What Is a Spousal IRA Rules Eligibility Benefits

Post on: 16 Март, 2015 No Comment

If you are a stay-at-home spouse, it seems unfair that you cant build up a retirement account in your name. After all, one of the requirements of opening an Individual Retirement Account (IRA) is that you need earned income. For those who stay home, though, this is actually a myth and one that could cost you.

The truth is that the IRS makes an exception for married couples that want to boost their household retirement savings while providing a stay-at-home spouse the ability to build a nest egg. This arrangement is often referred to as a spousal IRA.

Are You Eligible for a Spousal IRA?

Many households have an arrangement in which one spouse stays at home to care for the home and children. In such cases, if you are the stay-at-home parent. you can open an IRA in your name. In fact, the spousal IRA is just a regular IRA. The name merely refers to the fact that the working spouse can make a contribution to an IRA held in the name of a non-working spouse.

The eligibility requirements for the spousal IRA are straightforward:

- Marital Status: Married

- Tax Filing Status: Married, filing jointly

- Earnings: Contributing spouse must have compensation/earned income that amounts to at least the amount annually contributed to the non-working spouses IRA. If the contributing spouse also has an IRA, annual compensation/earned income must exceed the combined contributions the IRAs.

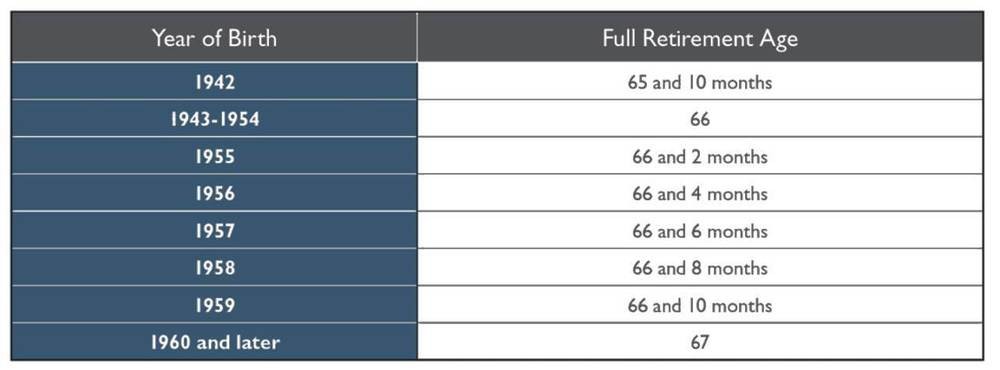

- Age: The non-working spouse must be under 70 1/2 in the year of the contribution for a traditional IRA. There are no age restrictions on a Roth IRA for a non-working spouse.

Once you determine that you meet the eligibility requirements, its possible for you to open an IRA in your name and have your working spouse contribute to it.

Understand that IRAs must be held separately, not jointly. This means that the non-working spouse owns the assets in the IRA. Once your working spouse contributes to the IRA, the money becomes yours. The IRA is in your name and opened with your social security number, and it remains yours even if you divorce .

Deductions, Contribution Limits & Income Limits

One of the reasons people contribute to retirement accounts such as IRAs is to get the tax advantage. A spousal IRA offers the same benefits as an account in the name of a working spouse. These tax advantages, though, come with limits that depend on your age and income, as well as the type of IRA you have.

Traditional IRA

The maximum IRA contribution limit is $5,000 for those under the age of 50. For those 50 and older, the contribution limit is $6,000. This contribution limit applies to all IRAs held in each persons name.

Since IRAs cant be held jointly, a married couple can contribute the maximum amount to two IRAs. As a result, your working partner can contribute $5,000 to his or her own IRA, and contribute another $5,000 to the IRA in your name, bringing the total annual retirement contribution to $10,000. For those over the age of 50, the numbers are $6,000 per account, for a total of $12,000.

No matter how high your income, you can contribute to a traditional IRA. However, whether you can deduct your contributions depends on a few other factors:

- If the working spouse doesnt participate in an employer-sponsored retirement plan, he or she can deduct the full amount contributed to the spousal IRA, and there is no income limit restricting the deduction. Things change, though, if the working spouse participates in an employer-sponsored plan.

- The deduction begins phasing out, for 2012, with a modified AGI of $92,000. You cant take a tax deduction if your household modified AGI is $112,000 or higher.

Remember that traditional IRAs are tax-deferred accounts. You dont pay taxes on the earnings until you withdraw money from the account during retirement. At that point, the amount you withdraw each year is taxed as regular income. Moreover, you are required to begin withdrawals once you turn 70 1/2. If you are eligible for the tax deduction, you receive a benefit now, lowering your tax liability.

Roth IRA

The contribution amount limits to a Roth IRA are the same as those to a traditional IRA. However, your eligibility to contribute to a Roth IRA depends on your income. You can make a full contribution to each Roth IRA as long as your working spouse makes less than $173,000 in 2012. At those levels of modified AGI, the contribution amount begins to phase out, and at $183,000 (2012) you are no longer eligible to make contributions.

Roth IRA accounts grow tax-free. so that means you dont receive a tax deduction for your contributions. However, when you are ready to take distributions from your Roth IRA. you dont have to pay income taxes on the amount. Also, unlike a traditional IRA, which requires you to begin taking minimum distributions at age 70 1/2, you are never required to take minimum distributions from a Roth IRA.

General Reminders About IRAs

For all IRAs, whether held by a working spouse or a non-working spouse, it is important to remember a few important points:

- Limits to Contributions and Income Can Fluctuate. Each year, the IRS evaluates the inflationary environment and decides whether to adjust the contribution limits and income requirements associated with IRAs. If inflation has a big enough impact, the IRS will increase the amount you can contribute to an IRA, and raise the income limits.

- You Have Until April 15th of the Following Year to Make Contributions. When you contribute to an IRA, you dont have to make your contribution in the same tax year. You have until April 15th of the following year to make your contribution; in other words, you have until April 15, 2012 to make contributions for the year 2011.

- You Must Indicate Which Year the Contribution Is for. Because you can contribute in a different year than the current tax year, indicate which year the contribution is for.

Final Word

A spousal IRA is a great way to boost household retirement account contributions and build a bigger nest egg. Plus, it gives a non-working spouse the chance to build up assets, rather than missing out on some of his or her potential earning power due to helping out at home.

If you or your spouse stay at home, check to see if you meet the criteria for eligibility, and consider investing in the spousal IRA.