Use ETFs to Make Asset Allocation Investing Even Better

Post on: 14 Апрель, 2015 No Comment

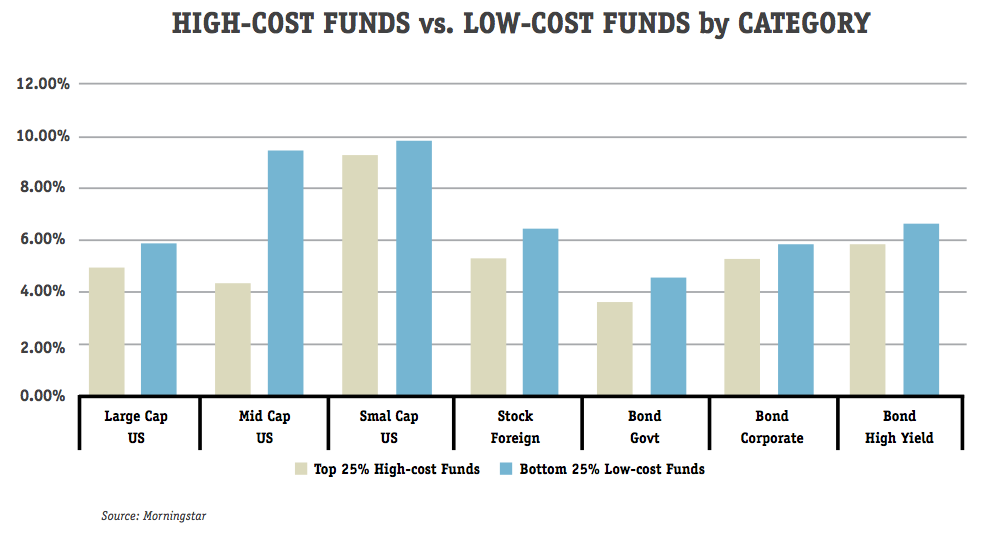

ETFs, or exchange traded funds, are like mutual funds only they trade on the open market as if they were stocks. (Ive written about them over at Investing for Beginners many, many times.) This means ETFs can be shorted, or fall above or below the net asset value, unlike a traditional open-ended mutual fund. ETFs often have very low cost structures and allow you to acquire very broad diversification for the cost of a brokerage commission, which is often below $10 today at most national discount brokerage firms.

Today, you can buy ETFs for virtually every asset class imaginable, from gold and silver to junk bonds and blue chip stocks. Thats what makes them a perfect candidate for your asset allocation plan. Unless you have the accounting skills necessary to judge the merits of individual investment opportunities, ETFs may provide one of the best, if not the best, mechanism for achieving low-cost diversification across dozens of asset classes, making your asset allocation model generate higher returns as a result of the cost savings.

Sample ETF Asset Allocation Model Portfolio

Imagine that you and your financial advisor decided that you were going to follow an extremely simple asset allocation model consisting of 50% blue chip stocks, 30% TIPS bonds, or Treasury Inflation Protected Securities, and 20% passive real estate.

How can you achieve this without selecting dozens, or hundreds, of individual investments? Simple! You would allocate 50% of your assets to the DIAMONDS Trust, ticker symbol DIA, which invests in the Dow Jones Industrial Average at a very low cost. You would put 30% in iShares Barclays TIP ETF, ticker symbol TIP, and 20% in the Vanguard REIT Index Viper ETF, ticker symbol VNQ. Your total brokerage costs? Under $30 if you are trading at a traditional discount brokerage firm such as Schwab or E-Trade and you have at least $50,000 in assets.

If you had attempted to put together your own collection of blue chip stocks and REITs, you would have had to select 300 or more individual positions and pay $3,000 to $4,000 in brokerage commissions. Most people have no desire, or sufficient assets, to justify this approach, making ETFs a cornerstone strategy for asset allocation investors.

Rebalancing Is Cheaper with ETF Asset Allocation

You even save money when it comes time to rebalance your portfolio asset classes according to your asset allocation plan because you are still only dealing with three securities, DIA, TIP, and VNQ. If you had the same 300 securities it would have taken to build the full portfolio yourself, you would have been stuck repaying that $3,000 to $4,000 every year or two as you bought or sold the individual investments to get things back into alignment.