What are Commercial MortgageBacked Securities (CMBS)

Post on: 13 Август, 2015 No Comment

Commercial Mortgage-Backed Securities: The Basics

A commercial mortgage-backed security (CMBS) is a type of fixed-income security that is collateralized by commercial real estate loans. Typically these loans are for commercial properties such as office buildings, hotels, malls, apartment buildings, factories, etc. but not single-family homes. CMBS make up about 2% of the total U.S. fixed income market.

In essence, CMBS are created when a bank takes a group of loans on its books, bundles them together, and sells them in securitized form as a series of bonds. Each series will typically be organized in tranches from the senior — or highest-rated, lowest-risk issue — to the highest-risk, lowest-rated issue. The senior issue is first in line to receive principal and interest payments, while the most junior issues will be the first to take a loss if a borrower defaults. Investors choose which issue they invest in based on their desired yield and capacity for risk.

This process of loan securitization is useful in many ways: it enables banks to make more loans, it provides institutional investors with a higher-yielding alternative to government bonds. and it makes it easier for commercial borrowers to gain access to funds.

CMBS Offer a Compelling Combination of Risk and Return Potential

CMBS offer investors a way to gain exposure (to the real estate market) with less risk than real estate investment trusts (REITS), writes Matt Tucker — head of iShares Fixed Income Investment Strategy at the asset manager BlackRock Inc. — on the iShares website. Since its inception six years ago, the Dow Jones US REIT Index has experienced volatility of 30.1% and a return of 2.6%, he continues, whereas the Barclays Capital US CMBS Index experienced a volatility of 13.3% and a return of 6.6% during the same timeframe. Keep in mind that REITS are equity securities, whereas CMBS are debt securities.

Tucker also notes that CMBS provide attractive yields, relative to their duration (interest rate sensitivity) than many other segments of the bond market. This indicates that CMBS may offer an attractive combination of risk and return potential.

The Risks of CMBS

As is the case with corporate bonds. commercial mortgage-backed securities are at risk of default. If the underlying borrowers fail to make their principal and interest payments, CMBS investors can experience a loss.

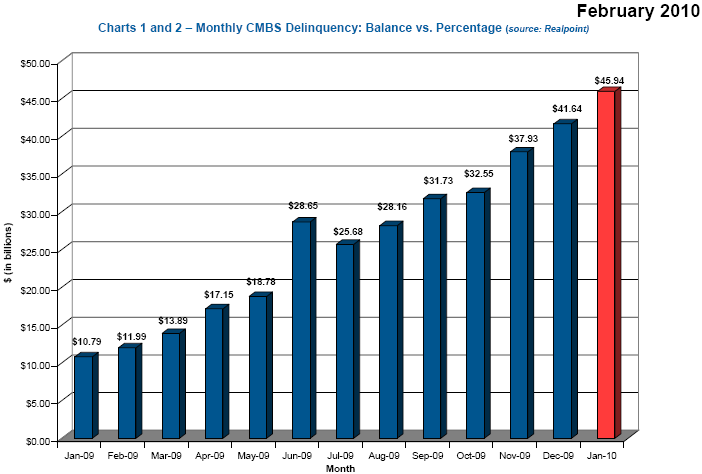

The risk of individual issues can vary based on the strength of the property market in the specific area where the loans were originated, as well as by the date of issuance. For instance, commercial mortgage-backed securities issued during a market peak or a time in which underwriting standards were more relaxed would be seen as having higher risk. CMBS can also be negatively affected by weakness in the real estate market, which was the case during 2009. CMBS lending dried up in the wake of the financial crisis of 2008, but it gradually came back as market conditions improved. Post-crisis CMBS tend to be larger and characterized by more stringent underwriting standards.

The loans that back CMBS typically are for a fixed term, meaning that they can’t be repaid early by the borrower without a penalty. As a result, CMBS typically off substantially lower prepayment risk than residential mortgage-backed securities (i.e. securities that are backed by mortgages on single-family homes). Prepayment risk is the possibility that falling interest rates will cause borrowers to refinance – and pay back their old mortgages sooner than expected as a result – thereby causing the investor to receive a lower yield than they had anticipated.

How to Invest in CMBS

While an individual could conceivably invest in a commercial mortgage-backed security, typically it is only the most wealthy, sophisticated investor that would do so. There are no mutual funds specifically dedicated to CMBS, but many bond or real estate related funds – invest a portion of their portfolios in CMBS when the asset class offers value.

As of August 2013, investors had one option among exchange-traded funds (ETFs) that provided direct access to commercial mortgage-backed securities: the iShares Barclays CMBS Bond Fund (ticker:CMBS). Before considering an investment, view the fund’s performance to make sure you are comfortable with the potential risks.

Learn about two types of securities similar to MBS:

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.