Using a Self Directed IRA LLC To Purchase Real Estate

Post on: 28 Май, 2015 No Comment

Appearing live on CNBC’s Squawk Box, Warren Buffett tells Becky Quick he’d buy up millions of single family homes if it were practical to do so.

-As reported on CNBC 2/27/12

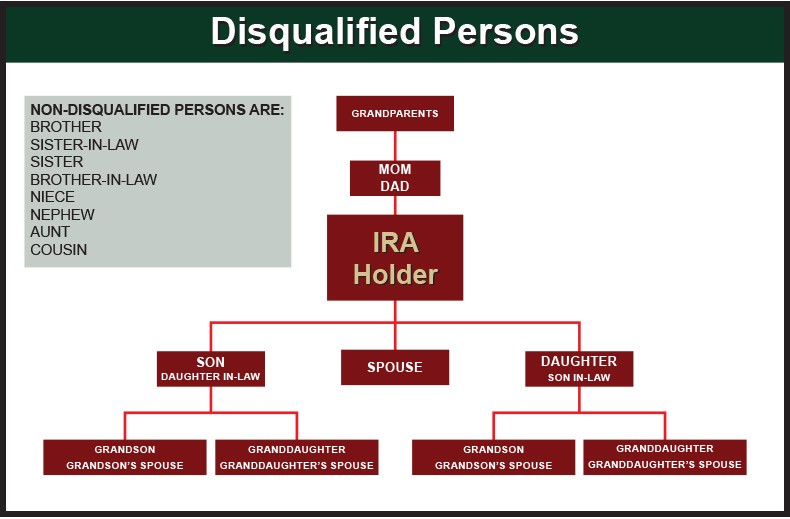

Most people mistakenly believe that their IRA must be invested in bank CDs, the stock market, or mutual funds. Few Investors realize that the IRS has always permitted real estate to be held inside IRA retirement accounts. Investments in real estate with a Self-Directed IRA LLC are fully permissible under the Employee Retirement Income Security Act of 1974 (ERISA). IRS rules permit you to engage in almost any type of real estate investment, aside generally from any investment involving a disqualified person.

In addition, the IRS states the following on their website. ..IRA law does not prohibit investing in real estate but trustees are not required to offer real estate as an option.

Advantages of Using a Self-Directed IRA LLC to Purchase Real Estate

Income or gains generated by an IRA generate tax-deferred/tax-free profits. Using a Self-Directed IRA LLC to purchase real estate allows the IRA to earn tax-free income/gains and pay taxes at a future date (in the case of a Roth IRA the income/gains are always tax-free), rather than in the year the investment produces income.

With a Self-Directed IRA LLC. you can invest tax-free and not have to pay taxes right away or in the case of a Roth IRA — ever! All the income or gains from your real estate deals flow through to your IRA tax-free!

Why Buy Real Estate Using a Self-Directed IRA LLC

- Gains are tax free

- Positive cash flow is tax free

- No time limit for holding property

- IRA can borrow money — Leverage your investment with non-recourse financing

- Potential to earn a larger rate of return on invested capital

Tax Advantages of Buying Real estate with a Self-Directed IRA LLC

When purchasing real estate with a Self-Directed IRA LLC, in general, all income and gains generated by your pre-tax retirement account investment would generally flow back into the retirement account tax-free. Instead of paying tax on the returns of a real estate investment, tax is paid only at a later date, leaving the real estate investment to grow unhindered. Generally, self-directed IRA real estate investments are usually made when a person is earning higher income and is taxed at a higher tax rate. Withdrawals are made from an investment account when a person is earning little or no income and is taxed at a lower rate.

For example, if Joe established a Self-Directed IRA LLC with $100,000 to purchase real estate and make other investments. Assume Joe kept his Self-Directed IRA LLC open for 20 years. Further assume that Joe was able to generate an average annual pre-tax rate of return of 8% and the average tax rate was 25%. By using a tax-deferred Self-Directed IRA LLC strategy, after 20 years Joes $100,000 investment would be worth $466,098 a whopping $349,572 after taxes on the earnings. Whereas, if Joe made the investments with taxable funds (non-retirement funds) Joe would have only accumulated $320,714 after 20 years.

Types of Real Estate Investments

Below is a partial list of domestic or foreign real estate-related investments that you can make with a Self-Directed IRA LLC:

- Raw land

- Residential homes

- Commercial property

- Apartments

- Duplexes

- Condos/townhomes

- Mobile homes

- Real estate notes

- Real estate purchase options

- Tax liens certificates

- Tax deeds

Investing in Real Estate with a Self-Directed IRA LLC is Quick & Easy!

Purchasing real estate with a Self-Directed IRA LLC is essentially the same as purchasing real estate personally.

- Set-up a Self-Directed IRA LLC with the IRA Financial Group

- Identify the investment property

- Purchase the investment property with the Self-Directed IRA LLC no need to seek the consent of the custodian with a Self-Directed IRA LLC with Checkbook Control

- Title to the investment property and all transaction documents should be in the name of the Self-Directed IRA LLC. Documents pertaining to the property investment must be signed by the LLC manager

- All expenses paid from the investment property go through the Self-Directed IRA LLC. Likewise, all rental income checks must be deposited directly in to the Self-Directed IRA LLC bank account. No IRA related investment checks should be deposited into your personal accounts.

- All income or gains from the investment flow through to the IRA tax-free!

Structuring the Purchase of Real Estate with a Self-Directed IRA LLC

When using a Self-Directed IRA LLC to make a real estate investment there are a number of ways you can structure the transaction:

1. Use your Self-Directed IRA LLC funds to make 100% of the investment

If you have enough funds in your Self-Directed IRA LLC to cover the entire real estate purchase, including closing costs, taxes, fees, insurance, you may make the purchase outright using your Self-Directed IRA LLC. All ongoing expenses relating to the real estate investment must be paid out of your Self-Directed IRA LLC bank account. In addition, all income or gains relating to your real estate investment must be returned to your Self-Directed IRA LLC bank account.

2. Partner with Family, Friends, Colleagues

If you dont have sufficient funds in your Self-Directed IRA LLC to make a real estate purchase outright, your Self-Directed IRA LLC can purchase an interest in the property along with a family member (non-disqualified person — any family member other than a parent, child, spouse, daughter-in-law, son-inlaw), friend, or colleague. The investment would not be made into an entity owned by the IRA owner, but instead would be invested directly into the property.

For example, your Self-Directed IRA LLC could partner with a family member (non disqualified person — any family member other than a parent, child, spouse, daughter-in-law, son-inlaw), friend, or colleague to purchase a piece of property for $150,000. Your Self-Directed IRA LLC could purchase an interest in the property (i.e. 50% for $75,000) and your family member, friend, or colleague could purchase the remaining interest (i.e. 50% for $75,000).

All income or gain from the property would be allocated to the parties in relation to their percentage of ownership in the property. Likewise, all property expenses must be paid in relation to the parties percentage of ownership in the property. Based on the above example, for a $2,000 property tax bill, the Self-Directed IRA LLC would be responsible for 50% of the bill ($1000) and the family member, friend, or colleague would be responsible for the remaining $1000 (50%).

Isnt Partnering with a family member in a Real Estate Transaction a Prohibited Transaction?

Likely not if the transaction is structured correctly. Investing in an investment entity with a family member and investing in an investment property directly are two different transaction structures that impact whether the transaction will be prohibited under Code Section 4975. The different tax treatment is based on who currently owns the investment. Using a Self-Directed IRA LLC to invest in an entity that is owned by a family member who is a disqualified person will likely be treated as a prohibited transaction. However, partnering with a family member that is a non-disqualified person directly into an investment property would likely not be a prohibited transaction. Note: If you, a family member, or other disqualified person already owns a property, then investing in that property with your Self-Directed IRA LLC would be prohibited.

3. Borrow Money for your Self-Directed IRA LLC

You may obtain financing through a loan or mortgage to finance a real estate purchase using a Self-Directed IRA LLC. However, two important points must be considered when selecting this option:

- Loan must be non-recourse A prohibited transaction is a transaction that, directly or indirectly involves the loan of money or other extension of credit between a plan and a disqualified person. Normally, when an individual purchases real estate with a mortgage, the traditional loan provides for recourse against the borrower (i.e. personal liability for the mortgage). However, if the IRA purchases real estate and secures a mortgage for the purchase, the loan must be non-recourse; otherwise there will be a prohibited transaction. A non-recourse loan only uses the property for collateral. In the event of default, the lender can collect only the property and cannot go after the IRA itself.

- Tax is due on profits from leveraged real estate Pursuant to Code Section 514, if your Self-Directed IRA LLC uses non-recourse debt financing (i.e. a loan) on a real estate investment, some portion of each item of gross income from the property are subject to Unrelated Business Income Tax (UBTI). Debt-financed property refers to borrowing money to purchase the real estate (i.e. a leveraged asset that is held to produce income). In such cases, only the income attributable to the financed portion of the property is taxed; gain on the profit from the sale of the leveraged assets is also UDFI (unless the debt is paid off more than 12 months before the property is sold). There are some important exceptions from UBTI: those exclusions relate to the central importance of investment in real estate — dividends, interest, annuities, royalties, most rentals from real estate, and gains/losses from the sale of real estate. However, rental income generated from real estate that is debt financed loses the exclusion, and that portion of the income becomes subject to UBTI. Thus, if the IRA borrows money to finance the purchase of real estate, the portion of the rental income attributable to that debt will be taxable as UBTI.

For example, if the average acquisition indebtedness is $50 and the average adjusted basis is $100, 50 percent of each item of gross income from the property is included in UBTI.

A Self-Directed IRA LLC subject to UBTI is taxed at the trust tax rate because an IRA is considered a trust. For 2015, a Self-Directed IRA LLC subject to UBTI is taxed at the following rates:

- $0 — $2,500 = 15% of taxable income

- $2,501 — $5,900 = $375 + 25% of the amount over $2500

- $5,901 — $9,050 = $1,225 + 28% of the amount over $5,900

- $9,051 — $12,300 = $2,107 + 33% of the amount over $9,050

- $12,300 + = $3,179.50 + 39.6% of the amount over $12,300

Why Work With the IRA Financial Group?

The IRA Financial Group was founded by a group of top law firm tax and ERISA lawyers who have worked at some of the largest law firms in the United States, such as White & Case LLP, Dewey & LeBoeuf LLP, and Thelen LLP. Over the years, we have helped thousands of clients establish IRS compliant Self-Directed IRA LLC solutions. With our work experience at some of the largest law firms in the country, our retirement tax professionals tax and real estate IRA knowledge in this area is unmatched.

To learn more about using a Self-Directed IRA LLC to invest in real estate, please contact one of our Self-Directed IRA Experts at 800-472-0646 for more information.

Did you know? You can flip properties and not pay tax with a Self-Directed Real Estate IRA LLC.