Way Undervalued Stocks How Way Undervalued Works

Post on: 24 Июнь, 2015 No Comment

How WayUndervalued Analysis works:

WayUndervalued.com doesn’t care about stock charts, headlines, or recent performance. It doesn’t matter if a stock has recently gone up or gone down. What matters is the current estimated value of a company based on a cash flow of future earnings.

You won’t see penny stock recommendations on this web site. You won’t see a buy of the day, or any short term picks. WayUndervalued stocks are meant to be held long term, meaning 12 months or longer.

Ever see a stock go up 10% or 20% in a single day after an earnings release, even if the earnings were on par with expectations? That’s because people pay attention to earnings. Earnings are the best non-emotional way to value a company by mathematically showing what a company is worth.

Sometimes stocks get beat down and become undervalued for a variety of reasons. Even less often, a stock price goes down enough that it becomes Way Undervalued . or at least 100% undervalued based on earnings. WayUndervalued is dedicated to identifying stocks that are Way Undervalued. The reason a stock is WayUndervalued doesn’t matter. What matters is the value of the company based on future earnings.

More about how WayUndervalued works:

Will this method be right 100% of the time? Probably not. The goal is to beat the average stock market return. In 2013, Way Undervalued picks easily did this.

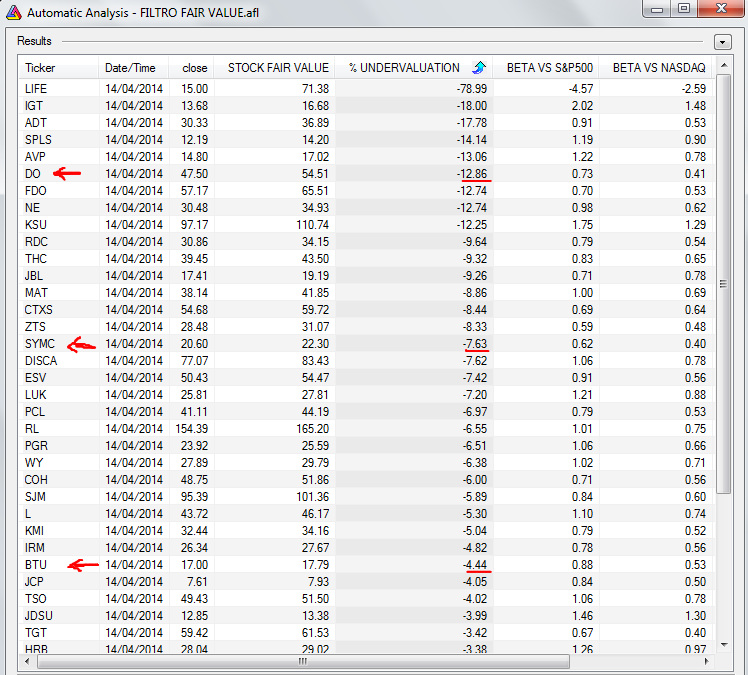

The stock must currently trade close to what the company is valued using current EPS and historical P/E ratio. More info on the P/E ratio used is available here . Using future years estimated earnings, the estimated stock value for both years must be 100% or more than where it trades today to be considered Way Undervalued. Earnings growth in future years is also required. The estimated value is determined by adding up a sum of future discounted earnings.

I have yet to find a place that applies these rules to identify and rank stocks. This method will weed down thousands of stocks into a handful of Way Undervalued companies using a consistent algorithm applied equally to all companies.

Out of the 5,000+ companies analyzed on this site, here’s how this method breaks down (as of March 2014):

- Many companies don’t provide consistent enough data to accurately quantify them as undervalued or way undervalued. These stocks are eliminated from comparison. This knocks out about 1/3 of the companies analyzed.

- With the remaining two-thirds of the list, less than 5% of companies are 50% or more undervalued. These companies are considered undervalued.

- 1% to 2% of companies are 100% or more undervalued. These companies are potentially Way Undervalued. This leaves us with about 85 companies.

- Of that 1% out of 5,000+ companies that are potentially Way Undervalued, the stocks are further filtered down to identify accurately priced companies based on today’s valuation. Real Estate companies are also removed from the list.

To summarize:

- Companies currently priced at least 50% below their calculated future value are considered undervalued.

- Companies currently priced at least 100% below their calculated future value are considered Way Undervalued.

To learn more about how the P/E ratio for each company is calculated, click here .

All data used by WayUndervalued.com is publicly available. WayUndervalued.com just analyzes that data in a unique way for a long list of companies, making undervalued companies easy to find.