Utilities And Healthcare Remain The Best Sectors For Summer

Post on: 15 Июль, 2015 No Comment

One of the biggest hurdles facing any investor is staying disciplined in the face of short term rallies or sell-offs. The manic nature of the markets often puts individual investors at a disadvantage because they end up whipsawed by short term moves higher or lower.

This is one reason systematic trading is a core characteristic of those legends interviewed by Jack Schwager in his original Market Wizards book. It’s also the driving reason institutional clients subscribe to my firm’s research, which uses a systematic approach to rank 1800 stocks every week.

The screens are designed to evaluate the likelihood of stocks outperforming the market.

By combining the key price drivers across both fundamental and technical analysis, investors gain greater clarity and earlier insight. They’re also able to stay laser focused on themes by aggregating individual stock scores by sector. The inputs for scores include EPS beats, EPS growth, insider buying, contra short interest, valuation, short and long term momentum and seasonality.

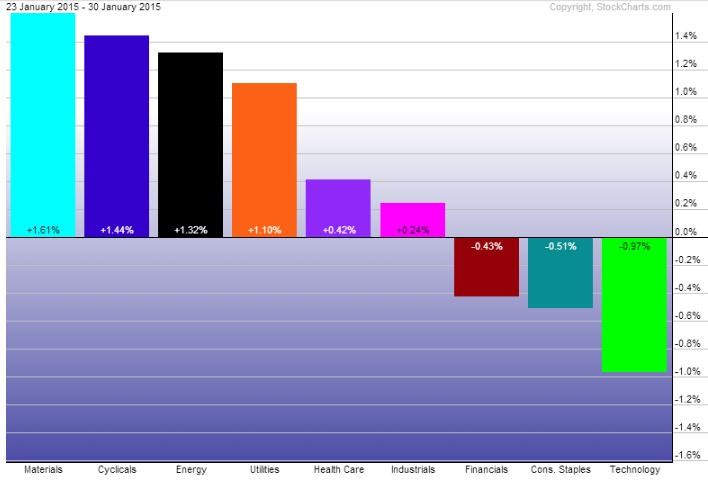

In the most recent week, defensive sectors continue to score highest, reflecting typical summer de-risking. The strongest sector is utilities (XLU ), which not only offers Treasury beating dividend yields but benefits from higher electricity demand tied to hot summer weather. Among the best scoring large cap utilities are Xcel (XEL ), Duke Energy (DUK ) and American Electric (AEP ).

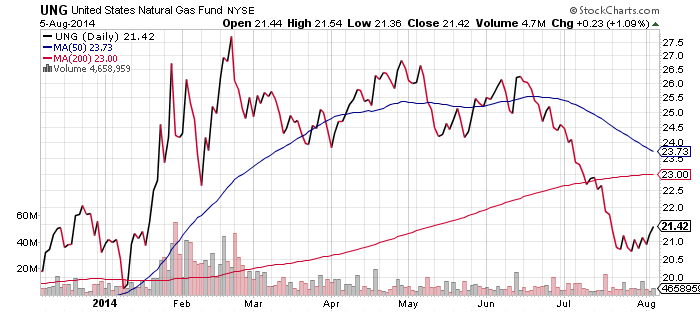

Monthly, the Association of American Railroads puts out an economist friendly treasure trove of data. In this month’s issue, they included the following chart, which shows the percentage jump in cooling degree days in states heavily reliant on coal for electricity production.

click to enlarge

Healthcare (XLV ) also remains strong scoring thanks to its historically defensive nature. Biotech was one of the best performing baskets in June and July, with the iShare Biotech ETF (IBB ) outpacing the SPY by 3.47%.

This market beating performance is common for the basket, as July is historically its best month for generating excess return. Investors typically shy away from earnings risk during the month, choosing instead to focus on news flow risk. This year was no different, with high profile PDUFA dates for Vivus (VVUS ), Amarin (AMRN ) and Arena (ARNA ) driving interest.

Just as biotech is historically a top performer in July, pharmaceuticals like Pfizer (PFE ), Abbott (ABT ) and Astrazeneca (AZN ), typically produce their biggest run of outperformance in August and September. As biotech hands off healthcare leadership to its bigger, dividend-paying drug cousins, investors are likely to benefit from buying down days in the industry.

Financials also score above average, which may seem odd in the wake of JP Morgan’s (JPM ) whale and Knight’s (KCG ) algo implosion. However, keep in mind the sector is broader than simply banks. Most of the groups strength comes from property & casualty insurers like Allstate (ALL ) and real estate investment trusts such as Boston Properties (BXP ).

The insurance (KIE ) sector typically performs well through summer storm season as damage typically results in higher premiums and rising demand for coverage. The ongoing drought and its impact on corn will trigger many farmers to plough fields under. Those under-insured won’t fail to make the same mistake next season, even if it means paying higher prices.

As for REITs (RWR ) (IYR ), much like in utilities investors continue to search for Treasury beating yields. Low financing rates have helped REITs restructure maturities and finance new development and acquisitions. And, as vacancy trends have improved, so have effective rents. All of this is translating into FFO growth.

As for weak sectors, it shouldn’t surprise long term investors to see technology among the poorest scoring. The group is notoriously troubled in summer and this year is no exception. But, as I wrote here. there’s a silver lining in summer’s typical weakness. For those able to patiently accumulate through quarter end, technology stocks — particularly software stocks (IGV ) — tend to finish October higher than they start August.

Arming yourself with a systematic approach to measuring markets, sectors and industries may help keep you focused and less likely to chase short term moves. For now, keeping focused on utilities and healthcare, buying insurers and REITs in financials and slowly accumulating technology through quarter end appear to be your best bet for market beating upside.