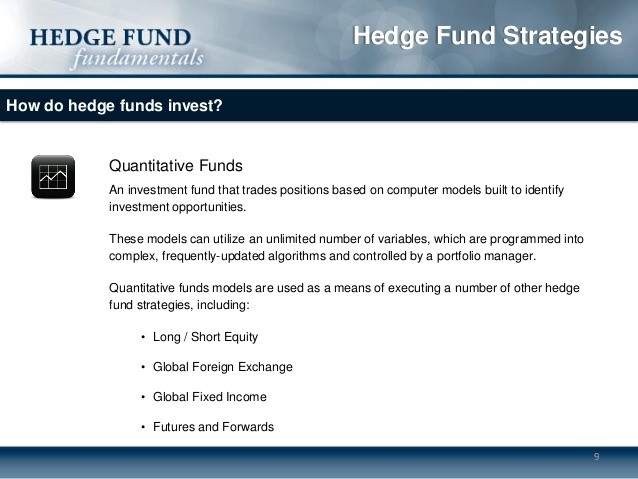

Hedge funds use many and diverse investment strategies. Managers look at financial markets for stocks, corporate bonds, government bonds, world currencies, futures, options and commodities like gold, platinum and corn. They search for prices that are out of balance, prices that do not reflect future conditions. Sometimes they use quantitative analysis and other statistical tools to find an investment idea. Other times, they become stock pickers. Some notice a stock price is trending higher and buy the stock to ride out the trend. Others are contrarians, and look for upward price trends that may peaked. By raking in profits, year after year, hedge funds disprove modern portfolio theory, random walk theory of stock markets, and the theory of efficient markets.

How Hedge Funds Use Leverage

The common practice at hedge funds is to borrow money to invest or to trade on margin. Borrowed money, called leverage, can amount to 10 times or 20 times the amount of capital the hedge fund has. If a hedge fund has one billion dollars in capital, it might borrow another $10 billion, so that it has $11 billion dollars to invest. That’s how the hedge fund takes risks. With borrowed money the fund can take a huge position in its investments and earn astounding returns for its investors. By the same token, if an investment strategy goes bad, leverage makes the loss much larger. Investment banks who lend money to hedge funds hold the fund investments as collateral for the loan. Hedge funds also use derivatives to increase the fund leverage.

Risk-takers with lots of confidence are drawn to hedge funds for this reason. Many times a hedge fund is wiped out and investors lose everything when investments go sour. If a hedge fund loses money, often the manager will close the fund and start a new fund under a new name. But successful hedge funds have made many people wealthy. Hedge funds on average outperform other investments, like the S&P 500, mutual funds and real estate.

Examples of Hedge Funds

Hedge funds don’t seek publicity, so most people don’t know them by name. Notable hedge funds are: Amaranth Advisors, Bridgewater Associates, Citadel Investment Group, D.E. Shaw, Fortress Investment Group, GLG Partners, Man Group, Marshall Wace, Paulson & Co. Renaissance Technologies, SAC Capital Advisors, and Soros Fund Management,

The Risks a Hedge Fund Takes

When a hedge fund crashes, it makes a big noise. The crisis at LTCM in 1998 illustrates the risks that hedge funds face.

- Some hedge funds make investments that are not liquid, that cannot be sold quickly.

- A hedge funds can grow so big that it becomes the market, and there are no buyers for their investments when the fund wants to sell. It is also difficult to put a value on an investment if there are no buyers for it.

- Hedge fund math models assume that investors act rationally, but in fact, when markets become unstable, investors panic, sell out and move their money into safer investments like U.S. Treasury bills.

- The sheer size of investments that fail can wipe out all the hedge fund capital, and trigger calls for more collateral from the lenders that the fund cannot meet.

- The market for some financial instruments is small, and one buyer or seller can affect the price significantly.

How Hedge Fund Long Term Capital Management Failed (LTCM)

Here’s how the crisis played out at hedge fund LTCM. When investment banker Salomon Smith Barney started selling its dollar interest arbitrage positions, prices dropped about 10%. LTCM owned these investments, too. And when the value of leveraged assets falls, the loss to LTCM was much greater than 10%. That summer Russia defaulted on its loans. In one day, LTCM lost $500 million. And lenders started calling in their loans to LTCM. The recession in Japan and the collapse of the Suharto regime in Indonesia introduced panic in the financial markets. LTCM’s portfolio was highly leveraged. LTCM’s on balance sheet assets totalled around $125 billion, on a capital base of $4 billion, a leverage of about 30 times capital. LTCM also made off-balance-sheet investments. LTCM’s off-balance sheet business was around $1 trillion. The combined leverage on and off-balance sheet came to 300 times the LTCM capital. Once other traders knew that LTCM would be making distress sales, they traded against LTCM, thus moving prices lower and making the LTCM loss greater.

The investors in LTCM were wiped out. But LTCM was saved by a consortium of 16 investment banks, led by Goldman, Merrill Lynch and J.P. Morgan, who took over LTCM and invested $3.625 billion in new capital. This action protected capital markets from a meltdown, and turned out to be profitable for the new investors.

In 2008, another crisis exploded at investment bank Lehman Brothers, insurance company AIG, Bear Stearns and others who held toxic assets like mortgage-backed securities. It became a world crisis because these banks and AIG were too big to fail. Hedge funds are small enough to fail. No government money or taxpayer money has ever been used to bail out a hedge fund.

I hope life brings you much success.

I wish you a very happy day.