Utah Short Sale Risks

Post on: 21 Май, 2015 No Comment

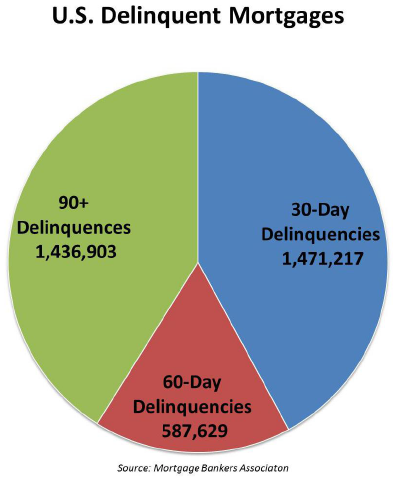

UPDATED August 2010! As if things could not get worse, Short Sale listings have become even riskier here in Utah. This list has been updated to include more examples of why Short Sale listings are not worth the time and risk involved. Short Sale properties are listings that have not yet foreclosed. The bank has agreed to let the owner list and sell the property at a price that is less than the remaining balance on the mortgage. The bank absorbs the loss and the seller is “forgiven” the unpaid principle. The following points outline some of the risks involved in purchasing a Short Sale property:

• As is the case with many Short Sales, the homeowner has to vacate their home in preparation of a foreclosure. The home is vandalized while empty. The borrower is responsible for this damage as long as they still own the home. The borrower’s homeowners insurance covers the damages, but the lender directs the homeowner to sign the check over to the lender for disbursement to the contractor after close of escrow (COE). After COE, the lender refuses to pay the contractor and sends funds to the note holder for missed payments, leaving the homeowner with an unpaid bill from the contractor.

• The lender’s mortgage insurance company demands a note from the homeowner before a short sale closing. This usually occurs at the eleventh hour and comes as a complete surprise to the borrower. In most cases, the borrower was unaware that the lender had purchased mortgage insurance on their loan. Again this is an example where the borrower needs legal counsel prior to any payments being made.

• A second lien holder in a short sale refuses to allow the sale to close unless the borrow pays the bank outside of escrow. This is called “Greenmail” and remember, in a foreclosure the borrower is protected from these practices but in Short Sale there is no such protection.

Second lien holder agrees to an amount in a Short Sale for release of lien. This is not a full release from deficiency. This is just the amount they require to allow the short sale to close. From a borrower’s point of view, it makes no financial sense to agree to pay this if there is not a full release, as the lender could still pursue a deficiency suit against the borrower. If the second lien holder persists and the first lien holder will not provide the funds to the second lien holder, it is generally better to let the home go to foreclosure.

• Homeowner has the house for sale as a short sale and the bank has set a foreclosure date in the future. Homeowner arrives home and finds the locks on the house have been changed and several boxes of personal belongings were taken. Bank admits to changing the locks even though the trustee’s sale has not been completed.

• If you are a homeowner, DO NOT have any other bank account with the same bank as your mortgage. In a short sale situation some mortgage banks are starting to “sweep” your other accounts to pay a delinquent mortgage payment. Some banks have even increased a checking account overdraft protection from $1,000 to $10,000 so they could take the mortgage payment out, leaving the homeowner with no way to close the account until the overdraft balance is paid.

• In a Short Sale the bank approves the purchase price. Since the bank typically orders a BPO (Broker Price Opinion) only after an offer is made, the list price you see advertised in the MLS is almost always not pre-approved by the bank, and may be listed artificially low to attract offers.

• Short Sale properties are listed “As-Is” and in most cases neither the bank nor the seller will provide any property disclosures, guarantee warranted items, or make any needed repairs. The buyer assumes nearly all of the risk pertaining to the condition of the home.

• In a Short Sale the bank may take weeks or months just to respond to an offer. In the meantime, even though the buyer can take their offer off the table, the buyer could miss another purchase opportunity or see the value of the real estate market drop during the lengthy process.

• In a Short Sale the bank has the right to foreclose on the property and sell it at auction, even after offers have been made and in some rare cases even after an offer has been accepted.

• A significant number of Short Sale listings are in a situation where the seller has two or more mortgages. The buyer may get approval from the first bank, but not the second bank, in which case there is no contract even after the buyer has waited a long period of time for the first bank to respond.

David Whitehead is a professional Buyer’s Agent specializing in helping clients buy homes in the St. George and Washington County, Utah areas. Contact David at 435-632-2900 for a no-obligation buyer consultation.

CLICK HERE TO SEARCH FOR HOMES USING THE SAME SYSTEM REAL ESTATE AGENTS USE!

Special thanks for contributions from Brett Woolley, Boulter Properties, Gilbert, AZ.