What are Mortgage REITs

Post on: 25 Июль, 2015 No Comment

by Michael Cook

With all the commotion happening in the Mortgage Industry, investors have begun to look into the status of Mortgage REITs. These instruments have had significant ups and downs over the past five years due to interest rate volatility. The biggest question on many investors’ minds is how the subprime lending fallout will affect Mortgage REITs.

What is a Mortgage REIT?

A mortgage REIT (Real Estate Investment Trust) is a special non-taxed entity that only invests in a variety of mortgage products. This could consist of lending, buying and selling mortgage backed securities, or anything else to do with mortgages. Due to the laws governing REITs, a mortgage REIT can only work with mortgages and must payout 90% of its earnings yearly. While there are many other laws governing REITs, these are the most important ones to understand. Investors typically invest in REITs because of their high dividend yields (due to the payout requirement).

How do Mortgage REITs make Money?

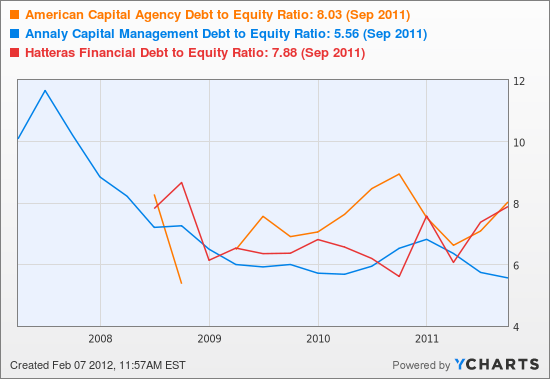

Like most other lenders, mortgage REITs make money by borrowing in the short term and lending in the long term. Short term interest rates are typically lower than long term rates, so these entities make money on this spread. When the spreads are very wide mortgage REITs can make a lot of money, conversely when the spreads are small (or even negative) mortgage REITs have problems.

This is easy for consumers to see. Today a consumer can get a standard 30 year mortgage for about 5.75%. That same consumer can also get a six month Certificate of Deposit (CD) yielding almost 5% or higher. This is a very tight spread. Keep in mind mortgage REITs also have to get some kind of return for the risk they take in lending and taking a longer term position.

From this analysis you might suspect that mortgage REITs are having a tough go of it right now. This would be correct. During the period right after the tech bubble burst (2001) and 9/11, mortgage REITs were riding high because short term rates were low and long term rates were high. Unfortunately for REITs (fortunate for borrowers), in 2004 the Federal Reserve began to increase short term rates. In 2006 the yield curve inverted, meaning short term rates were higher than long term rates, hitting mortgage REITs very hard. While this situation has eased a bit today, the spread between short term and long term rates is still very thin.

How will the Subprime Lending Situation Affect Mortgage REITs?

This will depend on the REIT and its strategy. REITs that take a more aggressive lending and investment approach will suffer dearly; however, REITs who are well diversified will see little material affect from this fallout. The bigger question is how this will affect the spread between short term and long term rates. This is a harder question to answer because it will depend on what the Federal Reserve chooses to do with rates. That is anyone’s guess.