WalLord How the Retail King s Landlord Could Pay You Monthly Rental Income

Post on: 23 Апрель, 2015 No Comment

Sleuthing out the teased Walmart landlord from Brian Hicks

Welcome! If you are new to Stock Gumshoe, grab a free membership here and join us to get our free newsletter alerts with new teaser answers and debunkings. Thanks!

The Wal*Lord teaser from Brian Hicks is not a new one, but Ive had readers asking about it over and over during the last week or so which must mean that its being re-run by Angel Publishing in an attempt to hoover up some more subscribers to The Wealth Advisory.

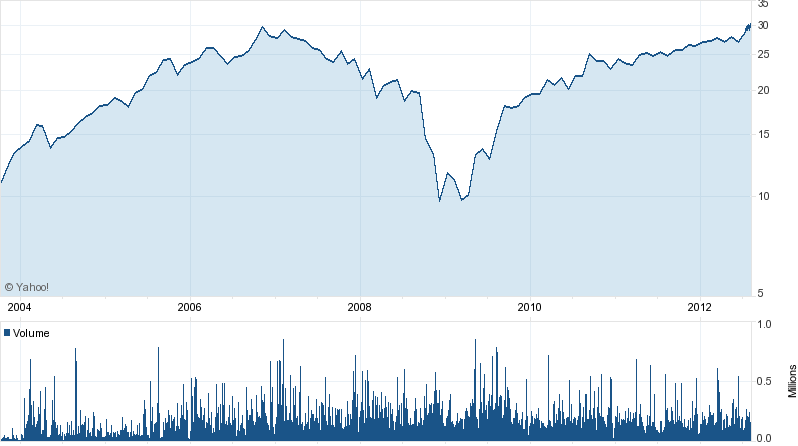

So I took a quick look to make sure that theyre still teasing the same company that they featured a little over 2-1/2 years ago and whaddya know, it is still the same. Indeed, the ad itself is almost exactly the same I didnt notice any real updates or edits (other than to say that theyve been paying their monthly dividend for 11 years now, not nine). The stock price of the company is pretty close to where it was back in April of 2012 at about C$27 though performance looks better for the shares in Canadian dollars (flat) than it does in US dollars (down 5-10%). Back when this ad first ran the US$ was slightly less valuable than the C$ so the stock was slightly over US$27 and slightly under C$27, that currency relationship has flipped so now the Canadian shares are still slightly under C$27 but in US terms the fair price is a bit under US$25. The company continues to have a decent yield, continues to rely heavily on Wal-Mart as a tenant, and has not raised or lowered the monthly dividend since the Summer of 2007.

If they cant come up with a new ad, Im not going to write a whole new article (so there!) what follows is our article that ran on April 5, 2012. It has not been edited, updated or revised. The original discussion from back then is still at the bottom of the article, so feel free to jump in if you have thoughts to share.

from 4/5/2012-

Every Month for the Past 9 Years, This Little-known Landlord Has Sent Out Rent Checks It Collects from Wal-Mart to Its Partners

Ive Found a Way for You to Become a Partner for as Little as $27.

Thats the intro to Brian Hicks Wal*Lord teaser ad thats been circulating very heavily today and to be honest, I almost didnt even look at the ad, because from the name I was certain it was just another version of the Walmart landlord teaser that Roger Conrad has been sending out for his Canadian Edge newsletter off and on for a couple years.

But though theyve lifted the basic idea from Conrads teaser ad campaign, this is a different pitch for a different company. The tease is an attempt to get you to subscribe to The Wealth Advisory from Angel Publishing, which apparently is now being edited by Brian Hicks and the promise, as always, is a lusty one

Its the single most reliable way you can get an extra check every single month.

One little-known landlord has been sending out rent checks it collects from the worlds largest retailers to its partners for the last NINE YEARS!

Im talking about collecting rent from some of the worlds biggest billion-dollar retailers — like electronics superstore Best Buy.

This landlord also gets rent from office supply behemoth Staples and from home improvement and crafts leaders Lowes and Michaels

This landlord even collects rent from the worlds largest retailer, Wal-Mart.

Thats right. Even the huge retailer Wal-Mart is contractually obligated to pay this landlord each month in order to honor its lease agreements — no matter how shaky the economy is, or how high inflation soars

Wal-Mart must pay him before it even pays itself

Thats why Ive dubbed him Wal-Lord.

And Ive found a way for you to become a partner of this landlord starting immediately — with as little as $27.

So I guess if were going to be calling ships she then calling real estate owners he is only fair, but it still sounds a bit odd.

And not to let the cat out of the bag too early here, but yes, this is clearly just another teaser for a REIT with a Wal-mart connection. Which many of them have.

REITs, if youre new to this game, are Real Estate Investment Trusts theyre popular in the US and Canada as a way to democratize real estate income, they buy or develop properties (some specialize in malls, or office buildings, or apartments or other niches, others are diversified), then they get a tax break (as in, dont pay any for their real estate income as long as they pass the lions share of that income through to their shareholders (or unitholders, as theyre sometimes called). Theyre almost all built to pay regular and growing dividends and appeal to income investors. And they trade and act just like regular stocks in almost every way, though their dividends are generally treated as regular income (not like stock dividends), since they didnt pay taxes at the corporate level.

And this particular one, though its not the same REIT Conrad has been pitching, is also Canadian. But which one? Here are a few more clues from the ad:

Wal-Lord has delivered reliable rent checks to partners for 113 consecutive months (thats NINE years!) without missing a single payment.

And this past October, Vancouvers main newspaper The Globe and Mail reported: A dollar invested [with this landlord] in 2001 is now worth $18.

That means it has returned well over 1,700%.

You could have turned a small $10,000 investment into a whopping $180,000 profits!

It has averaged 29.7% returns to its investors every year.

So thats almost enough detail to confirm our answer perhaps a little more?

This landlord specializes in retail real estate. Its strategy involves leasing shopping centers anchored by big box retailers.

It owns and manages a massive portfolio of shopping centers in major cities in our friendly neighbor to the north, Canada.

Their ownership interest contains an aggregate of over 25 million square feet.

Its already signed over 70 long-term lease agreements with Wal-Mart, and most of these leases have terms of 20 years or more.

And heres the beauty part of this opportunity

Because of its strong relationship with the worlds biggest retailer, several more retail powerhouses are also cozying up to this landlord.

This landlord has an enviable list of Fortune 500 clients including Best Buy, Staples, Lowes, Michaels, and most recently, Target.

So who is it, eh? Well, all those clues get poured into the Thinkolateur, and we learn that this is Calloway REIT (CWT in Toronto, CWYUF on the pink sheets).

Like many REITs in Canada, Calloway pays a monthly dividend in their case, it comes to a yield of about 5.8% at the current just-under-$27 share price. And they are a major Wal-mart landlord in Canada, thanks to a partnership with an aggressive big-box developer who basically helped to bankroll Wal-marts mass expansion in Canada and who then offloaded many of his SmartCentre developments to Calloway. You can see that whole story here in that Globe and Mail article that Hicks quotes from. and the partnership with SmartCentres and its aggressive CEO has indeed been a solid growth driver for Calloway though most of the aggressive parts of that growth came early in the last decade.

Ive never looked particularly closely at Calloway, but they do compare pretty favorably with Riocan (thats the one Conrad teased a couple years ago. and has continued to tease) Riocan is the Big Daddy of Canadian retail REITs, and arguably has more high-value urban locations in the East and a bit more diversification, and as such it gets a little bit of a premium price compared to Calloway, but theyre pretty close in valuation. Both are very low-cost operators (as befits a big box and strip mall landlord with economies of scale boxes are much cheaper than operating enclosed malls or office buildings), and both look reasonably appealing.

Theres been a bit of a buzz around Canadian retail lately, with the relatively strong economy and resilient real estate market making some folks more comfortable with Canadian REITs than those on our side of the border, but its worth noting that though demand is pretty high for Canadian retail space right now, its a dramatically smaller market and its apparently a tougher one to expand in even though more retail space is needed so much so that Riocan is pushing most of its expansion forward on our side of the border in a search for growth. Theres an interesting story here from Reuters today about demand for big retail space in Canada and how the lack of mall development has kept rents high and spaces hard to find so that ought to be a positive driver, particularly for folks like Calloway that have new malls with strong anchors that might draw more interest from US retailers who are moving north (and yes, they did get Target as a tenant recently, which could become a big deal, though it was largely because Target took over a defunct retailers space in a couple of their malls).

So there you have it a Canadian REIT, a pretty good yield, a strong base of centers with high occupancy, about 40% of of which are indeed anchored by Wal-mart. I dont know what their growth profile looks like going forward, but they do certainly have the high-profile and hard-charging leadership to push for more development, and they appear to be on track to expand along with their developer partner as more projects are developed and then spun off to the REIT. Its not as staid a pick as Riocan seems to be, and theyre more tied to strategic partners (Wal-mart Canada and SmartCentres) who might have an impact on their plans, but theyre a bit cheaper, have a higher yield, and own a lot of relatively young big box malls that appear to be doing quite well. If Wal-Mart loses the attention of the Canadian consumer theyd probably be in trouble, since Wal-Mart is both a large part of their revenue (more than 25%) as well as a critical anchor for most of their key properties, but as long as Canadians keep shopping at Wal-mart I imagine theyll probably do just fine. With a large portfolio already under their belt, and a market cap of well over $3 billion, Id be a bit surprised to see them churn out near-30% growth again over the next decade as they did in their first decade of growth, but if they continue to leverage their space and their backlog they ought to at least be able to keep up that steady dividend and, one hopes, keep pace with inflation as they gradually raise rents.

So whaddya think? Would you prefer Riocan or Calloway for your Canadian mall money, or do you have other real estate plays north of the border that you prefer? Or do you think US retail REITs are a better bet? I own a retail REIT in the western US (ROIC), and have suggested a few REITs to the Irregulars over the years, but do not own any of the companies mentioned above. Let us know what you think with a comment below.

I confess to being an addict.

I check my net worth, my spending and saving progress, and my portfolio (combined from several different brokerage accounts) using Personal Capital at least once a week, sometimes every day. after all, it’s free and brilliantly organized.

Personal Capital has great tools for tracking spending (they can cut your spending by 15%), but what I love most is their automated financial dashboard — it will look at all your assets and debts, tally up your asset allocation, project where you’ll be at retirement, and suggest ways to manage risk or improve returns. It’s free, I think their free tools are great, and I think it’s worth checking out — you can do so here.