What Are The Best Real Estate REIT ETFs

Post on: 16 Март, 2015 No Comment

In a period of low interest rates, Real Estate Investment Trusts (REITs) offer great income potential. They are also stocks, which subjects them to market volatility, but this means the firms are wired to grow their asset bases and profits over time. Exchange-traded funds (ETFs) hold baskets of these securities and offer investors liquid and low-cost ways to gain exposure to this asset class. Below are some of the best options currently in the marketplace:

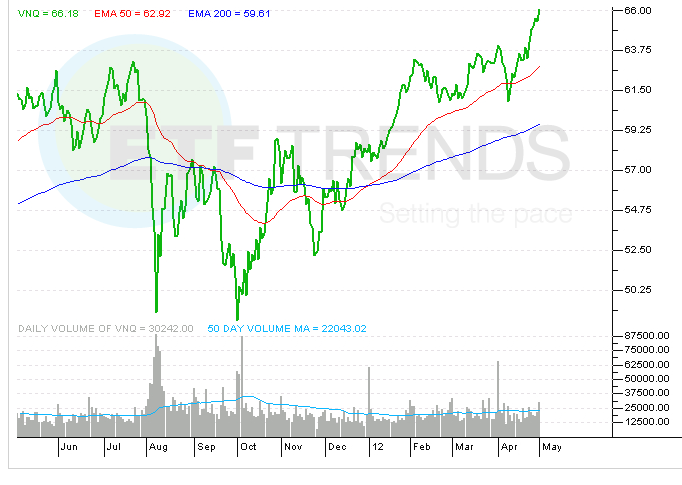

The best bet for most investors is to stay focused on the U.S. and buy into the largest public companies. The Vanguard REIT ETF (VNQ ) is at the top of the list for broad, diversified exposure and a very reasonable expense ratio. The ETF recently reported a robust $44 billion in total assets, a 3.1% dividend yield and rock-bottom expense ratio of 10 basis points. The top-five holdings represent a who’s who of the largest REIT operators out there: Simon Property Group (SPG ), Public Storage (PSA ), Equity Residential (EQR ), Prologis (PLD ) and Ventas (VTR ).

Two other options in the large-cap domestic space include the iShares Dow Jones U.S. Real Estate Index Fund (IYR ) with $4.5 billion in total recent assets and a 0.46% expense ratio. The SPDR Dow Jones REIT ETF (RWR ) is slightly smaller at $2.6 billion in assets but sports a more reasonable 0.25% expense ratio. There is much overlap with VNQ, making it the more liquid and lower-cost option.

Mid and Small Options

Smaller REIT firms have an opportunity to grow faster than the larger players in the industry. To that end, the PowerShares KBW Premium Yield Equity REIT (KBWY ) was built to have at least 90% of its assets in small- and mid-cap holdings of the KBW index listed in the ETF’s name. The current yield is impressive at 4.47%, though the expense ratio is getting up there at 0.35%. Total assets are also relatively small at around $90 million, which could make liquidity a concern to some investors.

Go International

Markets outside the U.S. have decent growth prospects as well. And though most don’t have a market as developed as the REIT market in the U.S. growth can be more robust, such as in certain emerging markets or those in Europe that are in the early stages of an economic recovery.

To supplement the Vanguard REIT ETF exposure detailed above, Vanguard logically offers the Vanguard Global ex-U.S. Real Estate ETF (VNQI ). It has nearly $2 billion in assets and a 3.5% yield. The expense ratio is 0.27%, which makes sense as international funds generally charge more than domestic ones.

An Active Alternative

Most ETFs simply mirror their underlying index, but a search revealed one ETF that looks to actively manage its REIT exposure. The PowerShares Active U.S. Real Estate Portfolio (PSR ) has a solid rating, though its yield is small at 1.4%, as are the asset levels of $47 million. The fee is more active as well at 0.80%, but the active exposure could at least let investors recoup the fee with a steady period of outperformance from its benchmark (the MSCI Global REIT Index).

The Bottom Line

Most investors will be best served investing in the passive ETF options. Active alternatives include the ETF above, as well as an option to invest in some of the better-run individual ETFs.