Video The Colombia Private Equity Opportunity

Post on: 16 Март, 2015 No Comment

Interviewed by: David Snow

David Snow, Privcap: We are joined today by Maximiliano del Vento of Partners Group and Cate Ambrose of The Latin America Private Equity and Venture Capital Association (LAVCA). Welcome to both of you. Thanks for coming to Privcap. So, we’re talking about a very hot part of the world, Colombia. In the sort of realm of destinations for private equity capital right up until just a few years ago, it wasn’t exactly a place that any private equity dollars were flowing — or that any private equity dollars were flowing out of. But now I can’t tell you how many times I hear that people can’t take a meeting with me because they’re in Colombia, or they’re in Bogotá, or they’re flying there or coming back, so, there’s clearly a lot of activity going on there, and I’d like to understand from both of you, both on the investor side and also on the deal side, what is going on in Colombia.

Maybe, Cate, you could kind of set the stage a bit and talk about what were some changes within Colombia that allowed this transformation to take place such that there is now sort of a new private equity opportunity unfolding.

Ambrose: Well maybe I start from a very macro perspective, I think something that’s been overlooked is Colombia’s actually been one of the most stable economies in Latin America historically, they haven’t had a default, it’s actually been a very diversified economy with a rich export base and very talented human capital, and that’s, you know, just historically has been true, you know, throughout the decades, they didn’t go through a lot of the cycles that other countries in Latin America did with hyperinflation and default.

Of course you had the transition over a decade ago under President Uribe where you had much greater security, and the issue of drug trafficking, you know, was largely reversed, so, you really have seen a macro environment that’s become much more attractive to CEOs and business people of all kinds that have been traveling to the country to look for opportunities.

Specific to private equity, I would say there are two to three major trends. Perhaps one of the most important one is that, in around 2007, the local pension funds started investing in private equity, they were given a mandate politically, and the regulation was changed and allowed them to allocate a percentage of their assets under management to domestic private equity and venture capital funds at that time. And that spurred the formation of the first domestic private equity funds in Colombia around 2007. There were at least four, five, six funds that were raised at that time, and many more have been raised with commitments from the local pension fund since that time, so, as we’ve seen in the U.S. with the Orissa laws in the ‘70s and in Brazil going back over a decade, that availability of local capital can really be an important detonator for the development of the industry.

And the other factor I would throw in there is that, you know, it’s incredibly, again, positive political environment, there’s great political support at a very high level for the development of the private equity and venture capital industry in Colombia so you have Bancóldex, the state development bank, with the fund to funds, which has also been putting capital into domestic private equity funds and has had a number of training programs and different types of resources for the development of the industry, and even from a regulatory framework, you really have political leaders and regulators of the banking super-intendency and the finance ministry that have worked to create fund lost, favorable taxation, again, the regulation around pension funds. So, it’s a combination of positive factors that have contributed to the development over the last five or six years.

Snow: Maximiliano, you’ve spent a lot of time in Colombia, and you know the local players there. From your perspective, what have been some of the important changes within Colombia that have led us to the current private equity opportunity there?

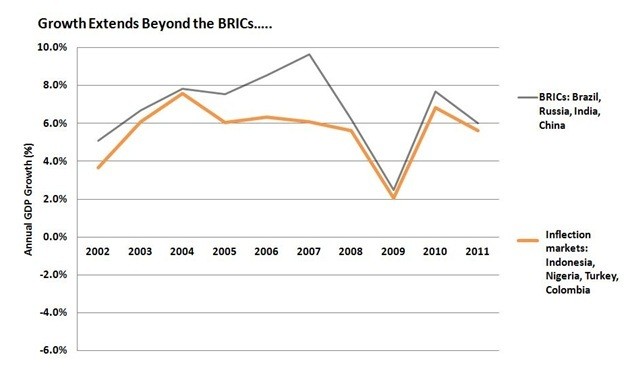

Del Vento: Sure. I think, you know, Cate mentioned several of them, I thoroughly think the government did a great job at improving the perception of Colombia internationally. And that was followed by the local pension funds and institutional investors investing in private equity, taking that leadership role to develop the environment. I think, also, the economic development that Colombia had in the last few years is fantastic.

As you know, private equity is very linked to GDP growth and consumption. And that’s Colombia, it’s been growing, if you look at GDP per capita, for example, from 6,000 in 2002 to $10,000 now foreign direct investments coming into Colombia at record levels. Colombia, its investment grade, even if you look at the CDS market, it trades like a European market. It’s a great place to do business.

I think, also, from the private equity framework perspective, I think the Bancóldex, the pro-exports, the policy-makers have done a great job protecting minority rights, setting up the right corporate governance to allow for the private equity market to start. I think, you know, also, you know, what the pension funds are doing right now, not just in Colombia but looking outside, it’s also, you know, it’s because of all these rules they have in place.

Snow: I’m interested in learning a bit more about the way that the institutional investment landscape looks in Colombia as, you know, you mentioned the local pensions, it’s very interesting that Colombia not only is a destination where deals get done, and we’re going to talk about that, but it’s also becoming a fundraising hub because of the large amount of capital that is there earmarked for private equity globally. Can you talk a bit more about what that looks like and how you expect it to continue to develop, Max?

Del Vento: Sure. I think it’s, again, an evolution, like Cate mentioned before, 2007 is when pension funds basically were allowed to invest in private equity locally, up to five percent of their assets. And that was, you know, the first step, next step, 2010, major milestone. The system changes from a uni-fund system to a multi-fund system, and also the limits for investing in private equity locally and internationally changed.

Today, if you look at the system, you have a mandatory scheme that is divided in three fund systems, one is a conservative one, moderate, and high-risk, and then, within those, you have limits. The moderate one can invest up to five percent, and the high-risk can invest up to seven percent. Looking at the statistics of how much has been invested, I would say around three to four billion has been invested out of probably seven to eight billion that could be invested in private equity, so, they have been very active. They have been very smart at implementing the asset class, learning and, you know, taking advantage of the asset class. But also there’s a great opportunity going forward.

Snow: And, Cate, you look across all of Latin America, and so you are aware of distinctive features of different countries. What is unique about the setup or the way that the Colombian LP market is developing?

Ambrose: Yeah. It’s interesting, it is distinct from the other markets in the region, I mean, in Brazil, you have, of course, you know, enormous assets, but the Brazilians are not investing outside of their domestic market, and the same is true in Mexico. Peru, Colombia, and Chile are the three markets where the local investor base can invest outside and have made allocations to private equity internationally.

But the difference in Colombia is that it doesn’t require, for example, until you have to set up a feeder fund, it’s quite, you know, quite complex, and in Peru, they started getting some traction and making some international investments, and then somebody new came into the banking super-intendency, and there was a very strict limit put, actually three percent, on allocations, so, the Colombians have been by far the most open market in Latin America to allocating internationally and to meeting international managers and diversifying their portfolio.

Snow: And is that because of just the global outlook they have and, I guess, the relatively unfettered allocations that they can place?

Ambrose: Yeah. I mean, again, they don’t have a big domestic market, it’s bigger than Peru or Chile, but I think they recognize both the opportunities domestically but the importance of participating internationally as well. And, to be fair, they’ve had a parade of international GPs coming through their market for quite a few years now, it’s interesting to note that we first started seeing the big global private equity funds going to the Indian region during the U.S. downturn, the global credit crisis, and financial downturn when there were really no sources of capital in developed markets. And that was when, I’m not going to name names, but I’m thinking of those big GPs, we saw the articles in the press that they were going to Colombia, Peru, and Chile.

Snow: Either of you, can you talk about, you know, it’s still relatively early days, but what does the appetite look like among the large Colombian institutions to allocate to private capital, are they tending towards one strategy over another? Do they want to do a regular way buyout fund, or are they looking for more nuance?

Del Vento: I think, you know, looking at their appetite, it’s really, you know, depends on the pension fund, I mean, locations and also the system makes them a little bit compete against each other. But in general, I think they understand the asset class. I think, as you know, you know, private equity, it’s a natural fit because it’s a long-term asset class, and they need a long-term return above inflation. So I’m convinced that the opportunity’s still there, that they’re going to keep adding.

Looking at the actual location, and, I mean, again, this is all public information, I mean, I think the next step, it’s them investing more, you know, in particular niche spaces in the market like small makeups, for example, or mezzanine opportunities perhaps in real estate. That’s what I see, what I hear when I meet them, that’s the questions I’m getting from them. But again, they were very smart and very fast in understanding the benefit of private equity as a long-term asset class, as a way to-, if you think about it, their local markets are very small. I mean, and they are huge, I mean, we’re talking about a $70 billion industry together with the insurance companies that I haven’t spoken about, but they’re also, you know, a significant player.

And, you know, they need to be able-, they have to diversify outside of their own countries. And they understand that, they understand how to build a private equity program, not just random positions, they really build private equity programs, which is, I think, very important.

Snow: So Colombia is a place from which capital’s emanating, but it’s also a robust and, as you say, Cate, stable market. And so, one would expect that there are direct investment opportunities in Colombia. Can both of you talk about what the direct deal activity looks like roughly, maybe what’s distinct about the deal flow and the deal activity taking place in Colombia relative to other Latin American countries?

Ambrose: Yeah, I think actually Colombia does face a fairly significant challenge in that front, and that is, you know, first, you saw this community of local funds that was raised or pool of first funds that were raised, which call it a half a dozen or so. But since that time, Colombia has been a magnet as you’ve seen, you know, just sort of Latin America playing out, Brazil became quite crowded, and there was a perception of what of the other countries, and so, quite a few of the large global and regional funds have gone and opened offices in Colombia. And then—

Snow: To do direct investments.

Ambrose: Exactly. Exactly, so you have a very competitive landscape today in Colombia and the same factors that have attracted those global firms, diversified economy, very talented entrepreneurial business sector, there are some factors that have created challenge as well, there’s a lot of money in the Colombian market. And the bottleneck today seems to be that there are not enough business owners who are ready to work with private equity managers, so, I think at LAVCA one of the challenges and one of the areas of focus for us is really education of business owners, specifically little owners, you know, the LPs and the GPs. What needs to happen in order for there to be more executives who would be willing to work with private equity investors, again, there’s a lot of money. So there’s not a need on the part of business owners to take private equity capital. And they need to understand private equity as a value-added partner, as somebody who’s going to, you know, either address governance issues or expand them into new markets. And I think, again, there’s a lot of money in that market, we’ve seen some good deals, but you would have expected to see more deals in the last few years given the number of investors active there.

Del Vento: Yeah, I mean, I tend to agree to a certain extent, I mean, if you look at the M&A market, I mean, it’s far from over, I mean, in the last couple years, mining, telecom, last year, financials, you know, huge activity in those sectors in particular. A great opportunity for international investors to come in and invest and especially regionally, not just in Colombia, but with opportunities, for example, buying and, you know, across the region, that’s what we see.

We’re not so much sector-oriented in the firm, I mean, we follow a value-oriented approach so we don’t really have to go to, you know, the mining or the financials, we really look at what opportunities are in Colombia, and then we benchmark that across the world. That’s how we approach investing at Partners Group. But we have seen great opportunities in infrastructure, great opportunities in education, healthcare, retail, real estate. Those are some of the areas that we really like.

Snow: Can you talk, maybe drill down a bit more into one or two of those sectors, is infrastructure a place where you’re seeing interesting and promising direct investment activities?

Del Vento: Yeah. Thoroughly. I mean, it’s, first of all, pushed by the government, I mean, the administration has the national plan to develop infrastructure and to be one of the main drivers of the economy going forward. And they have committed several billions of dollars to invest in the asset class. I was there with my infrastructure team a couple weeks ago to meet local players, the government, we were, you know, pro-export put us a fantastic red carpet to meet people in the government. And we were impressed, I mean, I think there’s great opportunities in roads, great opportunities in energy, mining. Things that are, you know-, we’re going definitely look into it.

Snow: And are those primarily PPP types of opportunities?

Del Vento: There are PPP opportunities as well. They just enacted a new law. The PPP law. So, you know, that’s also an area of, you know, yeah, that we’re going to be looking at.

Snow: Is Colombia as dominated by family groups as you see in other parts of Latin America and in obviously other parts of the emerging markets generally?

Ambrose: I mean, I would say yes. I mean, it’s not that, but you do have, you know, independent businesses that are professionally managed, but families play a very important role. And that relationship, that critical part of what a private equity manager in the Colombian market has to do is be able to build that relationship, it’s the same story, you know, as private equity anywhere in the world, but I think you feel it much more in a market like Colombia where you really need to be able to build that relationship with the family at a very personal level, align interests, and, you know, that they need to believe and understand that you have their business’s best interests at hearts.