What is a collateralized debt obligation (CDO)

Post on: 22 Апрель, 2015 No Comment

Collateralized debt obligation (CDO) is a term used to describe financial instruments that are structured asset-backed securities.

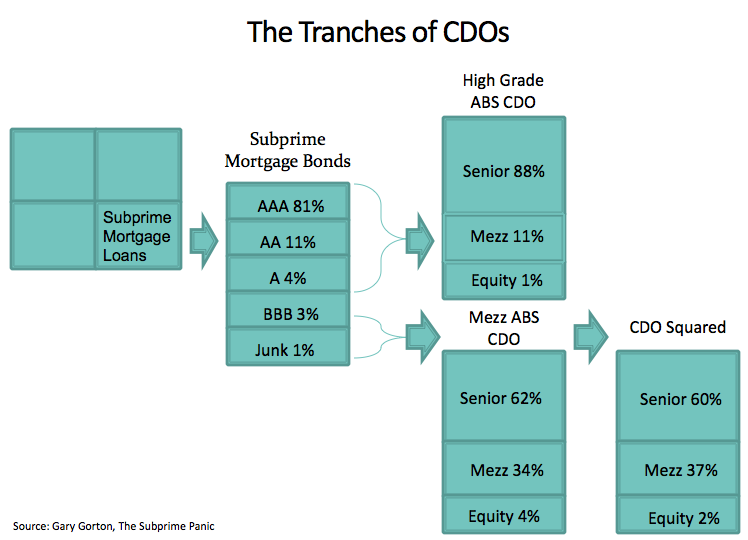

CDOs consist of a portfolio of fixed income securities split into many different tranches one of a number of related securities offered as part of the same transaction.

Tranches are divided into three different sections, according to the degree of risk taken by the investor:

- The equity tranches are the riskiest. These are usually purchased by a hedge fund manager. They are the first to bear the risk.

- The junior tranches are intermediaries. They are usually purchased by asset managers or investors.

- The senior tranches are the least riskiest. They are usually given an AAA rating by rating agencies and purchased by bond insurers.

A CDO tranche is comprised of:

- Portfolio of names

- Attachment point

- Detachment point

- Spread contract

- Maturity date

CDOs all vary in structure. However, they all share a similar basic structure:

A special purpose entity (SPV) acquires a portfolio of mortgage-backed securities or high-yield bonds .

The SPV sells bonds to investors. These bonds entitle the holder to the cash flows from the portfolio of the SPV. The distribution depends on the ranking of the bonds. Senior tranches are paid before the junior tranches and equity tranches.

Losses are distributed in reverse order of ratings, with equity tranches losing first and then junior tranches losing followed by senior tranches.

Types of CDOs

CDOs Based on the underlying asset:

- Collateralized loan obligations (CLOs) CDOs backed primarily by leveraged bank loans.

- Collateralized bond obligations (CBOs) CDOs backed primarily by leveraged fixed income securities.

- Collateralized synthetic obligations (CSOs) CDOs backed primarily by credit derivatives.

Other types of CDOs by assets/collateral:

- Commercial Real Estate CDOs (CRE CDOs) backed primarily by commercial real estate assets.

- Collateralized bond obligations (CBOs) CDOs backed primarily by corporate bonds.

- Collateralized Insurance Obligations (CIOs) backed by insurance or, more usually, reinsurance contracts.