What Do Falling Oil Prices Mean For Real Estate Markets

Post on: 10 Август, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

Just five years ago, Williston, North Dakota, was a smallish town of 15,000 on the plains of western North Dakota. Then the oil boom came to town. Newly drilled shale oil wells brought a new influx of workers that pushed the town’s population up by more than a third. Tent cities sprang up overnight, and shipping containers were used as housing. By July 2014, Williston had the highest average wages in the US and was the most expensive to rent new housing — even more extreme than San Francisco or Manhattan.

Now, that gold rush is drying up. On Thursday, the price of oil dropped below $44 a barrel in intraday trading, the first time the price dipped that low since 2009. The roughly 60 percent price drop within six months has provided a much-needed boost to U.S. consumption, but it spells bad news for both the economy and real estate markets in places like Williston.

What cities will be most affected by this change? According to a recent report from real estate data service Trulia, the major U.S. cities with the highest employment share in oil-related industries are Bakersfield, Baton Rouge, Houston, Oklahoma City, Tulsa, New Orleans and Fort Worth. All of these cities derive more than 2 percent of their jobs from oil-related industries.

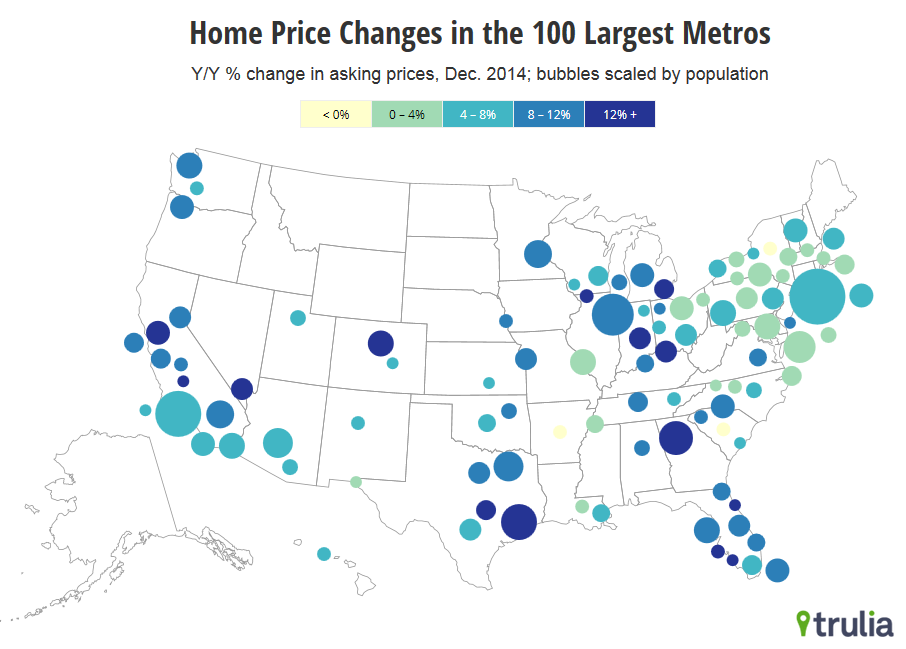

The oil boom of the past few years did spark an increase in house prices in those areas. According to Trulia, home prices rose 10.5 percent year-over-year in those seven major cities, compared with a 7.7 percent increase for the country’s 100 largest cities overall.

So can we expect a corresponding housing burst in those major markets? In the 1980s, plummeting oil prices led to falling employment and home prices in Houston, Oklahoma City, Tulsa, New Orleans and other markets.

Trulia says that home prices do tend to follow oil prices in major cities, but with a significant lag — roughly two years, historically. In other areas of the country, falling oil prices tend to encourage home ownership, since the cost of driving, heating a home and other activities will fall. In short, the oil price drop shouldn’t have much of an immediate impact on major cities with oil industries, like Houston, Oklahoma City and Tulsa.

For Williston, North Dakota, however, the boom may have turned to bust. In Williston, oil-related industries account for about a third of local jobs, according to Trulia, meaning falling prices have as much potential to transform the town as the boom did.