What Do Your Property Taxes Pay For

Post on: 9 Апрель, 2015 No Comment

How many times have you looked at your tax bill, threw your arms in the air, and yelled our where is all this property tax money going, this is way too high.

Maybe Im the wacky one, but Ive done that. (Actually, I would probably have an expletive or two in there.)

The problem with that view though is that property taxes are never a single number, but a combination of several.

Most of us tend to think our property taxes are too high, but then we get a bit hung up on the components. We may want a lower tax bill. but at the same time we might support high spending levels in certain areas, or even just one in particular.

There are constituencies behind each category of our property taxes, which is why it’s so hard to get lower taxes overall.

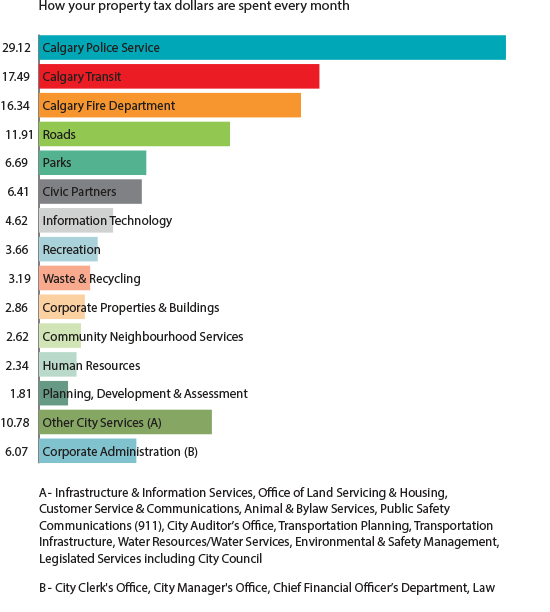

So What Do Your Property Taxes Pay For?

Public schools

This is the largest single line item in nearly any property tax bill. (It is for us.)

In fact, it’s usually greater than 50%, and much higher still in areas with large student populations or a strong local commitment to providing a premium education. Such a commitment often leads to higher local property values since areas with higher rated schools generally command higher house prices.

Public school systems get their funding from a variety of sources—federal government, state government, fund raising efforts—but the largest source is generally from property taxes. This is also why any tax reduction attempts meet strong resistance from both school employees and parents of school-aged children.

Maintenance of public roads and parks

Most of us drive, and when we do, we like to do it over well maintained roads. Unless you prefer off-roading it to the local grocery store.

We also may like to walk, jog, picnic and otherwise play in public parks.

Having all of that costs money, and that money comes mostly from our property tax bills.

Advertisement

In some areas, property tax bills may also include certain utility costs if they’re provided by the county or municipality. This can include water and sewer or garbage collection. Tax bills may be higher in communities that provide utilities through public systems, but they’re also providing more services.

Government administration costs

In most communities government administration is a relatively small part of the local budget, but it also covers a lot. It includes not only salaries and benefits for municipal administrative staff, but also the buildings that house them.

Police, public safety, and libraries

Ever wonder what all that property tax money went to?

Despite the fact that many of us think that police budgets are paid mostly with traffic citations, most is actually provided through property taxes (OK, let’s say in most jurisdictions and leave it at that!).

Again, this includes not only salary and benefits for police and support personnel, but also the acquisition of buildings and police cars.

Just as with a high local commitment to schools, a strong police presence can often have a positive influence on property values.

Two services that meet little resistance on the tax side are fire protection and public libraries. They’re not usually large parts of a typical tax bill, but both are considered highly desirable in most communities and largely beyond political haggling.

Can you imagine any politician running on a platform that includes cutting fire protection and public libraries?

Municipal allocations

Both municipalities and counties rely primarily on real estate tax revenues to support their operations so taxes are usually collected and paid to both.

While this may be evident in many cases, it isn’t always.

In many jurisdictions, one government agency may collect the tax under a single bill, then apportion the funds based on a predetermined formula. You may pay your taxes to your municipality who later forwards the required portion to your county.

There are however arrangements where the municipality and county each send out separate tax bills.

How your tax bills get paid

No matter what the arrangement, if you have a mortgage. chances are that your lender pays your property taxes through your loans escrow account and you never see a tax bill. Many people never become aware of the allocation until their mortgages are paid off and they become directly responsible for paying the taxes themselves.

Whether you pay your property taxes through your mortgage lender or directly to the local tax authorities, you should receive a copy of the bill at least once each year.

When you do, take a few minutes to study the bill and in particular the list of allocations. That will be the best starting point to get at least a general idea where your property tax dollars go. From there you can get more detailed information.

Note. Hold onto at least the last copy of your tax bills. You never know when you might need it. For example, we needed a copy of our last school bill in order to register our son for kindergarten (yeah, they want to make sure you are paying your share before you can register).

Sometimes a property tax bill is all it takes to get us more involved in local government. Paying money has a way of getting us to do that.

What do you think about your property taxes? Are they too high? Too low? About right? What do you wish they’d spend more on? What do you wish they’d spend less on?

Free Newsletter to Keep you Free From Broke!Name: Email: We respect your email privacyPowered by AWeber email marketing