What are Mortgage REITs

Post on: 4 Апрель, 2015 No Comment

When CDs yield less than 2% for a 5-year maturity period, 15% dividends look like a gift from the heavens. Mortgage REITs seemingly deliver huge returns when no other fixed-income or equity investment can do the same.

So what’s the special sauce? Why can mortgage REITs afford to pay huge dividends to their investors?

What Powers a Mortgage REIT?

There are a few distinctions that differentiate mortgage REITs from other investments:

- Payout requirements – Like all REITs, mortgage REITs have to pay out 90% of their earnings to investors in the form of dividends. The payout requirement allows a mortgage REIT to avoid all corporate income taxes. Instead, stockholders pay ordinary income taxes on REIT distributions, making a REIT a simple pass-through for earnings on real estate and mortgage holdings. Naturally, dividend investors tend to love mortgage REITs because there is a legal requirement for mortgage REITs to pay out virtually all of their earned income.

- Mortgage REITs employ leverage – Mortgage REITs use much more leverage than traditional REITs. Whereas ordinary REITs might use 2:1 leverage to purchase physical real estate like apartment buildings, retirement homes, college housing, and other physical property, mortgage REITs buy mortgages only. If you own your own home with a mortgage, your monthly payment might be going to one of the many mortgage REITs on the market. Mortgage REITs use far more substantial amount of leverage, sometimes as much as 5:1 to borrow cheaply and invest in higher-yielding mortgage-backed securities.

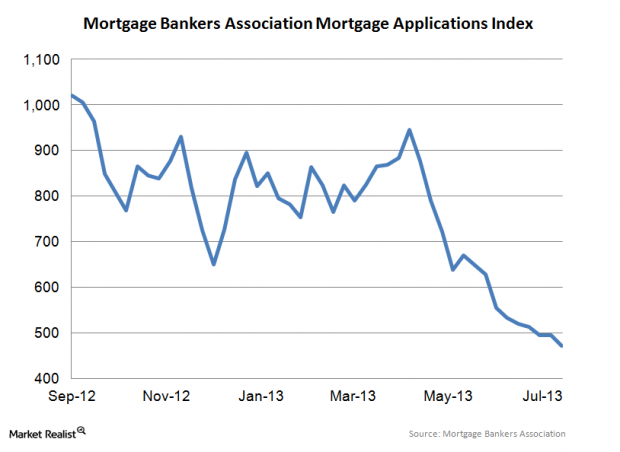

- Mortgage REITs have rate-risk – REITs carry a substantial amount of interest rate risk. Mortgage REITs borrow for 1-10 years to finance investments in 15-30 year mortgages. Should rates rise, the mortgage REIT risks paying more to borrow money than it can safely earn on its investments in home mortgages.

Two Divides in Mortgage REITs

There are two types of mortgage REITS – agency and non-agency REITS. Agency REITs invest only in mortgages that are secured by US Government agencies Fannie Mae and Freddie Mac. Non-agency REITs invest in mortgages of every flavor, typically generating higher returns because there is no guarantee on the quality of the debt or guarantee of future cash receipts.

Agency mortgages are perceived to be as risky as the US government’s US Treasury issuances. Following the US financial crisis, the United States government agreed to back all debts by Fannie and Freddie, making the risk of agency mortgages on par with the risk embedded in US Treasury securities. As US Treasuries are “risk-free” in the sense that the US Treasury can always print more money, so too are agency mortgages – at least for as long as the US government agrees to back mortgage debt.

Playing REITs Safely

Mortgage REITs are on every investor’s radar for their larger than average yields, but they do require some realistic thinking about the future of interest rates. Always read the annual and quarterly report for any REIT in which you would think about investing.

In particular, look for:

- Rate sensitivity – REITs disclose their sensitivity to interest rate fluctuations. As these are very complicated fund structures, most hedge their interest rate risks to moderate the risk that rates rise too quickly and push a REIT into money-losing territory.

- Total leverage – Look to see how much leverage a REIT uses. I like to use an asset to equity ratio to compare the total size of the portfolio to shareholder’s equity (assets minus debt). The leverage ratio is important for understanding just how sensitive the REIT will be to changes in interest rates.

Ideally, any REIT would have limited rate sensitivity (especially if you expect rates to go up over time) and would maximize potential rewards with risk by moderating leverage.

Readers: Do you own any REITs in your portfolio?