What does the data tell us about the US economy in 2015

Post on: 4 Июль, 2015 No Comment

Summary: Lets again look at the data about the US economy (we cannot directly see it, of course), both the recent past (dimly seen) and the immediate future (looming ahead in the darkness). Slower growth than usual since WWII, with higher risks and more unknowns. Just as Ive reported for the past four years. (2nd of 2 posts today)

Contents

- Status report

- Where we were

- Some leading indicators

- Market signals

- Conclusions

- For More Information

(1) Status report

For the past four years we have heard Wall Street and government (still slightly different groups) cheering the breakout economy, as we have one or two quarters of strong growth. The good times are here again! The stock market has risen on alternating periods of the boom is coming and growth is slowing so buy before the stimulus (demonstrating Rule One of Andrew Smithers Stockbroker Economics: all news is good news). We had the slowdown in Q1, followed by stronger growth in Q3 and Q4. Now comes another slowdown.

How long will this continue? How long will the bottom 80%, seeing little or no growth in real wages, tolerate this without either political protest or labor action? When will the next recession come? The theory of stall speed says that the risk of recession increases with growth slower than 2% (a darker version is the coffin corner ). The government appears to believe in a stall speed; since 2008 such slowdowns have been met with a combination of fiscal and monetary stimulus (except for last winters weather-caused slowing).

Probably we will learn soon. Conditions look a bit dark at the start of 2015: US fiscal tightening (shrinking deficits), the end of the US QE3 monetary stimulus, Europe on the edge of recession, and turbulence in the emerging nations (from falling oil prices and a rising US dollar). As I have said so often since the crash, in 2008 the world economy sailed off the map of the post-WWII world. Were in terra incognita. the unknown land with its unknown rules. Our leaders have pretended that were still in Kansas and nothing has changed. I suspect that illusion will become impossible to maintain in the next recession, and that the downturn will come even more unexpectedly than usual.

(2) Where we were

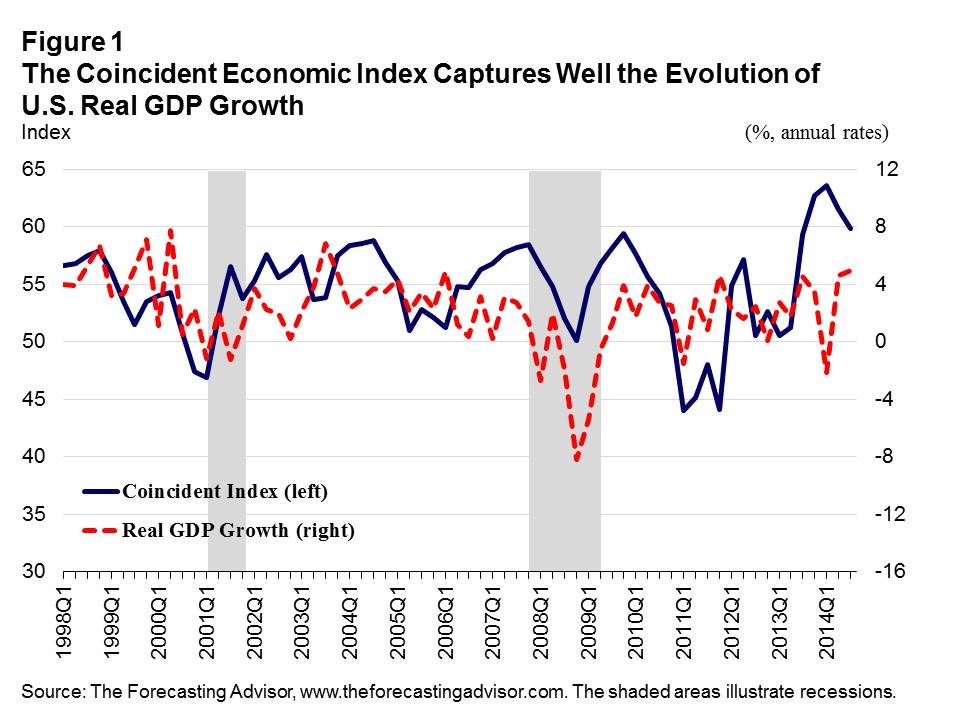

First lets orient ourselves by looking backwards. US real GDP has grown at

2.2%/year for the past four years, near stall speed. Sideways, with every breakout of a quarter or two quickly fading so that the year-over-year trend remains flattish. See the noisy quarter to quarter changes. Each breakout to 4% sparked cheers; but the sideways trend always resumed. Will 2015 see the true breakout?

(3) Some leading indicators

We look at leading indicators for clues to the future. Each is a dot; together they draw a picture. We only have a few so far in 2015, such as the Markit December 2014 index of its manufacturers purchasing manager survey. showing slowing growth, the weakest since January.

The US economy is mostly services, so we look at the less-accurate Markit December 2014 index of its services purchasing manager survey. showing slowing growth, the weakest since February.

Today we had one of the more important dots: the Census December 2014 survey of manufacturers new orders for core goods: shows slowing growth in a sideways trend for the past two years.

(4) Market signals

Market signals provide crowd-sourced information, reflecting the decisions of investors, households, businesses, and governments. Some of these are hard data, such as people setting prices through the buying and selling of goods. Some are softer data, such as investors buying and selling securities to act on their vision of the future.They provide an erratically accurate view of the future .

Two markets recently have given large signals. Unfortunately the tape tells us the prices at which people trade, but not the reasons. Markets provide a chiaroscuro of brights and shadows about which we tell stories. Often experts tell contradictory stories from the same data.

Oil is the largest size and most-economically sensitive of the industrial minerals. Something is happening, but we dont know what or even what it means for the future. Have prices fallen due to a slowing global economy or because of political decisions by the Saudi Princes? We have only adequate data on oil production, and poor data for inventories (in the developed nations we have good numbers from refiners but little from end users, and little data from the emerging nations). We have even less data on oil consumption. We have almost nothing telling us about the thinking of the Saudi Princes (only a few know the truth; they seldom talk to journalists, and even less often talk truthfully).

Heres a more useful perspective, showing year-over-year per cent changes. Note the boom-bust pattern around recessions. This 40% drop sometimes happens without a US recession. As in the 1987 false alarm, the 1997-98 bust of the emerging nations, and in 2005-2006 (a correction during one of the greatest oil bull markets, from $20 to $140). Its a red light on the dashboard.

(b) Interest rates on long US treasury bonds

This is the ur-market, the largest and most important securities in the world. And the most enigmatic. Millions of words are written about it every year, mostly specious. Thousands of forecasts are made, most wrong. But something is happening, for these rates are without historical precedent.

(c) US stock prices

They mean little to the economy, and tell us less. Most Americans own nothing. A large number have their wealth overwhelming invested in real estate. Unless you are one of the top 10% with a large fraction of your wealth invested in publicly traded stocks why do you care?

(5) Conclusions

Sailing off our map makes forecasts even more difficult than usual. My guess for 2015 is that something, somewhere will disrupt the careful balancing act each of the great nations has independently maintained since the crash (USA, China, Japan, EU). Probably resulting from some economic event, like a recession which spreads. Even a minor geopolitical upset might prove too disruptive for the weak global economy (e.g. conflicts in the Ukraine, Syria, and Iraq are smaller than minor).

Or we the US or the world might break through into a strong recovery, starting a new growth cycle. That would mark a new age, since we learned that even fantastically large monetary and fiscal stimulus work without ill effects. Id expect new economic theory, building on current models, to emerge.